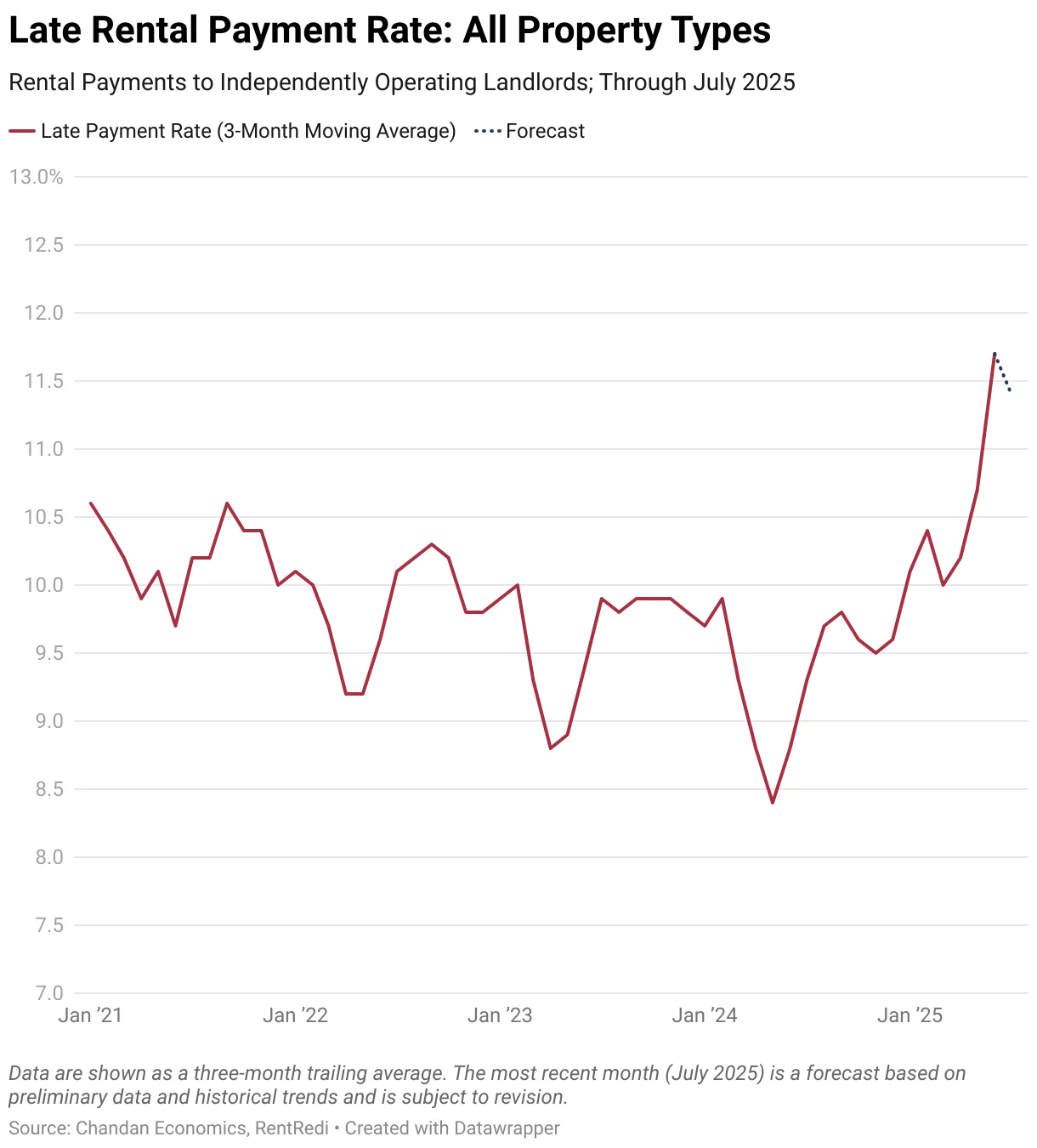

- On-time rent payments are slipping, with late payments reaching 11.7% in June 2025—the highest since mid-2024.rn

- Full rent collections remain steady, suggesting renters are catching up after delays, despite tighter household budgets.rn

- Seasonal relief is missing in 2025, pointing to deeper issues as household income and expenses fall out of sync.rnrnrn

Late Rent Reflects Growing Financial Strain

Chandan Economics reports that since April 2023, late rent has been on the rise as on-time rent collections have steadily declined. A modest improvement in August 2025 hasn’t reversed the overall drop. The trend highlights growing financial pressure on renter households.

A Growing Lag in Payments

Total rent collection has stayed relatively stable. However, more renters are paying late. In independently owned rentals, the late payment rate rose from 8.8% in mid-2024 to 11.7% in June 2025.

Seasonal Patterns Are Breaking Down

Late rent payments typically dip in the spring, when many renters receive tax refunds. That drop didn’t happen this year. The ongoing rise suggests many renters now rely on mid-month income to pay overdue rent.

Rising Costs, Slowing Wages

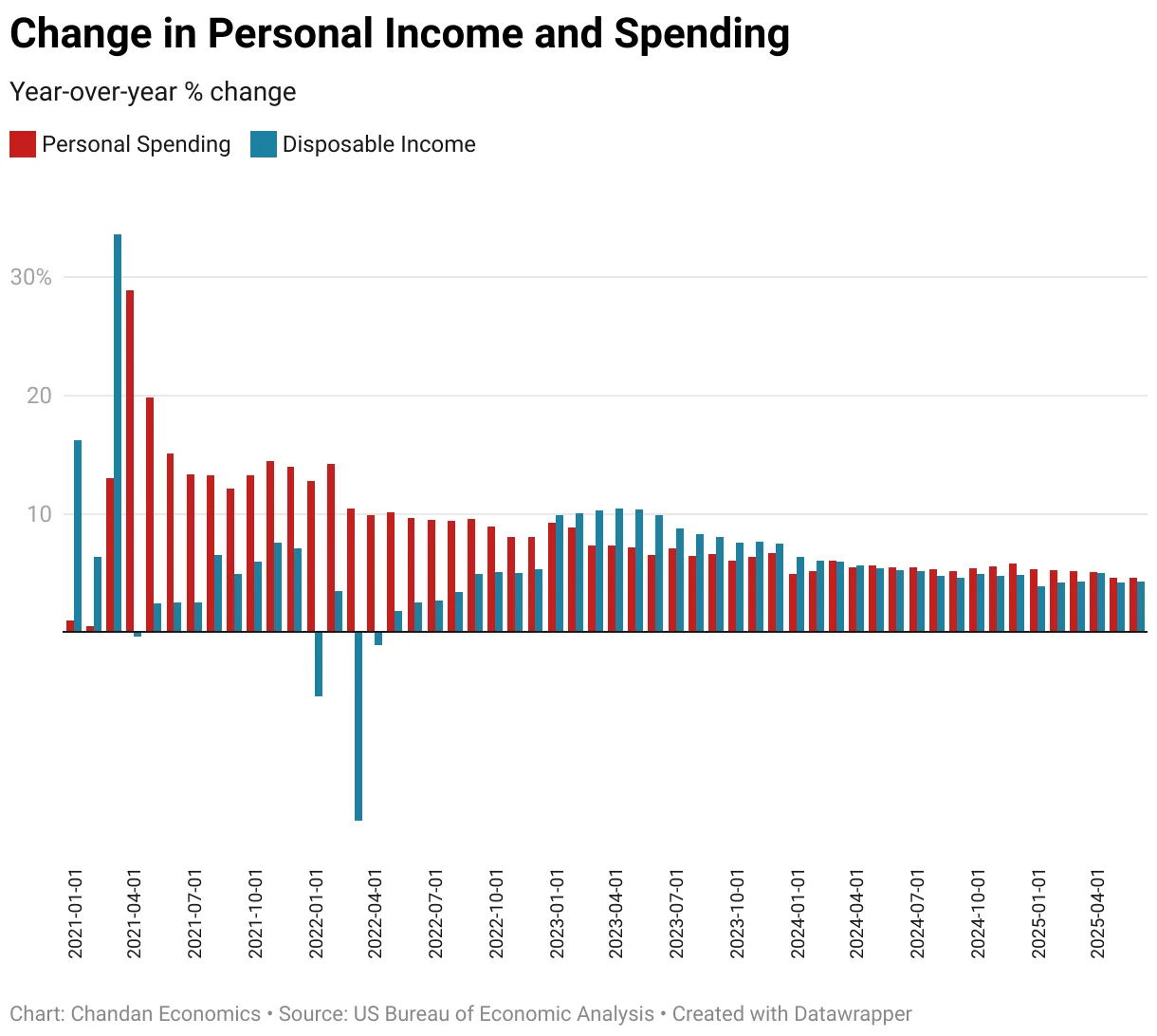

From 2021 to 2022, inflation outpaced wage growth. Incomes briefly gained ground in late 2022. But since early 2024, spending has again grown faster than earnings.

Debt Is Becoming a Major Risk

While wages have cooled, layoffs remain limited. That helps explain why most renters still pay rent—just later. Since January 2023, full payment rates have dropped 428 basis points. On-time payments, however, have fallen 502 basis points.

The New York Fed reported that non-housing debt rose by $40B in Q2 2025 after falling in Q1. Delinquencies over 90 days increased across all age groups, adding pressure to household budgets.

The Outlook

Debt and rising interest costs are crowding out other spending. Renters must now balance essentials more carefully. Whether they can stay on track depends on inflation, rental costs, and the pace of US economic growth.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes