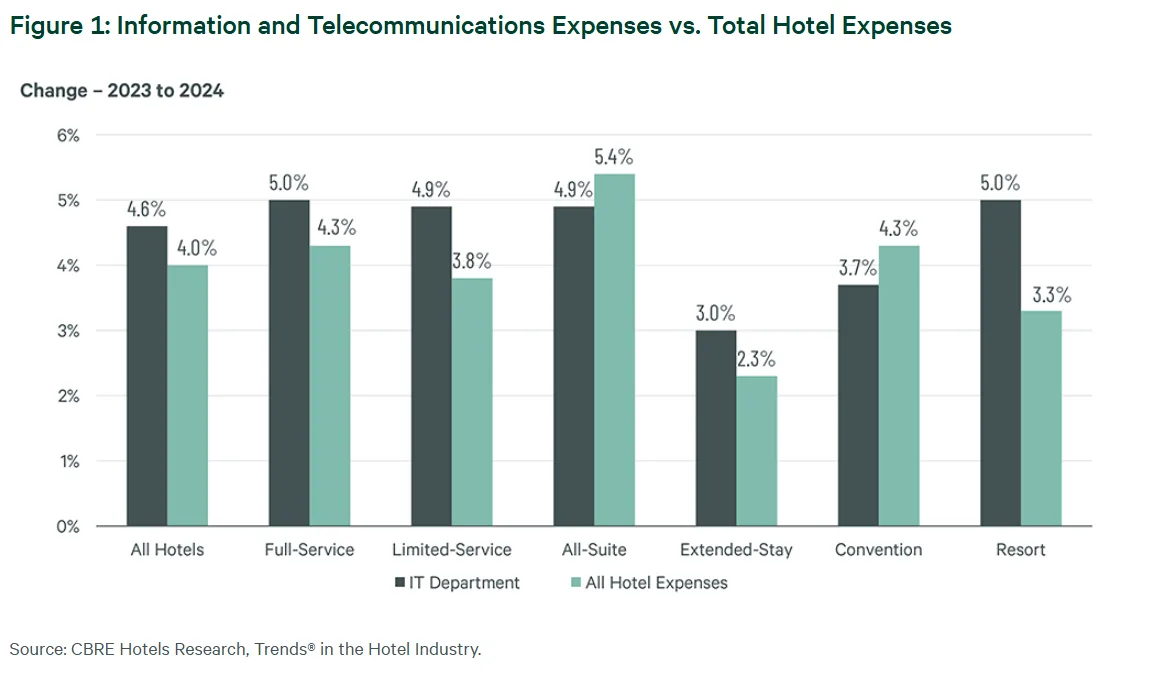

- IT Department costs rose 4.6% from 2023 to 2024, outpacing the 4.0% increase in total hotel expenses, according to CBRE’s Trends® in the Hotel Industry survey.

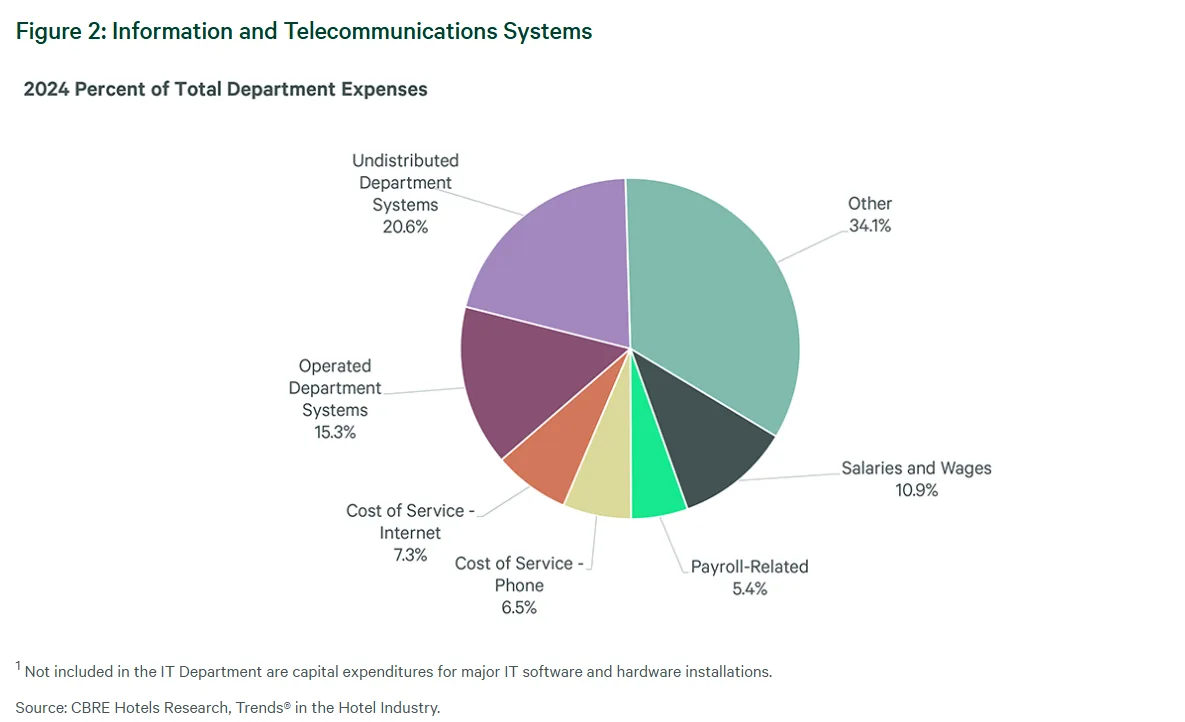

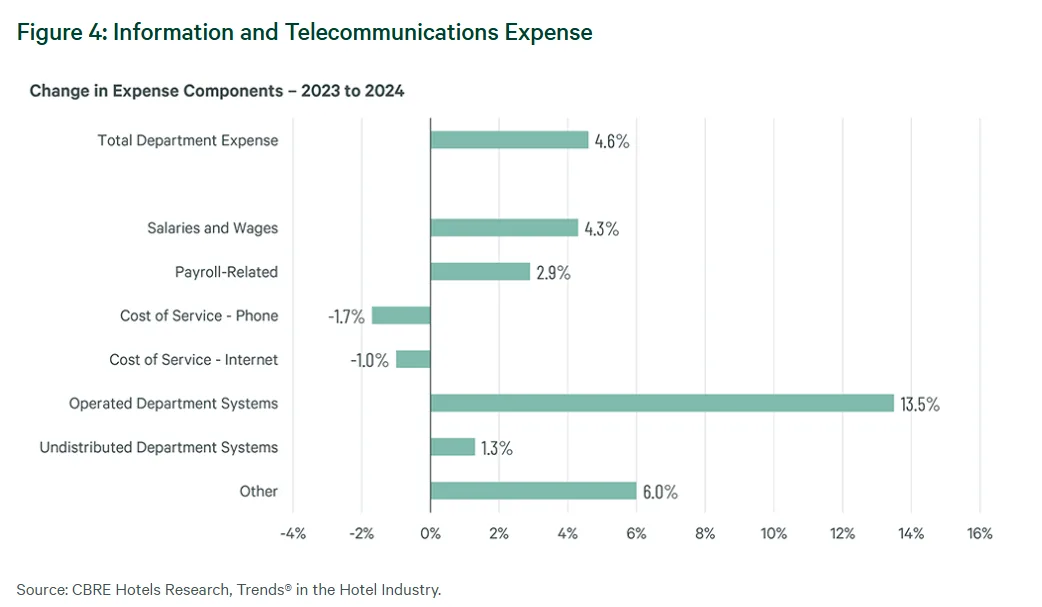

- Technology spending surged in operated-department systems such as property management, reservations, and guest-facing features, while back-office systems saw a more modest 1.3% rise.

- Internet and phone service costs declined slightly, offering modest relief, but anticipated capital expenditures on hardware and software are projected to increase 10% to 20% in 2025.

- Cost control strategies like vendor consolidation and system audits have proven effective, helping some operators uncover significant annual savings.

A Growing Concern For 2025

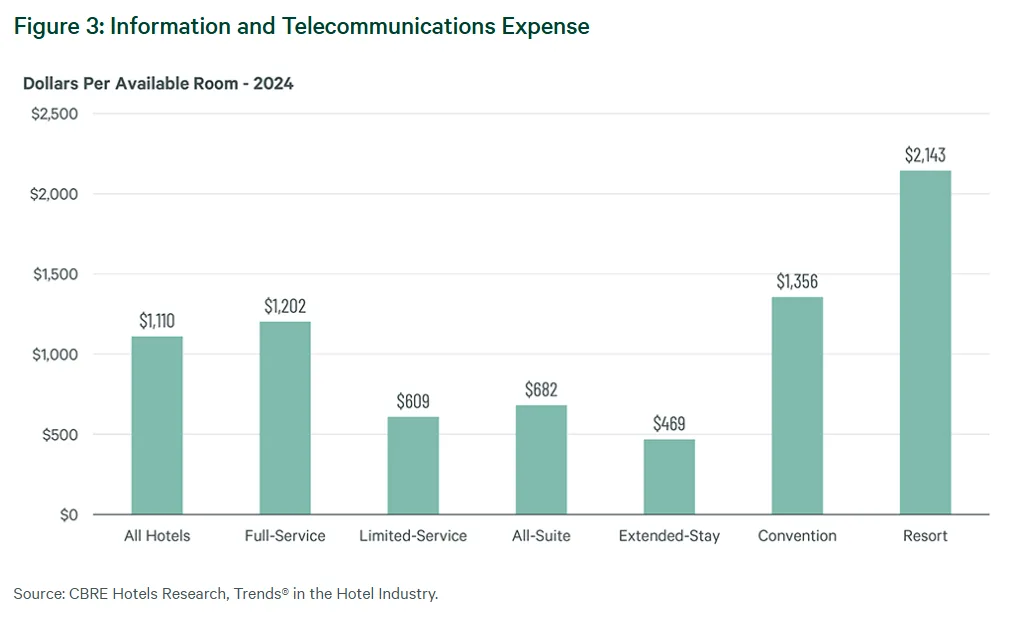

With tight margins expected in 2025, hotel operators are scrutinizing all expense categories—especially the more difficult-to-manage undistributed departments like IT, reports CBRE. Their latest analysis of nearly 4,800 US hotels reveals that IT expenditures grew faster than the industry’s overall expenses, driven by both operational needs and evolving guest expectations.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Driving The Rise?

In 2024, hotels leaned heavily on new technologies to meet rising guest and operational demands. Most of the IT cost increase stemmed from investments in operated-department systems—tools for managing reservations, key coding, POS, and guest services like in-room entertainment and concierge apps.

Conversely, back-office systems—supporting accounting, payroll, maintenance, and security—only saw a 1.3% cost uptick, suggesting operators are prioritizing front-end digital upgrades.

Labor-related IT costs also rose by 3.8% as hotels turned to in-house technicians or outsourced vendors to manage increasingly complex tech ecosystems.

Some Costs Did Fall

Administrative phone and internet service costs declined by 1.7% and 1.0% respectively in 2024. However, CBRE notes these reductions may be temporary as internet demand continues to escalate. The growing use of mobile check-in, digital keys, and staff handheld devices will likely reverse this trend.

CapEx And Replacement Pressures Ahead

Capital spending on IT hardware and software—tracked separately from operating expenses—is expected to increase by up to 20% in 2025. Many hotels are now replacing aging systems that were deferred during pandemic-era budget constraints, further pressuring tech budgets.

Tactics To Manage Technology Spend

To counter rising tech costs, CBRE recommends:

- Annual audits to identify unused or misbilled services.

- Vendor consolidation to negotiate better terms and reduce redundancy.

- Process reviews to identify productivity gains from automation and system upgrades.

One CBRE-led initiative uncovered $1M in annual savings by streamlining internet service providers across a 120-hotel portfolio.

The Bottom Line

As technology becomes more ingrained in hotel operations, managing IT costs will remain a top priority. While tech investments are often necessary for competitiveness and efficiency, disciplined auditing and vendor management are crucial. Strategic planning will also be essential to keep expenses in check.