- Older multifamily properties dominate 2025 deals, with many dating back to the 1960s or earlier—even in metros where newer inventory is prevalent.

- Smaller, vintage assets appeal to investors due to lower equity requirements and access to competitively priced agency financing.

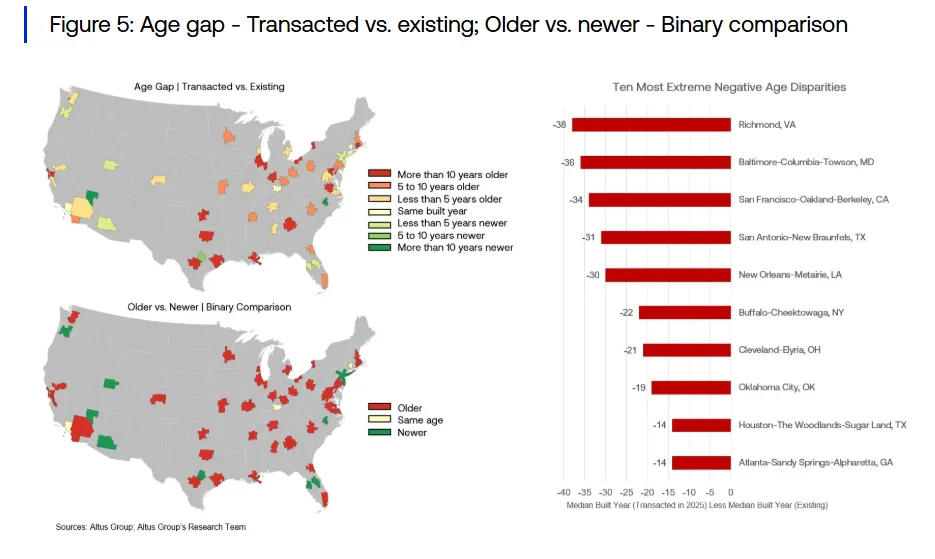

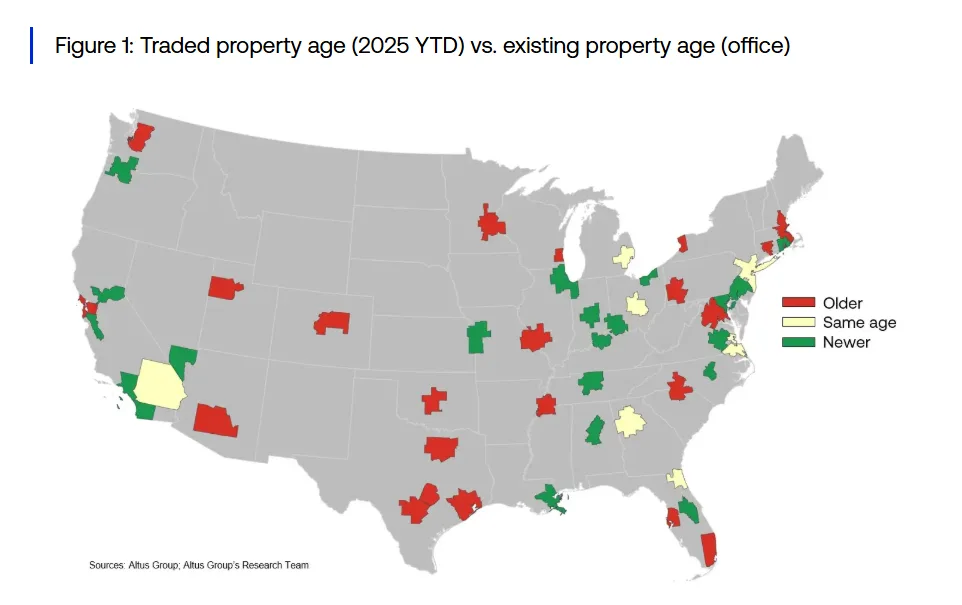

- Multifamily transactions show a sharper age skew than office trades, which more closely mirror national inventory in terms of building vintage.

Capital Shifts Push Investors Toward Vintage Multifamily

In 2025, buyers are focusing on older multifamily properties—often built before 1970. This trend stands out against the office sector, where trades align closely with inventory age, per Altus Group.

Office trades show consistency: The average US office building was built in the 1980s. Properties sold this year reflect that same decade. Among 50 major metros, most saw traded office assets fall within a similar age range.

Multifamily tells a different story: Properties sold in this sector skew significantly older. In 38 metros, buildings traded in 2025 are older than the area’s typical inventory. Cities like San Francisco, Baltimore, and Atlanta show age gaps of over 30 years between traded properties and existing stock.

Why Older Multifamily Properties Dominate

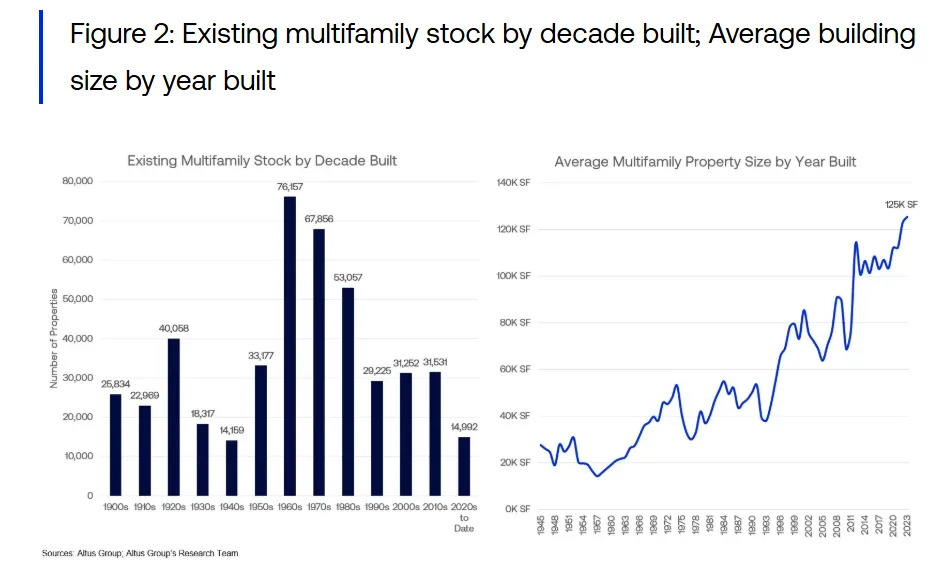

The US built over 76,000 multifamily properties in the 1960s—more than double the number from the 2000s or 2010s. These mid-century buildings were smaller, averaging around 40,000 SF. Newer buildings average nearly 100,000 SF.

These older assets still shape many markets. In the Northeast, Midwest, and parts of the West Coast, 1960s-era buildings dominate inventory. Many 2025 deals reflect this trend.

What’s Driving This Shift

Two main factors explain the rise in older multifamily transactions:

- Lower purchase prices: These buildings are smaller and less expensive, which means lower equity requirements. More buyers can compete for them.

- Attractive financing: Agency lenders like Fannie Mae and Freddie Mac provide competitive financing for stabilized, older multifamily properties. This capital remains available even as other financing sources tighten.

As a result, many investors are choosing vintage properties over newer ones, prioritizing affordability and access to financing.

What to Watch Next

If capital remains expensive and agency financing continues to favor older assets, this trend may persist into 2026. Investors are choosing liquidity, lower risk, and stable debt terms over newer construction.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes