- Large CRE transactions over $10M jumped 48% quarter-over-quarter and totaled $76.4B.

- These deals accounted for nearly 68% of all single-asset investment, the highest share since mid-2022.

- Investor interest is returning in industrial, multifamily, and retail assets, while the office sector continues to struggle.

- Median large-deal size remains below peak 2021 levels, pointing to cautious optimism.

Large Deals Make a Comeback

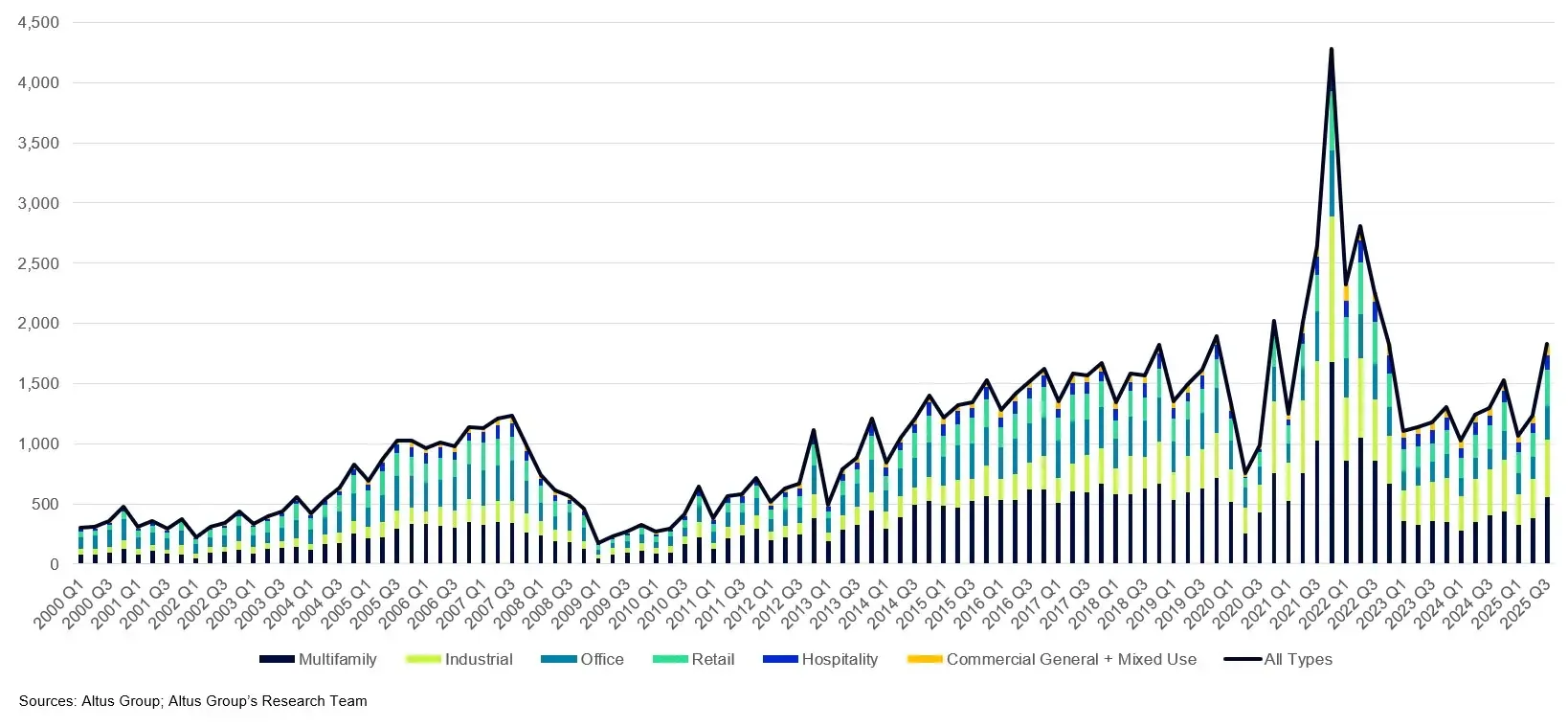

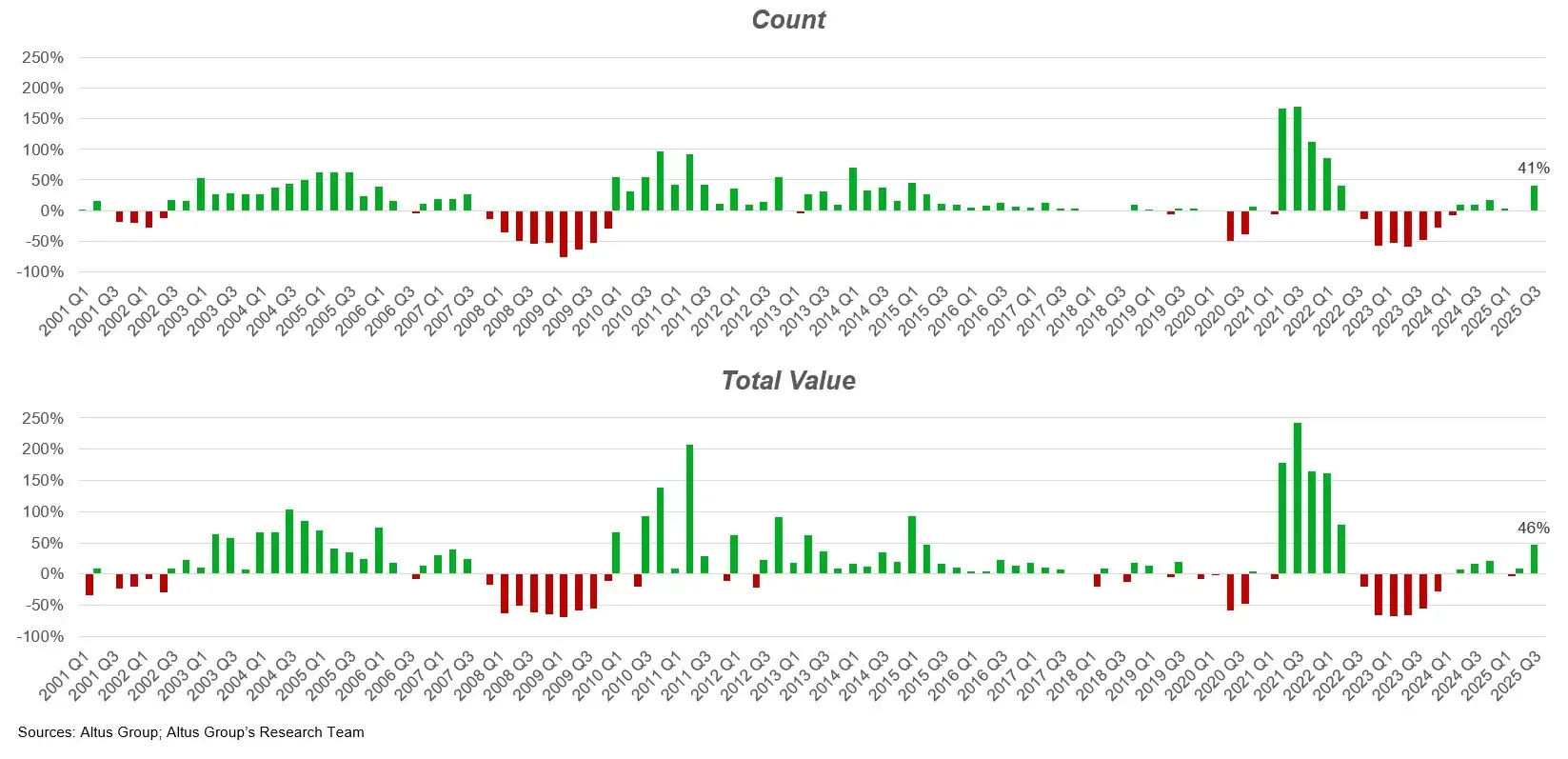

After a sluggish first half of the year, Q3 2025 delivered a sharp rebound in commercial real estate activity. According to Altus Group’s latest quarterly report, there were 1,826 single-asset transactions exceeding $10M — a 48% jump from the prior quarter and 41% higher than the same period in 2024.

The total value of these deals reached $76.4B, the most since Q3 2022 and a level that’s only been surpassed twice in the past decade, outside the post-pandemic spike.

Investor Sentiment Turns Positive

The renewed activity in the large-deal space suggests that investor conviction is returning. Large transactions made up nearly 68% of all single-asset CRE investment dollars — a significant increase and a clear sign that capital is once again flowing into top-tier assets.

While deal volume surged, pricing trends indicated stability rather than overheating. Median price PSF rose slightly — up 0.6% both quarter-over-quarter and year-over-year.

Sector Performance Highlights

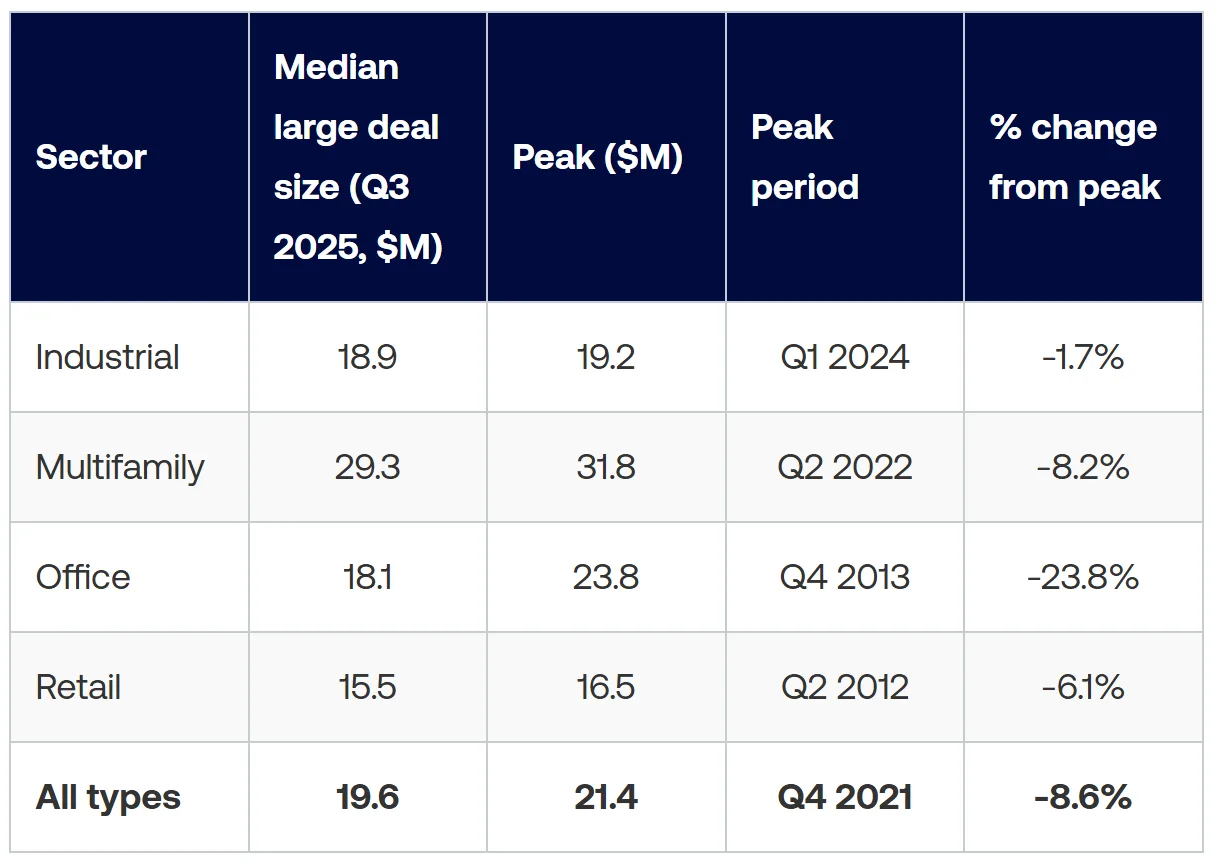

- Industrial assets are showing resilience. Deal sizes are just 1.7% below their recent peak in early 2024, and investor interest remains high.

- Multifamily is rebounding, with median deal sizes climbing 14.2% from their post-pandemic low, though still 8.2% below peak levels from 2022. Investor interest in multifamily has been steadily returning throughout 2025, contributing to the sector’s outsized performance in Q3.

- Retail has remained steady for years. Median deal sizes are only 6% below their 2012 high, reflecting consistent investor confidence.

- Office continues to lag significantly. Deal sizes are down nearly 24% from their 2013 peak, and pricing fell again in Q3 — 3% from Q2 and 4.4% year-over-year.

Cautious Optimism Amid Market Shifts

Despite the headline growth, large deal sizes have not fully returned to pre-rate-hike levels. The median transaction value across all sectors in Q3 2025 was $19.6M — still about $2M shy of the 2021 peak.

Even so, the scale of the rebound is notable. Q3 marked the fastest year-over-year growth in large-deal count since 2015, and the strongest quarterly increase in value since 2015 as well.

Looking Ahead

The big question now is whether this momentum carries into Q4 and beyond. With interest rates stabilizing and more clarity around pricing, the market may be finding its footing after a prolonged adjustment period.

While the rebound in large CRE deals doesn’t yet mark a full return to peak conditions, it’s a significant signal: investor confidence is returning, and capital is flowing back into the market’s upper tiers. Whether this is a turning point or a temporary surge remains to be seen, but Q3 2025 delivered the clearest signs yet of a CRE market on the mend.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes