- Investor sentiment is not a reliable predictor of sector performance. Popular property types often become crowded trades, leading to lower-than-expected returns.rn

- Institutional definitions have expanded. Sectors like data centers and life sciences, once fringe, are now firmly in the institutional spotlight.rn

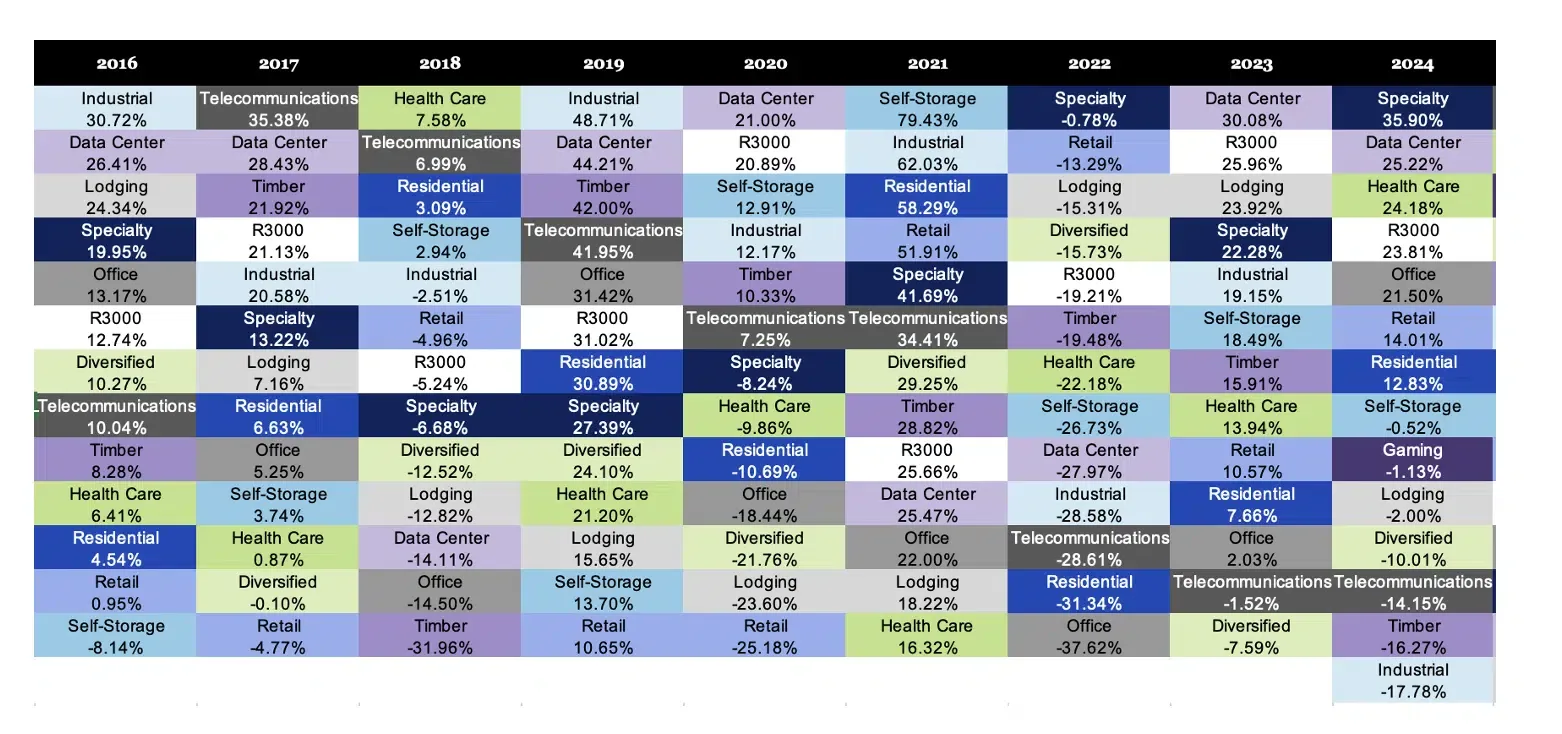

- Market cycles and macro events heavily influence preference. Life sciences surged during COVID but have since fallen out of favor, while retail has rebounded from its u0022deadu0022 narrative.rn

- Data limitations exist. IREI’s survey, while informative, represents a subset of the market, highlighting the need for more comprehensive analysis.rnrnrn

Sentiment vs. Returns: A 10-Year Comparison

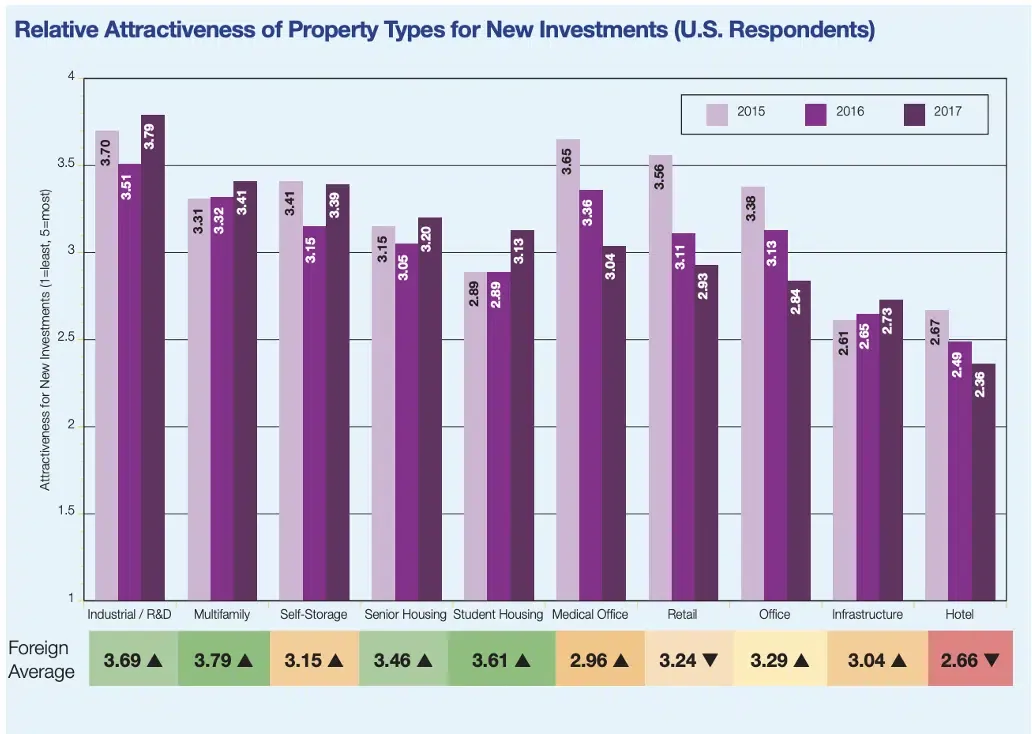

IREI’s Annual Investor Survey—now in its 29th year—has long been a pulse check on where institutional capital is heading in commercial real estate. But in a new analysis comparing a decade of investor preferences to actual performance data, a key question emerged: Do the most popular sectors actually perform the best?

The answer, according to IREI Managing Director Chase McWhorter: not necessarily.

From Niche to Normal

Looking back to 2015, the property types listed as “preferred” were narrower, often limited to traditional sectors like cbd office and retail. Fast forward to 2025, and the list has expanded dramatically to include life sciences, data centers, and other previously non-core assets.

“Fifteen years ago, raising capital for a data center fund was a challenge,” McWhorter notes. “Today, it’s a common institutional play.”

COVID’s Skewed Lens

A standout example from the past decade is life sciences real estate. In 2021 and 2022, this sector ranked second and third on the survey’s preference list. But performance in subsequent years hasn’t lived up to the hype, suggesting that pandemic-era sentiment may have led to over-allocation.

On the flip side, retail—particularly grocery-anchored centers—proved resilient despite being declared “dead” in the early COVID years. This reversal underscores the dangers of reactionary investing based on short-term disruptions.

Crowded Trades and Missed Vintages

A recurring insight from IREI’s roundtables: property types at the top of investor preference lists often attract too much capital, diminishing return potential. As one participant put it, “Multifamily and logistics are still favored, but that just means the trades are crowded.”

Another key theme? Don’t stop allocating. Many consultants emphasize that market timing is nearly impossible in private real estate. Opting out of a given vintage year may lead to missed opportunities.

The Data Caveat

McWhorter is clear that this review is a starting point—not a definitive thesis. The survey polls around 150–200 investors annually and is paired with return data from NCREIF and Nareit, which don’t fully capture the entire manager landscape.

Still, the insights provide a valuable lens into how investor behavior and market performance can diverge—and why trend-following isn’t always a winning strategy.

Why It Matters

For capital allocators, understanding the gap between sentiment and performance is critical. While favored sectors might seem “safer,” they can also be saturated, pushing down returns. Conversely, overlooked sectors—like retail—may offer upside precisely because they’re out of favor.

As institutional real estate continues to evolve, so too must the frameworks used to analyze where to invest—and why.

What’s Next

IREI plans to collaborate with data scientists and researchers to build on this analysis. By layering deeper performance metrics and behavioral trends, future studies may offer more predictive power for real estate investors navigating the next decade of change.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes