Lenders meticulously assess risk to determine how much financing makes sense for a property venture. Getting the loan amount right matters – overextend, and the deal can crumble. Undersize and you may leave opportunities on the table.

Lenders weigh four key metrics when determining your potential loan amount:

- Debt Service Coverage Ratio

- Loan-to-Value

- Debt Yield

- Loan-to-Cost

These figures gauge risk, signal borrowing capacity and benchmark deals. A commercial real estate lender may use one of these metrics (or a combination of all) to determine a potential loan amount they are willing to extend credit on.

We’ll demystify each factor’s role in the loan sizing decision process. Arm yourself with this intel to pursue better-matched, bigger-picture financing for your next commercial real estate play. Let’s level up your borrowing power!

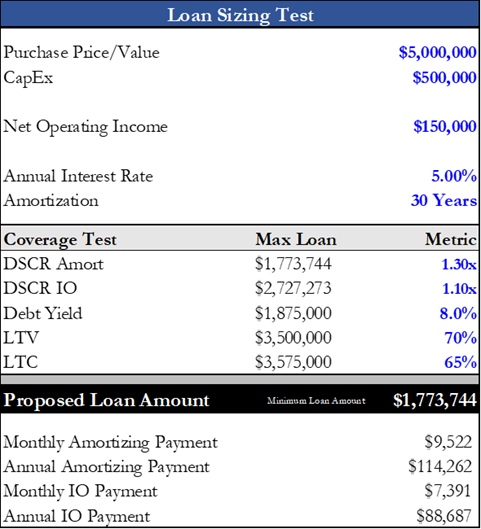

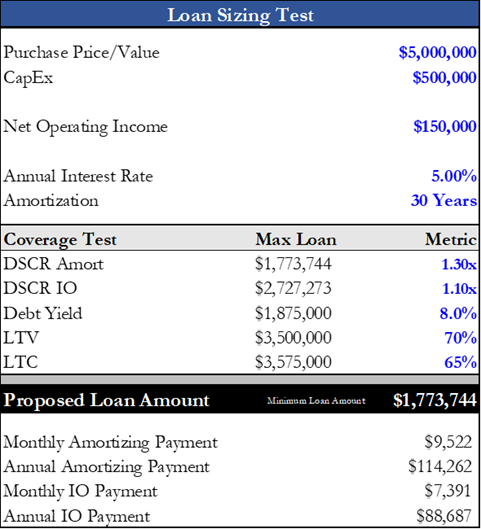

Size your loan exactly like a commercial real estate lender will!

Based on your desired DSCR, Debt Yield, LTV, or LTC metric, this loan sizing tool will determine the maximum loan amount possible for your next acquisition!

Understanding Debt Service Coverage Ratio (DSCR)

When a lender assesses a commercial real estate loan application, one key factor influencing their loan sizing equation is the Debt Service Coverage Ratio (DSCR). This metric evaluates the property’s capacity to cover its required loan payments, including interest and principal.

In plain terms, DSCR analyzes if the expected net operating income can handle the annual debt burden.

The DSCR formula is:

DSCR = Net Operating Income / Annual Debt Service

Lenders have minimum DSCR benchmarks that borrowers must meet to qualify for financing. Common thresholds are 1.25x, 1.35x, or 1.5x based on property type and market conditions.

Higher DSCR is better from a lender’s perspective. Abundant income cushion to fund debt signals lower default risk and more protection for their investment.

Let’s walk through an example DSCR calculation:

- A property generates $100,000 in Net Operating Income (NOI) yearly

- The lender requires a minimum of 1.25x DSCR

Plugging this into the formula:

$100,000 NOI / 1.25 DSCR = $80,000

Based on their 1.25x requirement, this property can support $80,000 yearly debt payments. The lender would size their loan based on this service level.

DSCR sets the guardrails for loan amounts. Learn the policy of lenders you apply with, and maximize your property’s NOI generation to drive better terms.

Loan-to-Value (LTV): Role in Loan Sizing

The Loan-to-Value (LTV) ratio plays a pivotal role as lenders size appropriate commercial real estate loans. Expressed as a percentage, this metric compares the requested loan amount to the appraised property value or purchase price.

Specifically, the LTV ratio formula is:

LTV Ratio = (Loan Amount / Property Value) * 100%

Analyzing this percentage provides critical context on leverage levels and signals the degree of risk involved to lenders.

Lenders establish maximum LTV thresholds for financing based on factors like property type, market conditions, and loan terms. For example, maximum LTV ratios may range from 65-80%.

The lower the ratio, the more equity possessed – and less risk assumed – by the borrower. Higher LTV ratios imply greater leverage and risk.

Let’s walk through an example:

- A property is appraised at $1,000,000

- The lender’s maximum LTV is 75%

At a 75% LTV, the max loan amount is:

$1,000,000 x 0.75 = $750,000

In this case, a $750,000 loan would match the lender’s risk tolerance. The 25% equity reduces defaults.

Understanding lenders’ LTV criteria allows for pursuing aligned financing for CRE needs. Optimizing equity positions also strengthens mortgage eligibility.

Please provide any feedback on areas requiring more clarity or depth. Striving to balance readability with covering key information.

Debt Yield and its Impact on Loan Sizing

Debt yield measures a property’s net operating income against the requested loan amount.

Debt Yield can be calculated with this formula:

Debt Yield = Net Operating Income (NOI) / Loan Amount

Analyzing this percentage provides insight into repayment ability – how sufficiently the asset’s expected incomes cover desired financing levels.

Lenders establish minimum debt yield benchmarks such as 6-12% based on risk tolerance. Required levels directly shape maximum supportable loan sizes.

Higher debt yields indicate a lower chance of default. More cushion between NOI and debt eases concerns.

Lower debt yields imply higher risk. Tighter coverage raises doubts about consistently meeting mortgage obligations.

For example:

- A property’s annual NOI is $120,000

- Lender requires a 10% minimum debt yield

At the 10% required yield, the max loan amount is:

$120,000 NOI / 10% = $1,200,000

Lenders constrain loan sizes to meet risk metrics like debt yield. Evaluate requirements to determine feasible financing for needs.

Loan-to-Cost (LTC): The Meaning in Lending Decisions

For commercial construction and redevelopment projects, lenders analyze Loan-to-Cost (LTC) ratios during loan sizing decisions. This metric compares the requested loan amount to the project’s total estimated costs.

Specifically, the LTC calculation is:

LTC = (Loan Amount / Total Project Cost) x 100%

The resulting percentage indicates how much of the overall budget gets financed through debt. Typically, lenders establish maximum loan to cost leverage between 60% – 85%, based on risk tolerance.

Higher LTC ratios mean more leverage, implying larger risk exposure for lenders. More equity possessed by borrowers lowers ratios.

Let’s walk through an example:

- A project’s total cost is $2,000,000

- The lender’s maximum LTC is 75%

At a 75% LTC, the max loan amount would be:

$2,000,000 x 75% = $1,500,000

Constraining LTC ratios allows lenders to size loans at levels matching their risk and return profiles.

Conclusion

When lenders size commercial real estate loans, they meticulously assess risk from four key angles – Debt Service Coverage Ratio, Loan-to-Value, Debt Yield, and Loan-to-Cost. Mastering these metrics is crucial for securing financing matched to property needs.

Each factor uniquely evaluates borrowers’ ability to handle debt based on property incomes, costs, and equity positions.

Together, they determine appropriate leverage levels in balance with returns. Learn to optimize them when applying and demonstrate aligned risk and reward.

Based on your desired DSCR, Debt Yield, LTV, or LTC metric, this loan sizing tool will determine the maximum loan amount possible for your next acquisition!