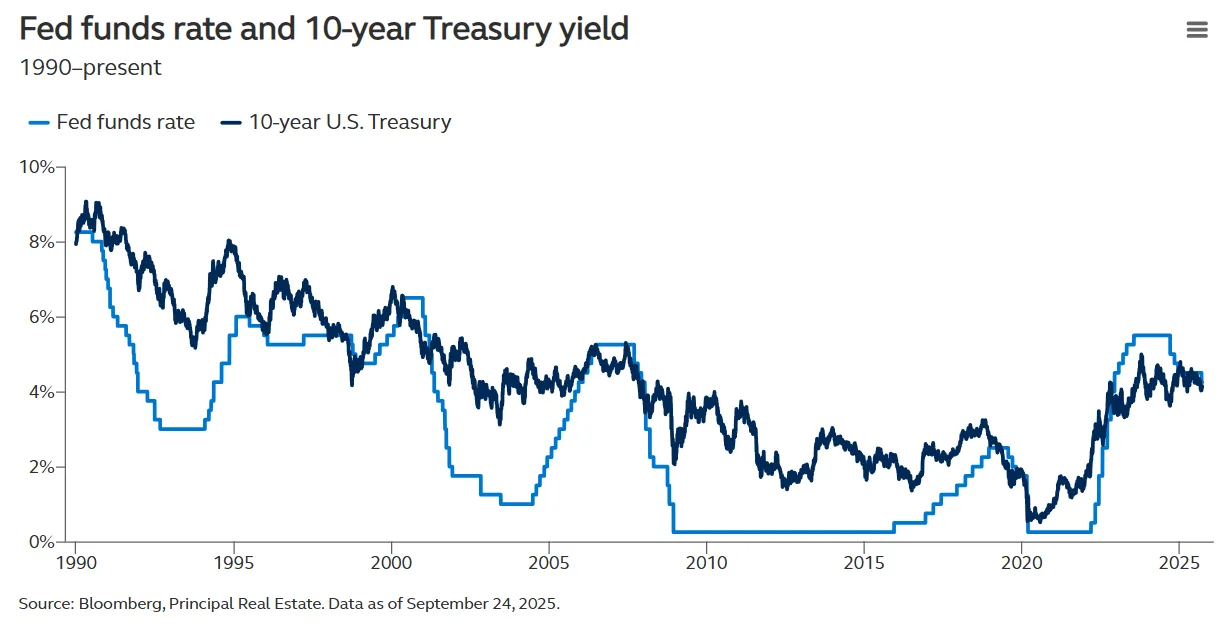

- The Fed’s easing cycle doesn’t guarantee lower long-term borrowing costs for CRE, as the correlation between Fed funds and 10-year Treasury yields is weak.

- With 10-year yields near historical averages, stability around 4.0–4.25%—combined with ~3% inflation—would create a favorable real rate environment for real estate.

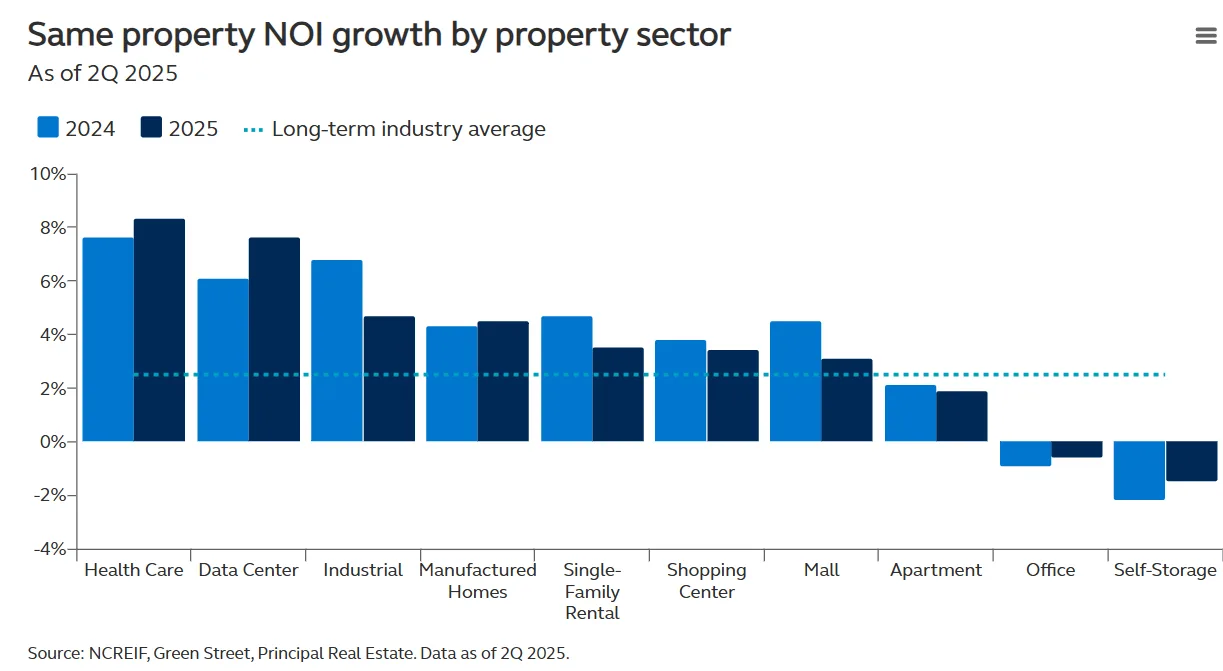

- CRE returns in the coming cycle will be driven more by income growth and fundamentals than by cap rate compression, with alternatives like data centers positioned to outperform.

A Shifting Focus

The Fed’s rate cuts may grab headlines, but they don’t always translate into cheaper financing for commercial real estate, according to Principal Asset Management.

Historically, the Fed funds rate and 10-year Treasuries move in the same direction, but their cycle-to-cycle alignment remains weak. That makes long-term yields—not short-term policy—the more relevant benchmark for property investors.

Where Yields Stand Now

After decades of decline, 10-year Treasury yields are back near long-run averages, currently around 4.1%. This is in line with pre-GFC norms, when yields averaged 4.35%–4.5%. The post-2008 period of ultra-low rates was the anomaly, not today’s levels. Stability in the 4.0%–4.25% range, with inflation near 3%, implies a real rate close to 1%—a backdrop historically supportive of CRE performance.

Returns Driven by Fundamentals

Investors should not expect another round of cap rate compression to power returns. Instead, growth in net operating income (NOI) will be the key driver. According to mid-2025 projections, unlevered returns are expected to reach 5–6% this year, trending toward 7% annually over the next five years, with a return to ~10% annualized over a decade. Alternatives such as data centers, which continue to post some of the strongest NOI growth, are expected to outperform traditional property sectors.

What’s Next

For CRE, the Fed funds rate matters less than long-term yields. A meaningful drop in Treasuries below 4% may not signal relief—it could instead point to weaker economic conditions and wider credit spreads. The healthier backdrop for investors is steady long-term rates that reflect stable growth and moderate inflation, not aggressive Fed action.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes