- The US added 119,000 jobs in September—far surpassing Wall Street forecasts—despite an uptick in unemployment to 4.4%.

- Odds of a December Fed rate cut dropped to 39.1%, down sharply from 98.8% a month ago, amid conflicting labor signals and outdated data.

- Construction and rental demand remain sensitive to rate shifts; while multifamily building activity ticked up in August, sustained recovery may depend on monetary easing.

A Long-Awaited Data Drop

After a 44-day blackout, September’s jobs report offered a mixed signal: a surprisingly strong headline jobs number at 119,000, sharply reversing August’s 4,000-job decline, but with the highest unemployment rate (4.4%) since October 2021. This mix complicates how policymakers—and investors—interpret labor market health heading into the end of the year, reports Chandan Economics.

Cooling Expectations for a December Cut

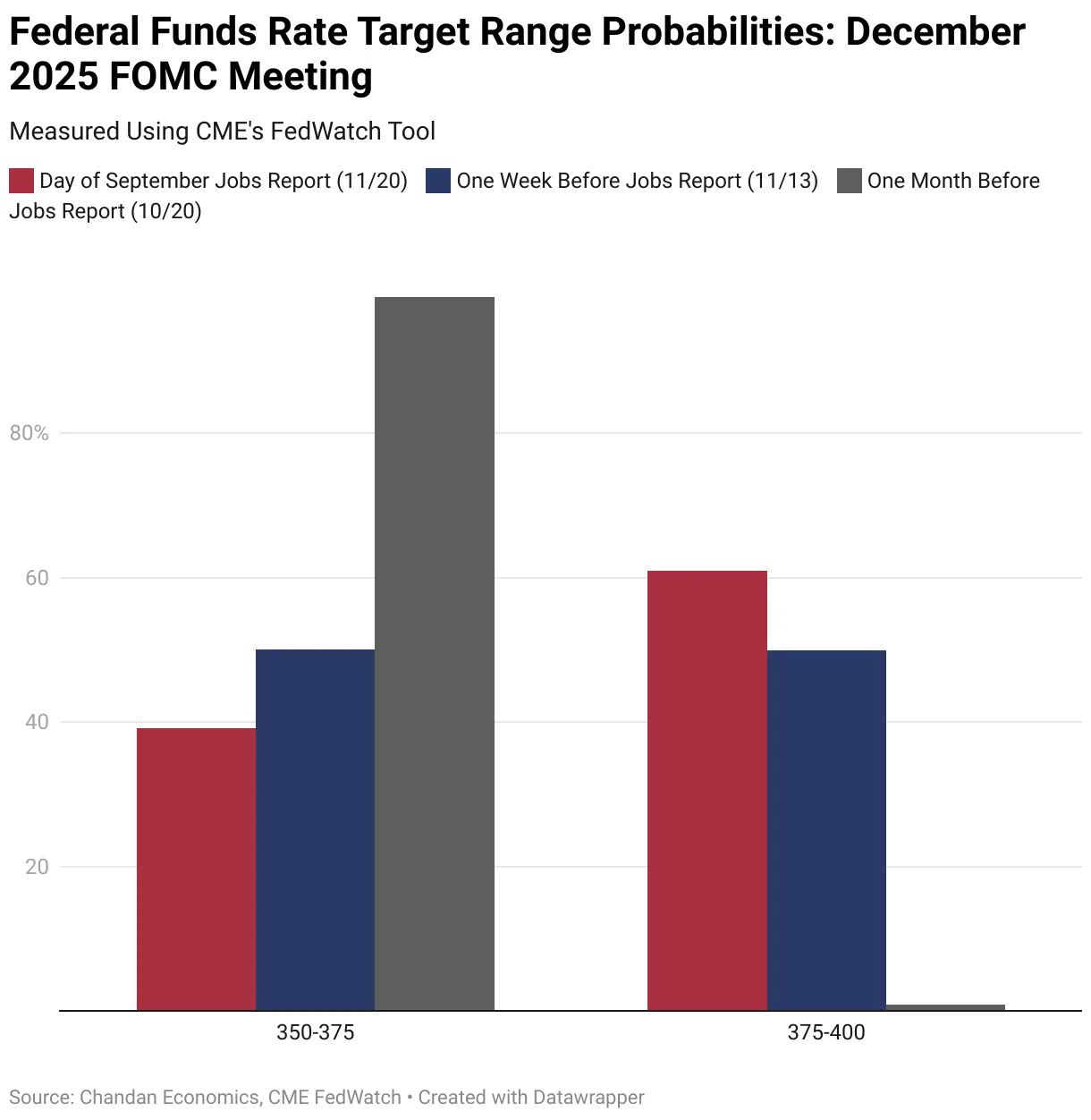

For weeks, markets had largely priced in a December rate cut. But the release of September’s jobs numbers—despite their lag—recalibrated those odds. As of the afternoon following the report’s publication, futures markets assigned just a 39.1% chance of a 25-basis-point cut at the December FOMC meeting, down from nearly 99% a month earlier. The likelihood of holding steady rose to over 60%, reflecting growing hesitation among investors and policymakers, amid ongoing divisions within the Fed over the path forward.

Mixed Signals for Rental Housing

While the labor data adds a layer of uncertainty, its lagging nature—combined with mounting signs of corporate layoffs and a turn in private sector job creation—dilutes its forward-looking value. Additional indicators, such as the Fed’s Beige Book, the Producer Price Index, and real-time private employment data, will likely carry more weight as the Fed considers its next move.

On the construction front, recent numbers show multifamily activity is holding on: private residential construction rose 0.8% from July to August, even as total private construction spending slipped 1.6% year-over-year before inflation. Still, rising input costs (+2.2% YoY) and tight financing conditions may constrain further growth unless borrowing costs ease.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Why It Matters

Rental housing—both in terms of demand and new supply—remains highly sensitive to interest rates. Developers and renters alike are in a holding pattern, waiting on clearer signals from the Fed. With employment and inflation data now back online, the central bank faces a narrowing window to act decisively—or risk further destabilizing sectors like housing that rely on rate relief.

What’s Next

Look for upcoming data releases, including October’s job numbers and inflation reports, to shape the final Fed decision of 2025. In the meantime, rental markets may remain in limbo, as construction costs climb and uncertainty clouds leasing activity. With housing’s momentum tied closely to monetary policy, all eyes remain on the Fed this December.