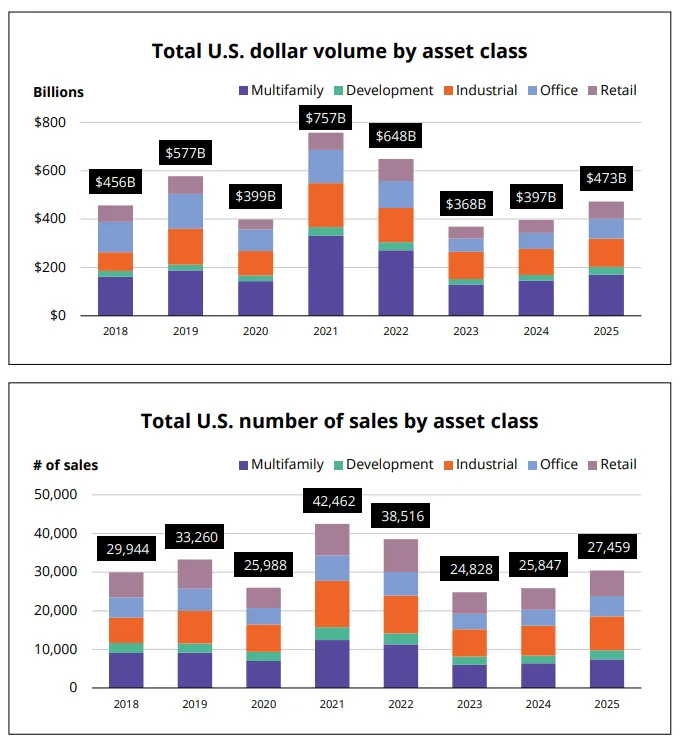

- US investment sales in 2025 hit $472.6B across 30,425 deals, up nearly 20% in volume year-over-year.

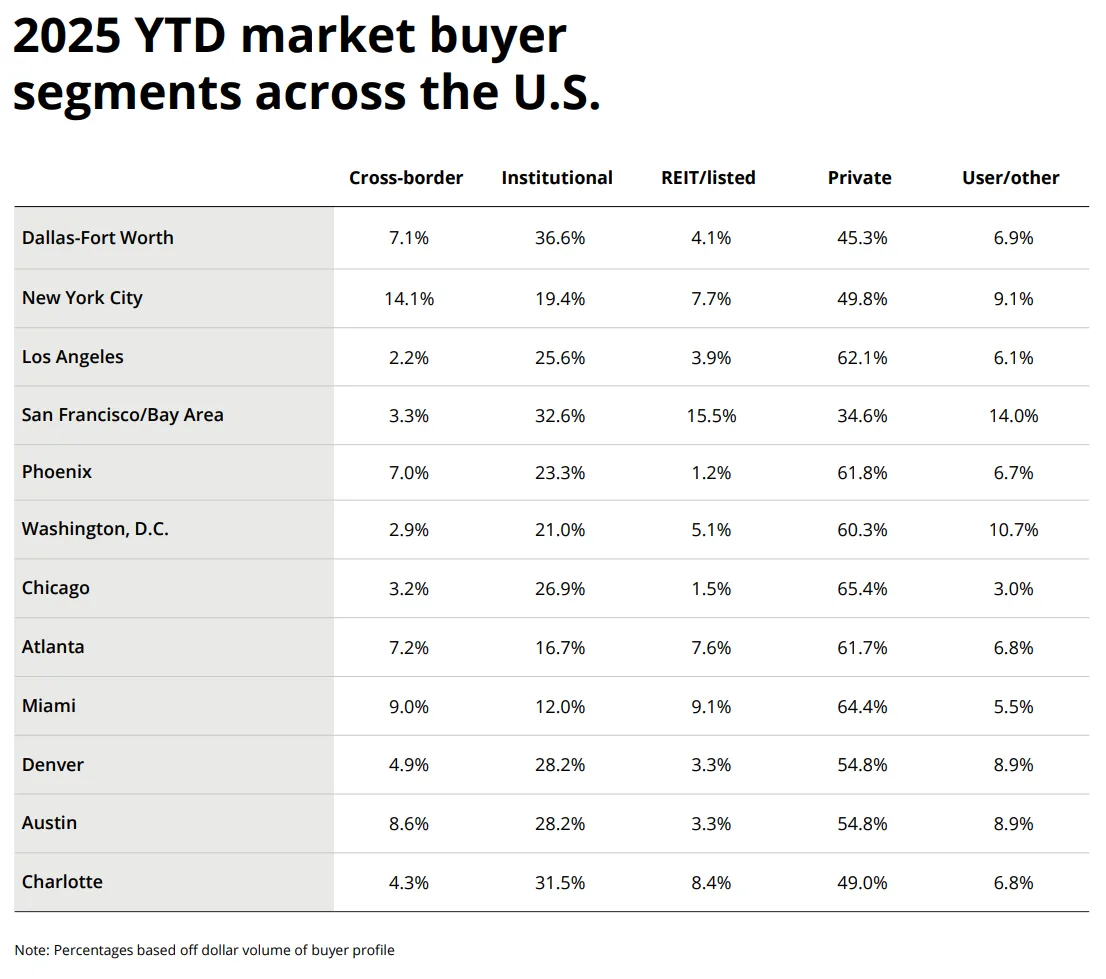

- The top 12 US markets accounted for 41.5% of investment activity, led by Dallas-Fort Worth, San Francisco, Los Angeles, and New York.

- Multifamily, retail, and development/land sectors drove growth, with strong investor activity projected to continue into 2026.

- Market performance varied, Dallas, Miami, Denver and San Francisco saw double-digit volume gains, while New York and Charlotte trailed with modest or negative growth.

Momentum Builds in Investment Sales

Globe St reports that the US investment sales market delivered its third consecutive annual increase in 2025, recording 30,425 transactions totaling $472.6B, according to Avison Young. Deal count climbed 17.7% and dollar volume jumped 19.9% from the previous year. Multifamily remained the largest segment, but major gains in retail and development/land activity exceeded expectations and powered overall growth. Avison Young forecasts that positive investment sales momentum will extend into 2026.

Top Markets Drive Activity

The country’s 12 largest markets represented the lion’s share—41.5%—of 2025’s investment sales. Dallas-Fort Worth led the pack with $22.3B in volume, up 6.6% year-over-year. San Francisco/Bay Area followed at $20.5B (+24.6%), while Los Angeles posted $18.9B (+21.8%) and New York $18.8B (+1.1%). Miami’s resurgence stood out, with volume soaring 34.7% and transaction count jumping 15.5%. Denver also performed strongly, advancing 30.1% in dollar volume and 20.8% in deal count. In contrast, Phoenix, Washington, D.C., Atlanta and Charlotte faced softer results, though many are expected to rebound in 2026.

Sector Standouts and Investor Trends

Multifamily assets comprised the largest share of investment sales, but retail and land/development sectors posted outsized gains. Across major metros, cap rates and PSF pricing demonstrated stability or modest improvement, while institutional capital and private buyers continued to dominate. In Dallas-Fort Worth, every asset class except industrial saw growth; San Francisco and Los Angeles posted especially strong gains in office and retail, while Miami nearly doubled multifamily and retail sales volumes from the prior year.

What’s Ahead for 2026

With buyer conviction and deal volumes rising, most top US markets are positioned for continued growth in 2026. Bid-ask spreads are narrowing in areas like Dallas-Fort Worth, and pricing is stabilizing nationwide. Markets lagging in 2025, such as Phoenix, Atlanta, and Charlotte, are seen as likely candidates for recovery. Momentum is also being supported by a more favorable lending climate that began improving in mid-2025, giving investors greater flexibility in underwriting deals. Overall, the sustained momentum in investment sales signals robust investor confidence in US commercial real estate fundamentals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes