- CRE loan modifications reached $11.2B in Q3 2025, with extensions accounting for 67% of total volume, according to CRED iQ.

- Hospitality and office sectors remain under the most pressure, while industrial and self-storage saw minimal modifications.

- Large loans dominate: Loans over $50M made up more than 74% of the total modified balance, reflecting distress in big-ticket debt.

The Strategy: Extend, Don’t Foreclose

According to a report from CRED iQ, Lenders are doubling down on a familiar tactic: “extend and pretend.” The strategy—extending loan terms rather than foreclosing—has re-emerged in full force amid high interest rates and weakening property valuations. First seen widely during the post-2012 downturn, the method is now being used to manage balance sheet risks without triggering defaults.

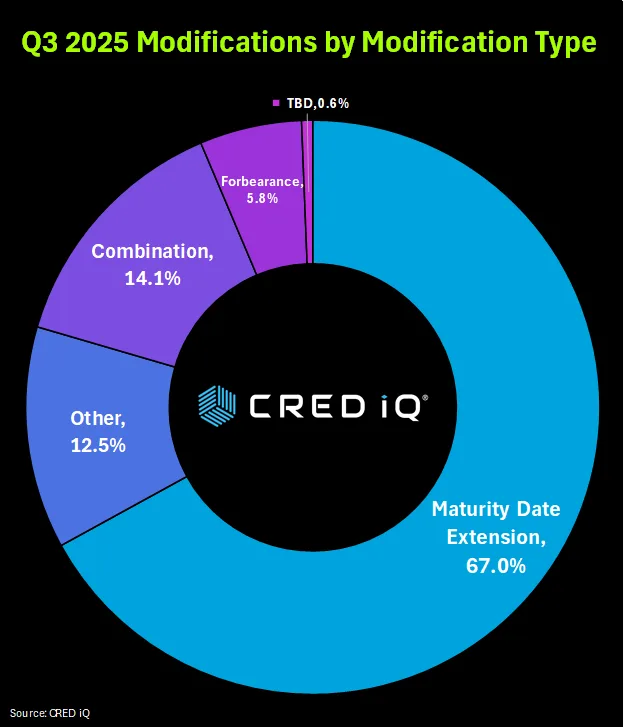

In Q3, maturity date extensions made up 67% of the $11.2B in modified CRE loans. Other changes included forbearance (5.8%), combination strategies (14.1%), and miscellaneous adjustments (12.5%).

By Property Type: Hotels and Offices Bear the Brunt

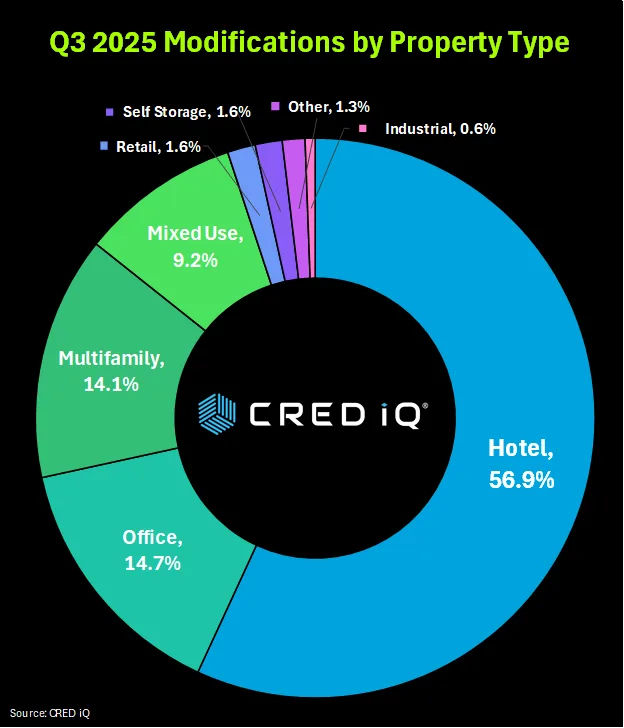

While modifications span all sectors, some are clearly more vulnerable than others:

- Hotels: $5.5B across 53 loans (49% of total modified balance)

- Office: $1.4B across 36 loans

- Multifamily: 55 loans (most by count), but $1.4B in balance

- Mixed-Use: $891.9M across 20 loans

- Retail: $156.2M across 6 loans

- Self-Storage: $150M across 3 loans

- Industrial: Just $55.8M across 5 loans

The disparity highlights a bifurcated market: hospitality and office sectors are actively restructuring debt, while industrial and storage remain relatively insulated due to more stable fundamentals.

By Loan Size: Big Loans, Big Problems

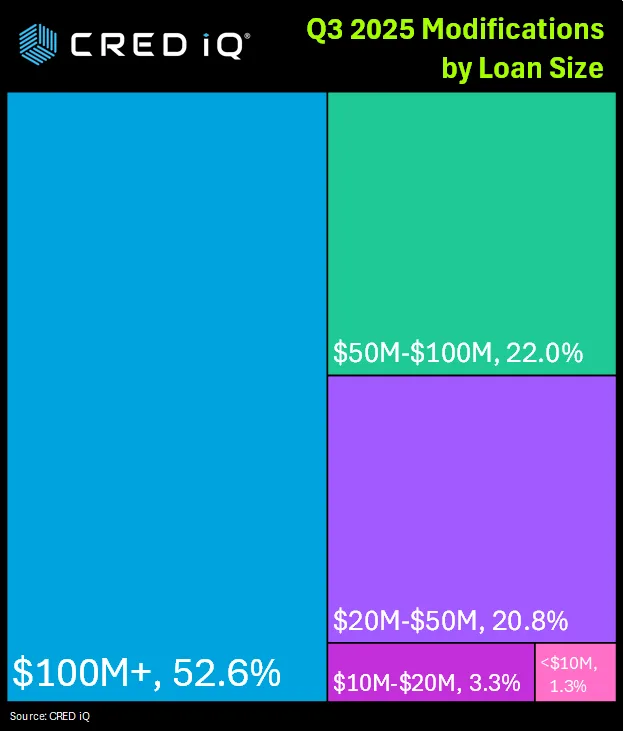

Loan size remains a major differentiator in modification trends:

- $100M+: 50 loans totaling $5.9B

- $50M–$100M: 38 loans for $2.5B

- $20M–$50M: 73 loans, $2.3B

- $10M–$20M: 24 loans, $670.4M

- Under $10M: 30 loans, $145.9M

Together, the two largest categories—loans over $50M—make up more than 74% of total modified balances. Smaller loans, by contrast, are modified less frequently, likely due to quicker workouts or lower risk profiles.

Why It Matters

Loan modifications are becoming a proxy for distress in the market. With more than $11B restructured in just three months, it’s clear that borrowers and lenders alike are under pressure—particularly in sectors still grappling with post-pandemic disruptions and elevated financing costs.

As higher-for-longer interest rates weigh on cash flows and refinancing, the industry’s reliance on maturity extensions may delay, but not resolve, underlying issues.

What’s Next

Expect loan modifications to remain elevated through at least mid-2026 as more maturing debt faces refinancing hurdles. As market scrutiny grows, lenders may eventually shift from temporary fixes to more permanent restructurings—or even defaults.

For now, “extend and pretend” remains the path of least resistance.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes