- Insurance profits have surged, while premium rates for home and auto policies stay high.

- New York and other states are considering profit caps to address affordability issues for consumers.

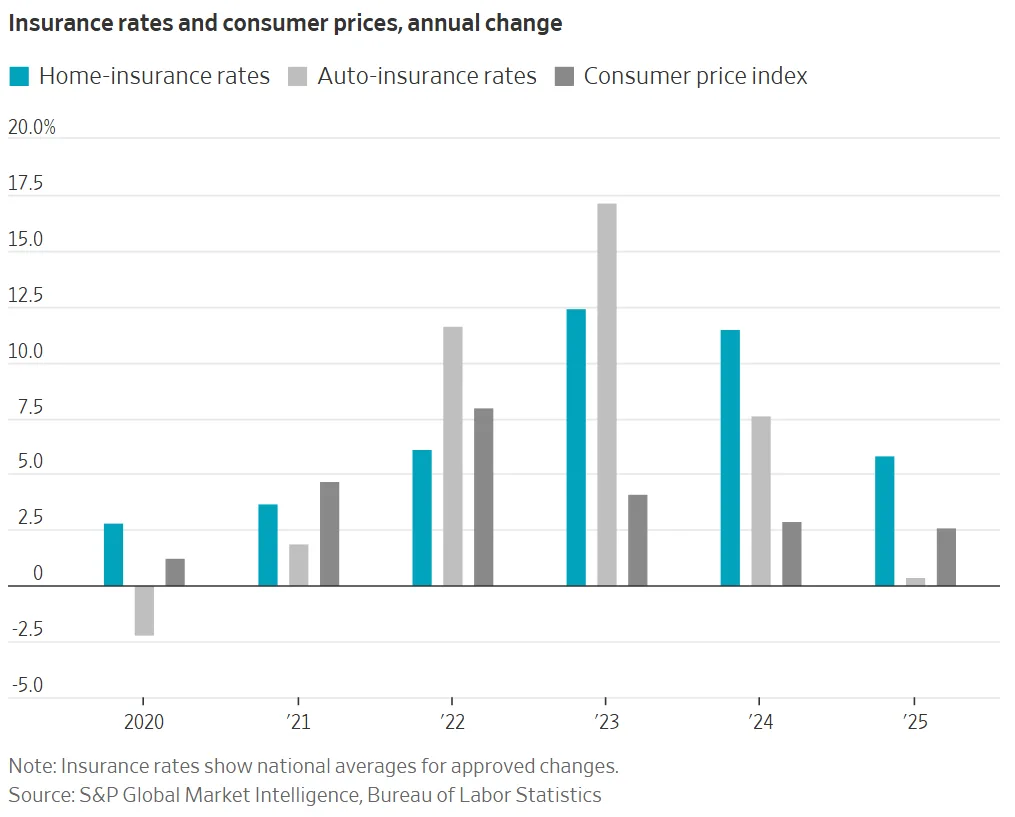

- Rate increases outpaced inflation, drawing growing regulatory and political scrutiny.

- Insurers warn profit curbs could reduce competition and disrupt markets.

Regulatory Pressure Grows

Insurance profits are drawing increasing scrutiny as state officials react to public frustration over rising premiums. The WSJ reports that New York Governor Kathy Hochul recently proposed profit caps for insurers with high margins, aiming to bring relief to homeowners and drivers paying elevated rates.

Other states, including Oklahoma, have floated similar measures. These moves reflect bipartisan pressure to rein in insurance profits as consumers grapple with affordability challenges. Industry leaders argue such caps could undermine competition and lead to market exits, referencing experiences like the California insurance pullback.

