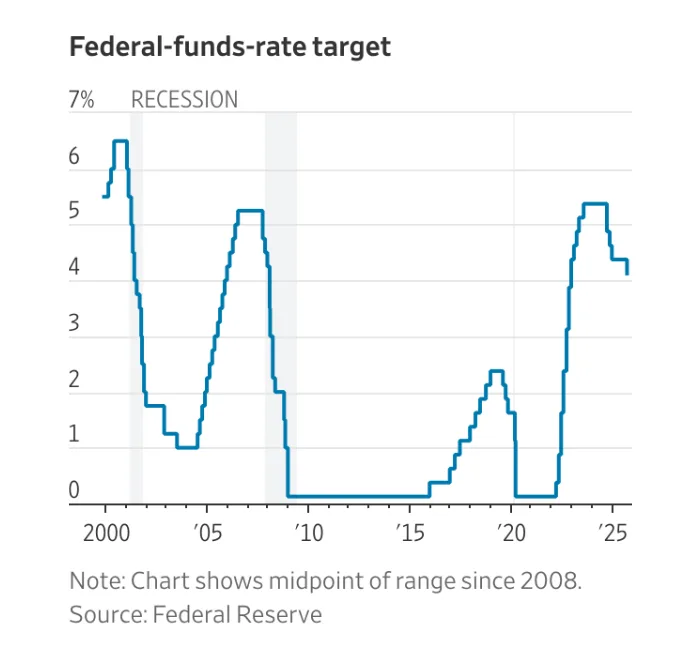

- The Fed’s recent 25 basis point rate cut could provide immediate relief to the commercial real estate (CRE) market, which has struggled since interest rate hikes began in 2022.

- Falling borrowing costs may boost sales, lending activity, and refinancing—especially for distressed office and multifamily properties.

- Analysts warn that persistent inflation, economic uncertainty, and higher long-term Treasury yields could limit CRE’s recovery despite short-term rate cuts.

The Federal Reserve’s decision to cut interest rates by 25 basis points last week may not move the needle for homebuyers right away—but in commercial real estate, the impact could be more immediate, according to WSJ.

After a multi-year slowdown caused by aggressive rate hikes starting in 2022, the sector is now eyeing a rebound.

A Long-Awaited Shift

Commercial real estate has been under pressure since 2022, with property values falling over 20% and transactions dropping off significantly. But with the Fed signaling the start of a new easing cycle, industry players are hopeful that lending and investment activity will resume.

CBRE responded by raising its property-sales projections, while Marcus & Millichap CEO Hessam Nadji called the rate cut a “big relief” for a market that effectively froze in 2023.

Why This Matters Now

Unlike fixed-rate home mortgages, a large portion of CRE debt is tied to shorter-term or floating-rate loans, making the sector more immediately responsive to Fed rate changes. This makes lower rates especially critical for refinancing the wave of expiring—and often distressed—loans in the multifamily and office sectors.

Already, signs of stabilization are emerging: Central business district office prices rose nearly 2% year-over-year in July, a turnaround from a 25% drop a year earlier, according to MSCI.

Not All Smooth Sailing

Despite momentum, risks remain. Inflation remains above the Fed’s 2% target, and uncertainty over tariffs, hiring trends, and long-term rates continues to cloud the outlook. Economists also point to a sluggish 10-year Treasury yield response, which is key for CRE loan underwriting.

Sectors that previously outperformed—like industrial and retail—are now showing rising vacancies. Data centers remain the outlier, continuing to grow rapidly on the back of AI demand.

What’s Next

Fed Chair Jerome Powell suggested more cuts may come, with two additional reductions projected by year-end. While deeper cuts could ease pressure on property owners, the overall CRE recovery still hinges on broader economic conditions and investor confidence.

As Rachel Szymanski of Trepp noted, “Cheaper money could make inflation worse,” potentially complicating the Fed’s path forward and the market’s trajectory.

Outlook

If rate cuts continue, expect a rebound in sales, refinancing, and select development projects—particularly office-to-residential conversions. But with long-term borrowing costs still stubborn and macro risks looming, a full CRE recovery may take longer to materialize.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes