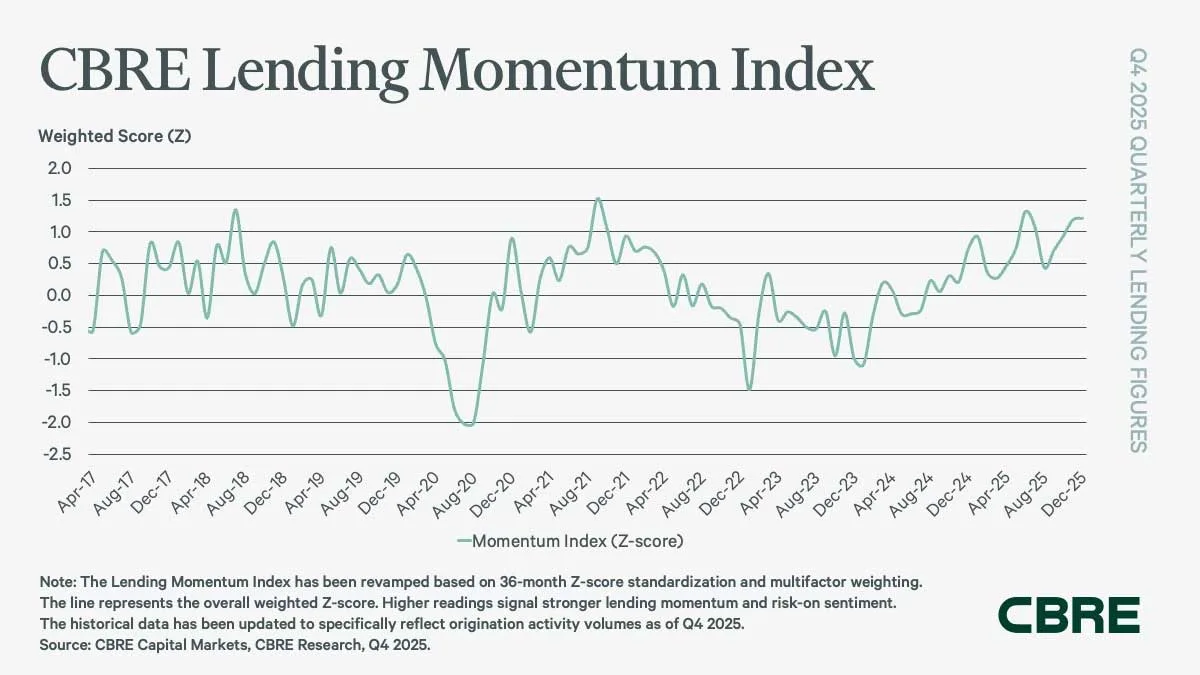

- Lending momentum in US commercial real estate rose 67% year-over-year in Q4 2025, reaching its highest level since 2018.

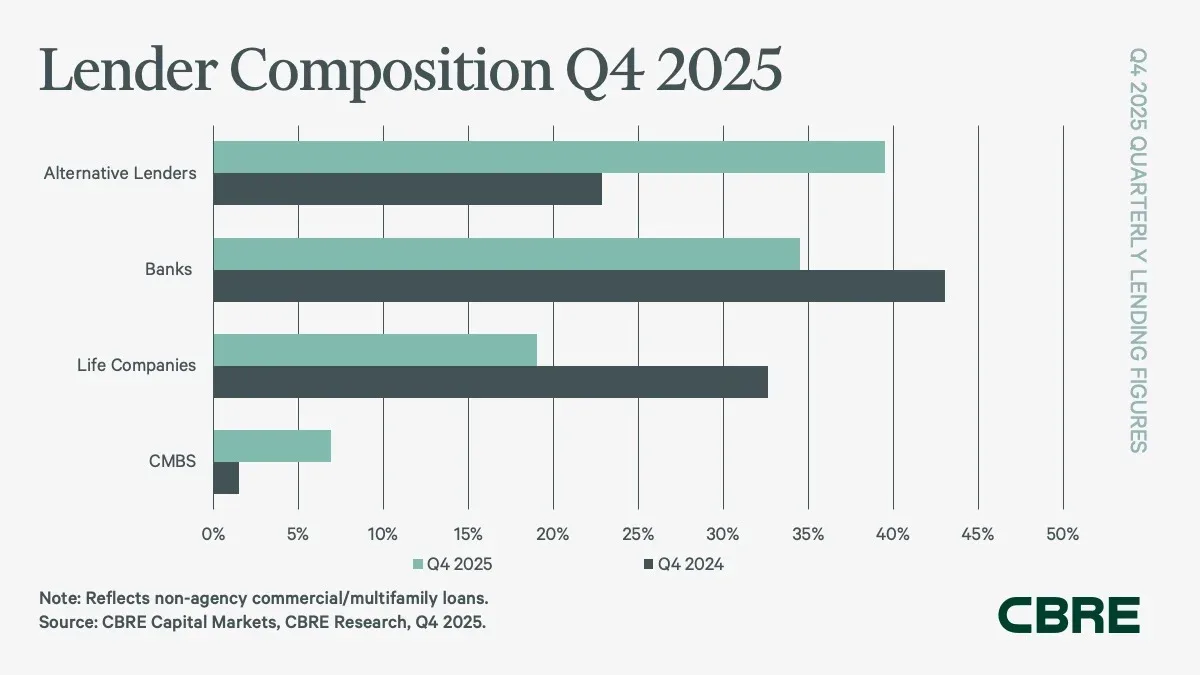

- Alternative lenders led non-agency originations, accounting for 40% of volume, while banks increased activity by 73% quarter-over-quarter.

- Key loan metrics improved, including lower spreads and rates, stronger loan-to-value ratios, and an uptick in agency multifamily lending.

- CMBS issuance reached $158B in 2025, the highest annual total since 2007, boosting non-agency lending diversity.

Strong Momentum Across Lender Types

US commercial real estate lending gained significant ground in Q4 2025, according to the CBRE Lending Momentum Index. The index registered a 67% year-over-year increase, driven by a surge in both commercial and multifamily originations. This upward trend outpaces activity seen since 2018, signaling renewed lender confidence.

Alternative lenders—particularly debt funds and mortgage REITs—captured 40% of CBRE’s non-agency loan volume, nearly doubling their share from the previous year. Banks accounted for 35% of non-agency volume and ramped up originations by 73% quarter-over-quarter. Life insurers and CMBS lenders rounded out the market, with CMBS volume expanding sixfold over the prior year.

Loan Terms and Underwriting Metrics

Markets saw stable or tightening loan spreads in Q4 2025, with commercial mortgage spreads unchanged at 197 bps and multifamily spreads inching up to 142 bps. Loan constants and mortgage rates declined modestly, while debt service coverage improved to 1.36. The average commercial loan-to-value ratio rose to 60.9%, suggesting slightly more aggressive underwriting, while multifamily LTVs climbed to 66.2%.

Agency lending for multifamily remained robust, with Q4 volume hitting $55B and 2025 reaching $150B, up 25% from the prior year. The CBRE Agency Pricing Index also fell, tracking lower mortgage rates for fixed-rate agency debt. Meanwhile, tighter CMBS spreads contributed to improved financing conditions, helping broaden capital availability across borrower profiles.

What’s Next

With investor capital readily available and lender participation broadening, commercial real estate lending momentum is positioned for continued growth. Credit spreads remain healthy, and strong agency activity points to ongoing liquidity in the multifamily sector. Market watchers will monitor whether underwriting becomes more aggressive or lenders maintain the current prudent approach as 2026 unfolds.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes