- Primaris REIT has acquired C$2.4B worth of malls since 2022, targeting aging retail properties that Canada’s pension funds are eager to offload.

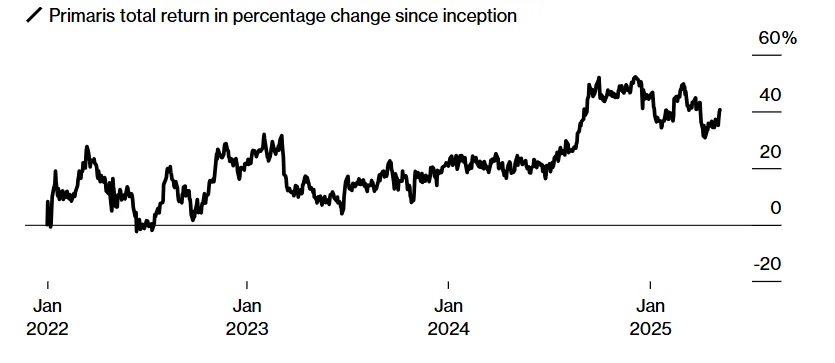

- Its mall-focused strategy has returned 40% to investors, making it the best-performing real estate investment trust in Canada since its launch.

- The REIT is in talks for C$4B in new acquisitions, betting on scale and improved management to boost mall profitability while offering sellers partial ownership via shares.

- With pension funds shifting away from malls, Primaris is becoming a rare, reliable buyer—often the only one—helping it negotiate favorable deals and secure long-term growth.

A Contrarian Play

As Canada’s largest pension funds exit their mall portfolios, Toronto-based Primaris REIT is buying in, reports Bloomberg. Founded in 2022, Primaris has emerged as a consolidator of distressed enclosed malls, often stepping in as the sole buyer with a willingness to pay in a mix of cash and stock.

The strategy is paying off. Since its formation, Primaris shares have returned roughly 40%, outperforming all other Canadian equity REITs, according to Bloomberg data.

The Deals So Far

Primaris has spent over C$2.4B acquiring malls from institutions like Quebec’s Caisse de Dépôt and Ontario’s municipal employee pension fund. Many of these sellers have accepted Primaris shares as partial payment, allowing them to benefit from any upside as the REIT revives underperforming malls.

Recent acquisitions include:

- A C$585M transaction for two malls from Quebec’s pension fund.

- A C$325M purchase of a Quebec City mall from OMERS, Ontario’s municipal pension fund.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It’s Working

Primaris CEO Alex Avery says scale is key. Owning more malls allows the company to centralize operations, reduce costs, and better negotiate with retailers. And with mall vacancies declining and foot traffic returning to pre-COVID levels, Avery believes mid-tier malls in secondary markets—those overlooked by others—offer untapped value.

“For some malls, they are the only buyer,” noted Canaccord Genuity analyst Mark Rothschild, who maintains a buy rating on the stock.

Selling, Not Buying

Even as the retail environment stabilizes, major pension funds are moving on. CPPIB and CDPQ are reallocating capital toward infrastructure and other real estate types like apartments. That leaves Primaris as a key liquidity provider in a market with few active buyers.

What’s Next

Primaris is in discussions to acquire another C$4B in malls, and Avery believes about 50 Canadian malls meet their investment criteria—half of which they already own. With less competition and more sellers seeking exits, Primaris appears well-positioned to keep expanding.

As more online retailers embrace physical locations and retail space remains constrained, Avery is confident that mall rents—and valuations—will rise.