- Prologis’ Leasing Driver Dimensions framework identifies five key demand factors—Topline Growth, Inventory Resilience, Production Location Repositioning, the Service Imperative, and the Efficiency Mandate—that help explain customer leasing behavior across cycles.rn

- Uncertainty is deferring, not reversing, leasing decisions—with many companies delaying commitments in the face of economic and geopolitical volatility while quietly preparing to act on pent-up demand.

- Structural trends—like nearshoring, e-commerce, and automation—are driving long-term demand, as companies reconfigure supply chains and modernize facilities for resilience, flexibility, and sustainability.

- Near-term leasing activity is mixed, shaped by trade policy shifts, frontloaded inventory moves, and cautious capex planning—especially among smaller and cyclical businesses.

A Framework For Uncertain Times

With market uncertainty and uneven logistics demand, the Leasing Driver Dimensions framework offers a lens into why companies lease space, reports Prologis. It also explains why they’re making different choices even in similar conditions. This five-part framework is based on customer feedback, expert insight, and real-time leasing pipeline activity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Topline Growth

Revenue growth—particularly from e-commerce and nondiscretionary goods—remains a primary driver of logistics demand. Larger, diversified firms maintain steady leasing, while smaller players hesitate.

- E-commerce growth is structural, expected to require 50–75M SF of new space per year through 2030.

- In 2025, growth accelerated as onshoring of fulfillment followed changes to de minimis provisions.

- While uncertainty persists, positive economic indicators are improving leasing sentiment.

Inventory Resilience

Inventory strategies in 2025 reflect efforts to manage uncertainty and mitigate stockout risk.

- Companies began frontloading inventory in late 2024 ahead of expected tariffs, creating a spike in port volumes and warehouse utilization.

- Logistics facilities buffer against supply chain volatility more effectively than other segments like freight or shipping.

- Third-party logistics providers (3PLs) are critical in managing overflow and providing flexible space in real time.

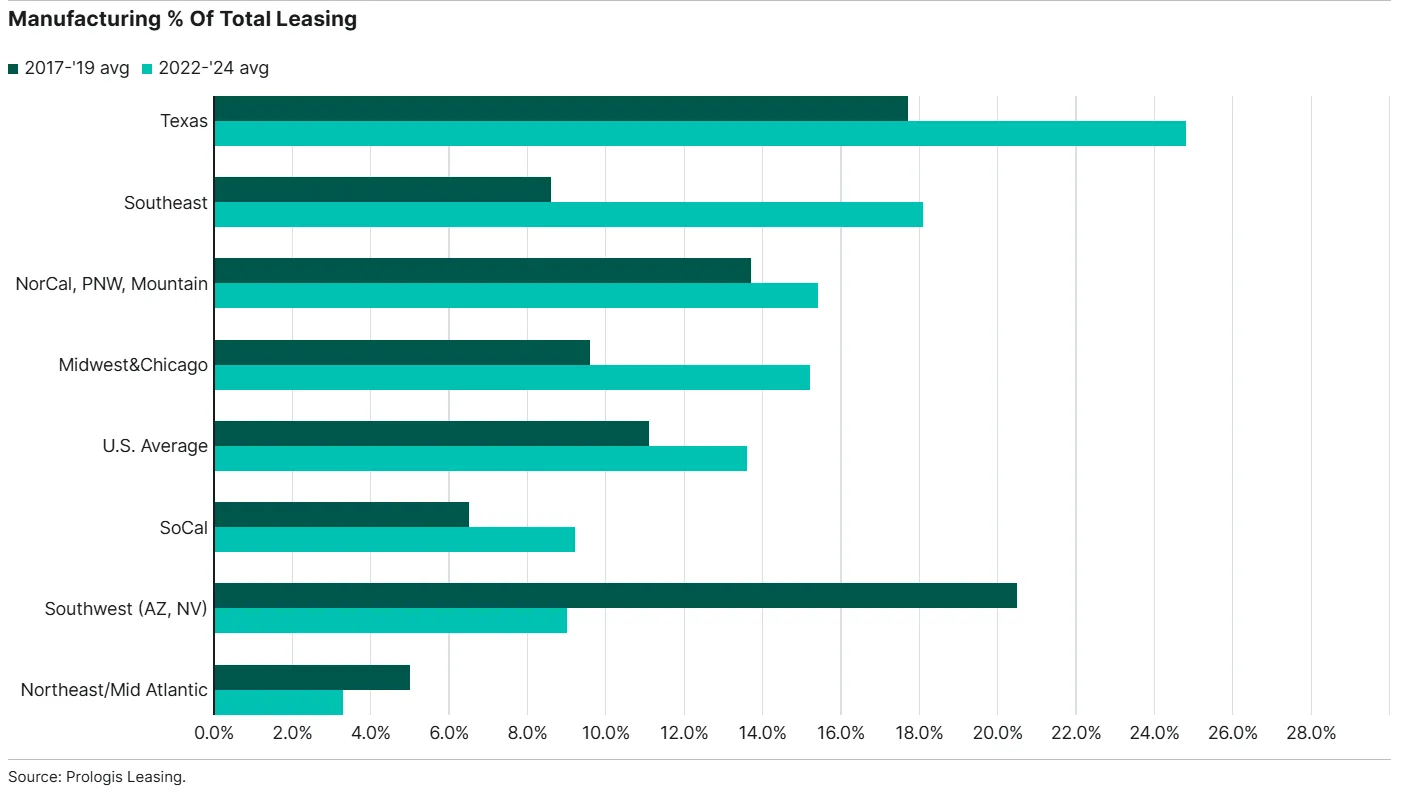

Production Location Repositioning

Global manufacturing is moving, and location strategy is shifting accordingly.

- High-value sectors (e.g., semiconductors, pharma, automotive) are increasingly investing in US manufacturing, driving demand for domestic logistics space.

- Lower-value, cost-sensitive goods are moving within Asia—notably to India and Southeast Asia—while keeping US import hubs vital.

The Service Imperative

As logistics plays a more direct role in customer experience, speed, flexibility and omnichannel capability are now table stakes.

- E-commerce now represents over 25% of US retail, with logistics enabling more than half of retailers’ revenue growth.

- Rapid delivery, customization, and omnichannel fulfillment are pushing companies to build more localized and responsive networks.

The Efficiency Mandate

Even amid capital constraints, companies are targeting next-generation facilities to achieve productivity and sustainability goals.

- Automation and energy needs are reshaping definitions of “best-in-class,” with high-tech facilities in strong demand.

- Sustainability factors are increasingly tied to leasing decisions, particularly among multinational tenants.

- Power availability and workforce access are key constraints on future supply, especially in energy-strained or labor-scarce markets.

Market Outlook

In 2025, uncertainty is driving delays—but not cancellations—of leasing decisions. Many companies are in wait-and-see mode, but ready to act as clarity improves.

- 3PLs are playing a critical role, offering flexibility amid fast-moving trade shifts.

- Deferred decisions are stacking up, creating a growing pipeline of leasing activity that could snap back quickly once confidence returns.

- Over the long term, demographics, e-commerce, and supply chain restructuring are expected to keep logistics real estate on a growth path—even if short-term demand remains uneven.

Why It Matters

The Leasing Driver Dimensions framework shows that leasing decisions are driven by more than just the business cycle—they reflect deeper, structural shifts in how companies produce, distribute and deliver goods. Understanding these drivers is essential for anticipating logistics real estate demand through both near-term turbulence and long-term transformation.