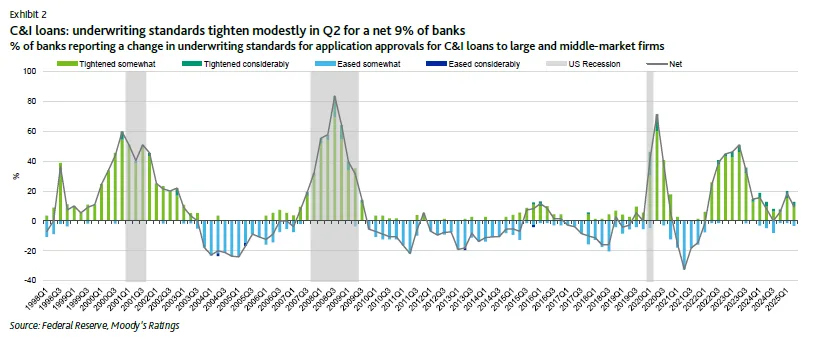

- Banks reported modest further tightening in commercial and CRE lending, though less severe than in 2023–24.

- Demand weakened sharply, especially for Cu0026I loans, marking the softest appetite since 2023.

- CRE underwriting is still tight vs. historical norms, and Moody’s expects some further deterioration in asset performance.

The Fed’s Q2 2025 SLOOS paints a picture of a cautious lending environment, according to Moody’s Q2 2025 report. While banks are no longer ratcheting up standards as aggressively as they did last year, appetite for borrowing—particularly among businesses—has dropped off. The survey, which covers responses through June 30, highlights the gap between more stable underwriting and softening loan demand.

A first time for everything

Although credit standards remain tighter than average, banks reported they are generally less tight than a year ago, especially in commercial real estate. Residential real estate was the lone exception, where standards have not meaningfully eased. The shift suggests conditions are stabilizing, though not returning to pre-2022 norms.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

The details

- C&I loans: About 10% of banks tightened standards, while nearly 30% reported weaker demand from large and mid-sized firms.

- CRE loans: Nonfarm nonresidential and construction loans saw modest tightening (~10–11%), while multifamily lending standards held steady. Demand slipped for construction and nonfarm nonres, but was flat in multifamily.

- Consumer loans: Credit cards continued to tighten (~10%), with demand declining. Auto lending standards held firm, with a slight uptick in demand, and jumbo mortgage standards remained unchanged.

Why it matters

For banks, this mix means slower loan growth: credit remains harder to access, and demand isn’t picking up. For borrowers, especially in CRE and unsecured consumer credit, conditions remain restrictive despite the moderation. Moody’s warns that CRE underwriting is still tight and expects some near-term stress in delinquency and charge-off metrics, particularly if economic uncertainty lingers.

What’s next

The survey points to three areas to watch:

- fed rate cuts and how they shift borrowing appetite.

- CRE refinancing pipelines as 2025–26 maturities meet cautious underwriting.

- Consumer credit performance, with card charge-offs rising but auto loans plateauing.

Overall, Q2 shows banks stepping back from peak caution, but with loan demand weakening, the credit cycle remains in a holding pattern.