- 65% of working-age renters face residual income cost burdens, meaning they can’t cover basic expenses like food, healthcare, and childcare after paying rent.

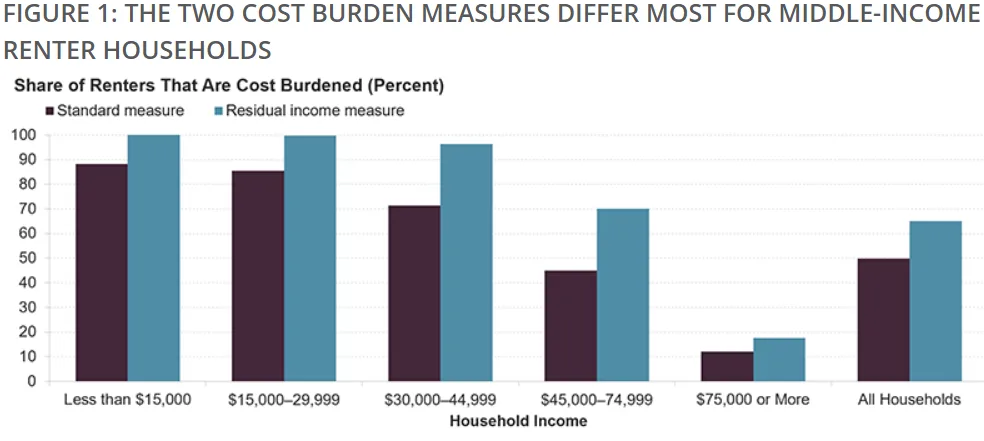

- This newer affordability measure reveals deeper struggles than the traditional “30% of income” rent burden metric, particularly among middle-income households.

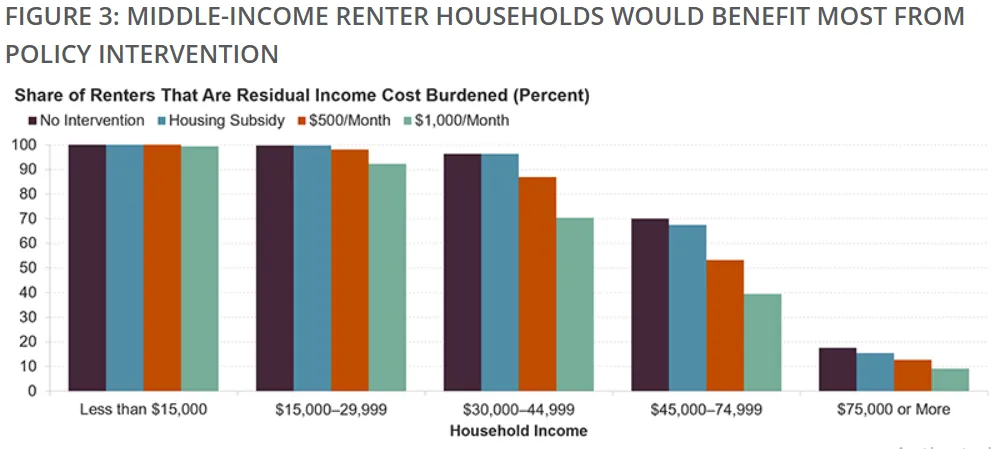

- A $1,000 monthly allowance would reduce residual income burdens by over 15 percentage points, highlighting the potential of broad cash-based policy interventions.

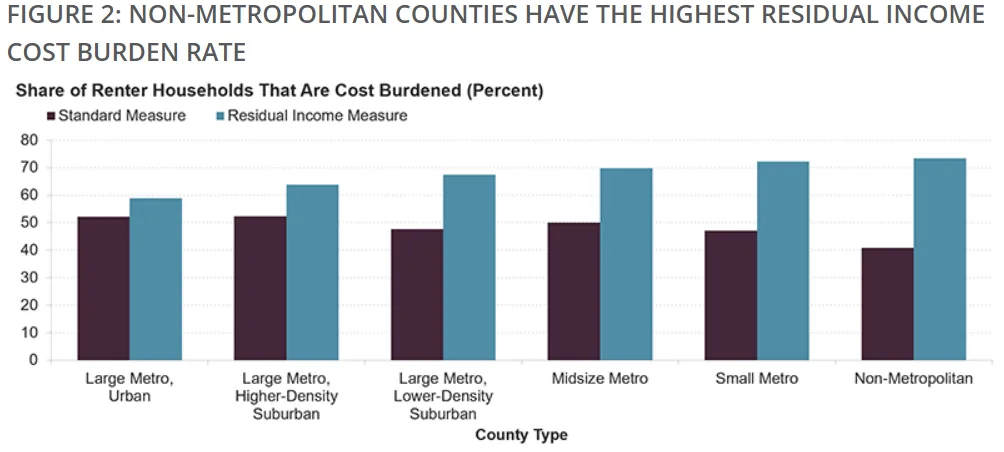

- Rural renters and residents of lower-cost states face surprisingly high cost burdens due to low incomes, not just high rents.

Rethinking Affordability

A recent paper by Harvard’s Joint Center for Housing Studies presents a sobering look at housing affordability for working-age renters.

Instead of using the traditional standard of whether rent exceeds 30% of income, researchers analyzed whether renters had enough residual income, what’s left after rent, to cover essential needs. The result: two-thirds of working-age renters fall short.

This approach exposes hidden financial stress among households often missed by conventional metrics, especially those in middle-income brackets or living in “affordable” parts of the country.

Digging Into the Data

The study analyzed 2023 American Community Survey data in conjunction with the Economic Policy Institute’s Family Budget Calculator, which estimates the cost of necessities like food, transportation, healthcare, and taxes. On average:

- Renters spend $18,000 per year on housing

- Basic non-housing expenses add up to $57,000 annually

That means only the highest-income renters can cover both housing and basic needs. In fact, over 90% of renters earning under $45,000 a year are unable to afford a modest standard of living.

Who’s Most Affected?

While housing cost burdens are highest in expensive coastal metros, residual income burdens are most severe in lower-cost states like Arkansas, West Virginia, and Wyoming, where incomes are simply too low to meet even modest living standards.

Similarly, non-metropolitan counties showed the highest residual income burden rates (73%), a stark contrast to their relatively low traditional housing burden rates.

What Could Help?

Researchers modeled three potential policy interventions:

- A rent subsidy capping rent at 30% of income

→ Modest impact: only a 1.3 percentage point drop in burdened households - $500/month universal allowance

→ Reduces burdened households by 7.3 percentage points - $1,000/month universal allowance

→ Most effective: reduces burdened households by 15.2 percentage points

Middle-income households benefit most under these scenarios, many of whom earn just enough to be disqualified from many traditional assistance programs but still fall short of covering basic needs.

Why It Matters

The findings illustrate that housing affordability is no longer just a rent issue, it’s a broader income and cost-of-living crisis. Tinkering with existing support programs may help at the margins, but bolder income-based solutions may be needed to truly address the scale of the challenge.

As inflation continues to drive up everyday costs, the call for flexible, generous income supports, rather than siloed subsidies, may gain more traction among policymakers.

What’s Next

The study reinforces a growing policy debate: Should affordability be measured solely by rent-to-income ratios, or should we consider a household’s ability to cover all essentials?

With 5.3M renter households currently missed by traditional affordability metrics, rethinking how we define and address housing cost burdens could reshape the next wave of housing and anti-poverty policy in the US.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes