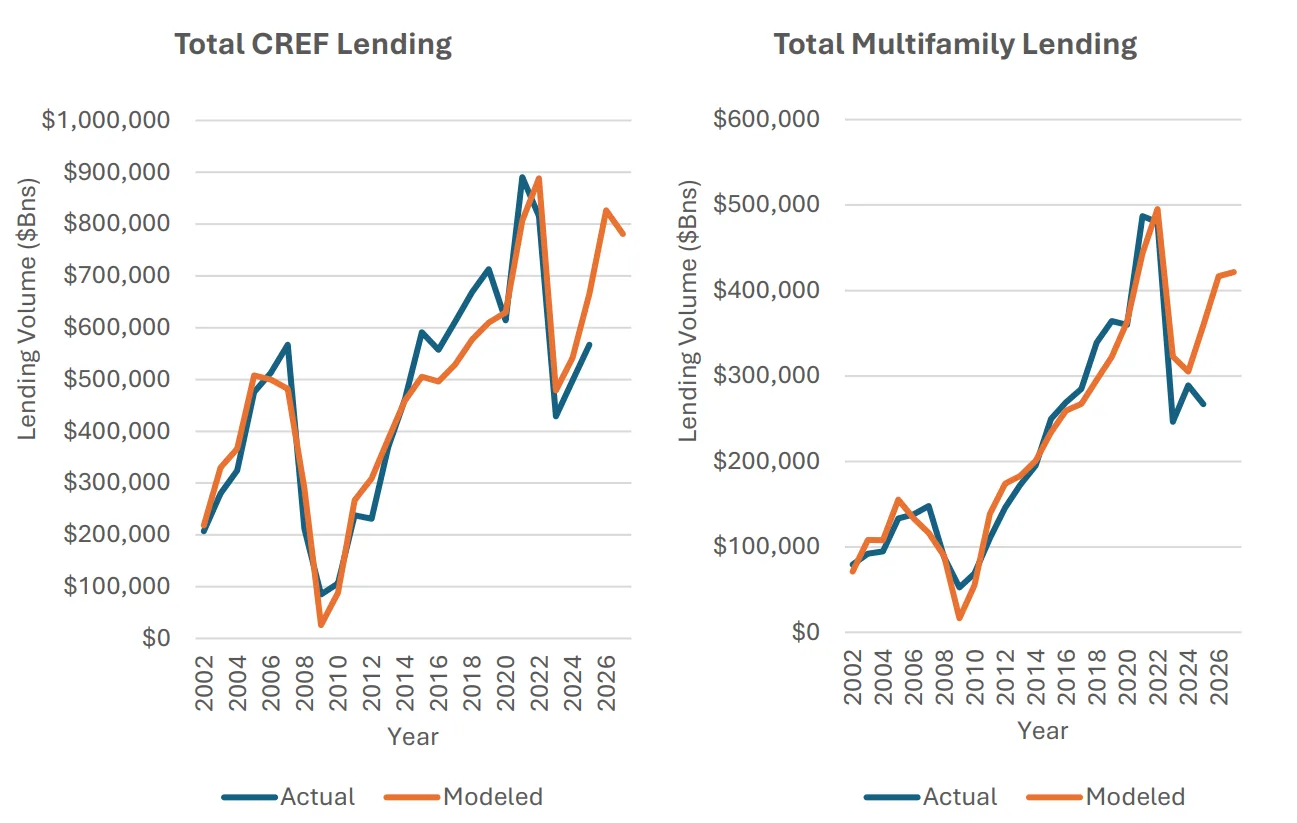

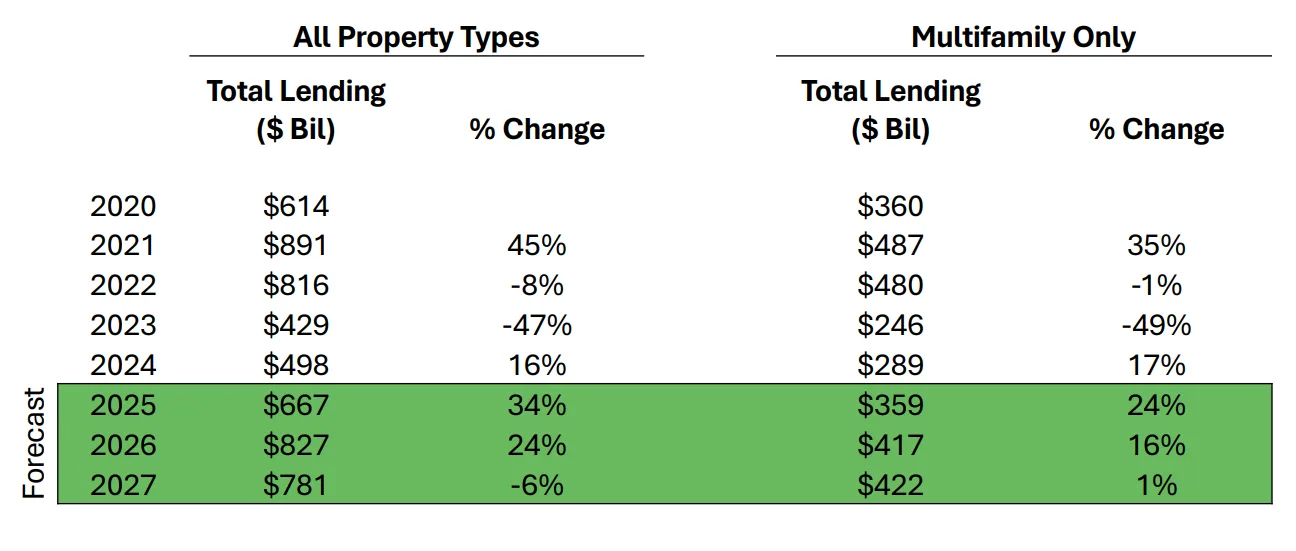

- The MBA forecasts a 24% increase in originations across commercial and multifamily properties.

- Volume is projected to reach $417B, driven by strong agency activity.

- The Fed is expected to cut rates again, following its first reduction in September.

- MBA sees lending growth slowing by 2027, with total CRE originations expected to drop 6%.

Lending Bounces Back in 2025

According to Globe St, commercial and multifamily lending is on track for a strong recovery in 2025. The Mortgage Bankers Association expects total originations to reach $827B, marking a 24% jump from 2024. Of that, $417B will come from multifamily loans, while $410B will come from other commercial property types.

Rate Cuts Help Fuel the Recovery

Lower interest rates are helping to drive this turnaround. MBA Chief Economist Mike Fratantoni said the group expects additional Fed rate cuts at the end of October and again in December. Although inflation remains above target, the Fed is now focusing more on full employment due to signs of a weakening job market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Multifamily Leads the Way

Multifamily lending continues to perform well. Judie Ricks, associate VP of CREF research at MBA, said originations rose year-over-year during the first half of 2025. She expects this momentum to continue into 2026. In 2024, agency lenders accounted for more than 40% of all multifamily originations, underscoring their influence on the market.

Longer-Term Projections Point to Slowdown

While 2025 looks promising, MBA’s forecast shows a slower pace ahead. By 2027, total commercial and multifamily originations could fall 6% to $781B. Multifamily lending may grow just 1% to $422B, while non-multifamily volume could dip to $359B.

Residential Lending Also Set to Rise

On the residential side, the MBA projects mortgage originations will climb 8% to $2.2 trillion in 2026. Purchase loans could grow 7.7% to $1.46 trillion, and refinance activity is expected to rise 9.2% to $737B. In total, mortgage volume by loan count should grow 7.6% to 5.8M loans.

Why It Matters

The MBA’s outlook signals renewed confidence among lenders and investors heading into 2025. Easing borrowing costs and strong demand—especially in multifamily—are encouraging more lending activity across asset classes.

What’s Next

Look for continued growth in 2025 as the Fed eases rates and capital becomes more available. But the window for aggressive expansion may be short-lived. MBA expects lending activity to level off by 2027, signaling the need for careful long-term planning.