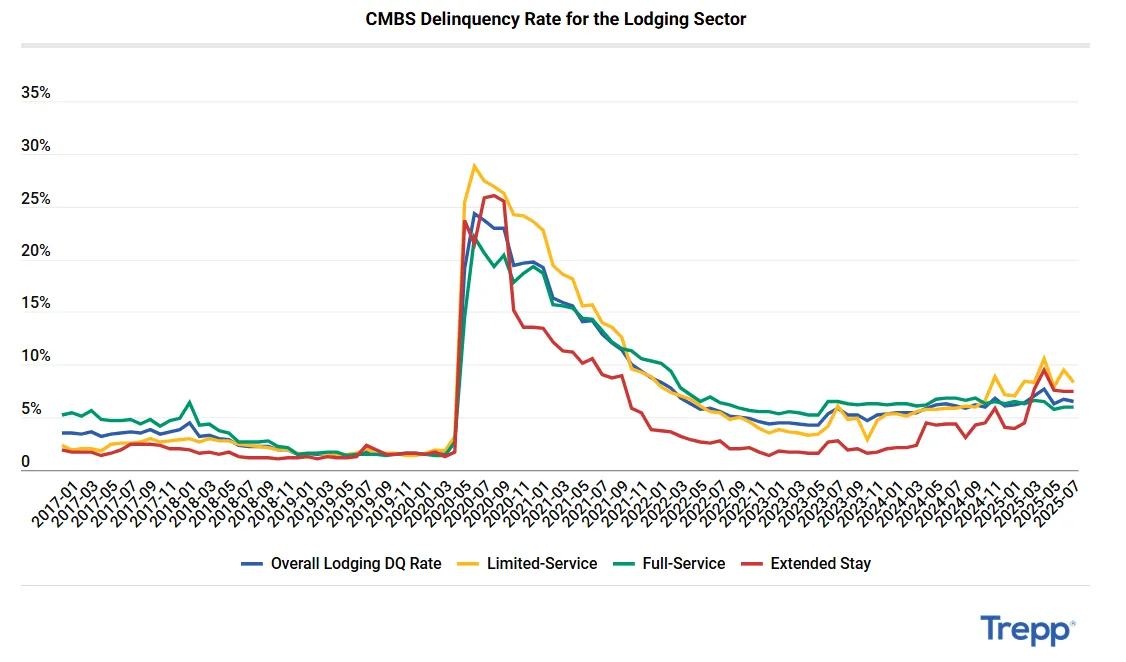

- Lodging-backed CMBS delinquencies peaked at nearly 20% in 2020 but remain above pre-COVID levels, with limited-service hotels showing the weakest recovery.

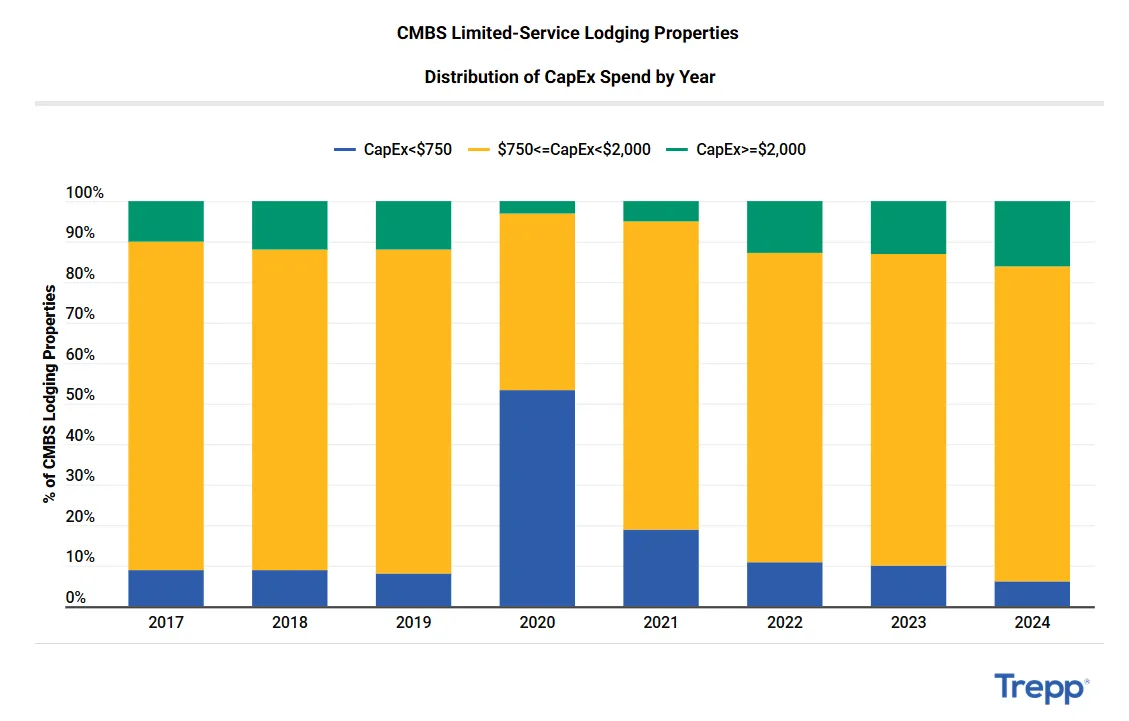

- Capital expenditure per key at limited-service hotels plummeted in 2020 and has failed to meaningfully rebound, raising concerns about deferred maintenance and brand erosion.

- Underinvestment is strongly correlated with loan distress, suggesting physical asset deterioration could drive future CMBS performance challenges.

The lodging sector has emerged as both a recovery story and a cautionary tale within the CMBS market, reports Trepp. Overall hotel-backed delinquency rates have fallen sharply since the pandemic peak. However, limited-service hotels continue to lag. A slowdown in property reinvestment could be setting the stage for renewed distress.

Delinquency Breakdown by Hotel Subtype

- Limited-Service: The hardest hit during COVID, with delinquency surging from 1.44% in 2019 to 23.56% in 2020. Rates improved to 3.48% in 2022 but have since climbed back to 8.35% as of July 2025—well above other subtypes.

- Full-Service: Peaked at 19.28% in 2020; now at 5.94%, still higher than the 1.6% pre-pandemic baseline.

Extended Stay: Initially more resilient, bottoming at 1.38% in 2022, but rising to 7.47% in mid-2025 amid possible oversupply and macroeconomic headwinds.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

CapEx Trends Reveal Deeper Issues

- Pre-2020: Most limited-service hotels spent $750–$2K per key annually, with fewer than 10% underinvesting below $750.

- 2020 Collapse: Share of sub-$750 spenders jumped to 54%, while high spenders (over $2K) fell to 3%.

- Post-Pandemic: Low spenders dropped back to 6% by 2024, but high-spending remained stuck at pre-COVID levels (13–16%), signaling only modest upgrades.

Why It Matters

Underinvestment is linked to higher delinquency—43% of delinquent limited-service loans from 2017–2024 spent under $750 per key in the prior year. Deferred maintenance can erode brand status, depress valuations, and complicate refinancing.

Bottom Line

Headline delinquency declines mask underlying vulnerabilities in the lodging sector. Without a stronger CapEx rebound—especially in limited-service hotels—physical obsolescence could trigger the next phase of distress. This phase would be driven not by demand shocks, but by neglected assets and weakening borrower resilience.