Profit Increases Fuel Debate

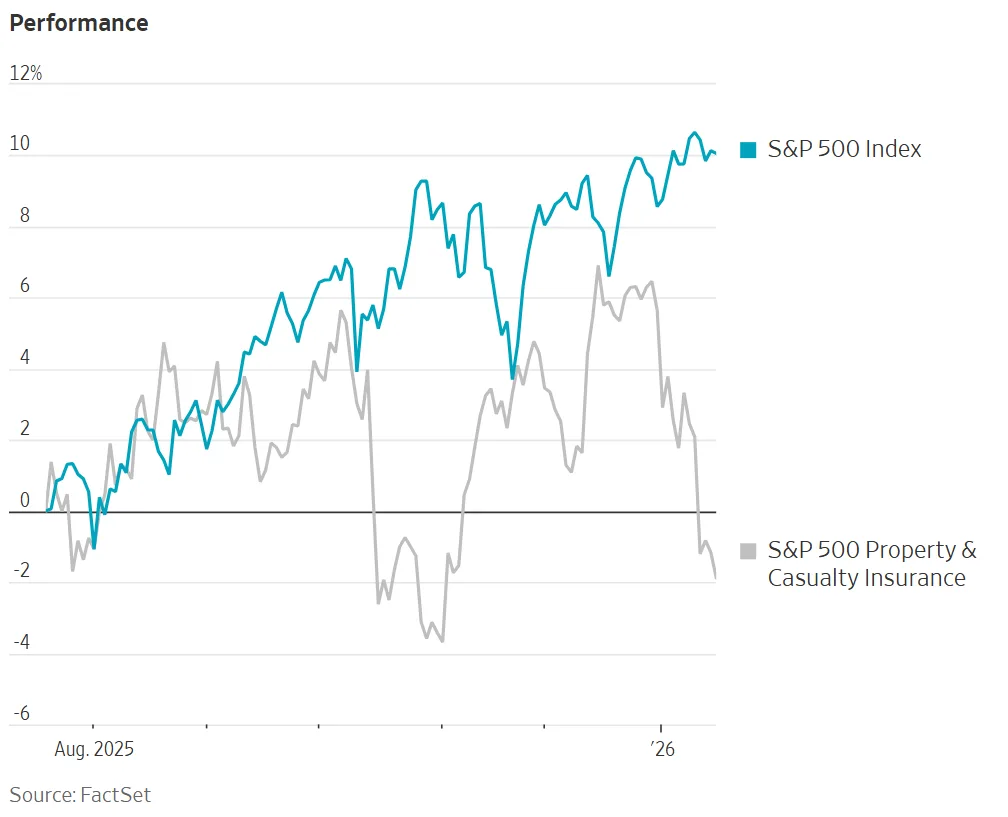

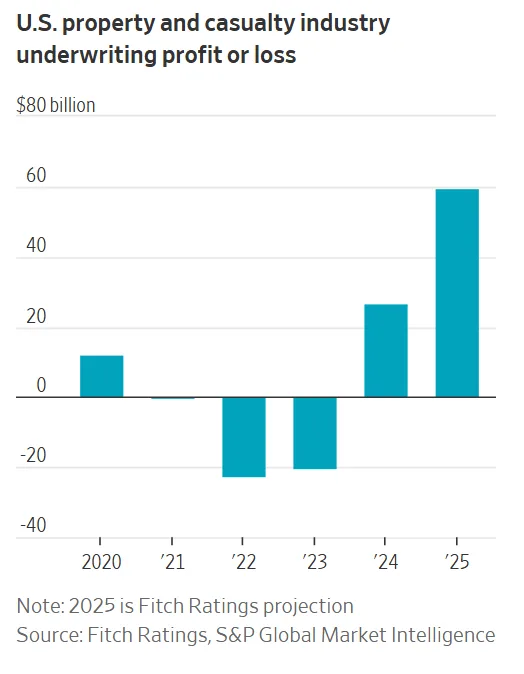

Strong financial performance has intensified the debate. Travelers reported a 26% jump in net income to $6.3B in 2025, as insurers generally rebounded from prior pandemic-related losses. S&P Global forecasts show the property and casualty sector attaining its best underwriting profit in nearly 20 years.

Despite this, rate increases continued: home-insurance premiums rose 6% on average nationwide last year. Some markets saw sharper spikes—for example, Colorado’s rates more than doubled since 2020, including a 21% hike in 2025. Auto rates were more stable but varied regionally.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Rates, Profits, and Market Dynamics

Industry executives say that profit limitations could backfire by reducing insurer competition. They contend that current profitability is a rebound from previous losses, not a sign of over-earning. Executives indicated no intent to implement sweeping price cuts that could erode these gains. Across the broader real estate and financial landscape, other sectors are also navigating margin pressures and adjusting to changing cost structures as market momentum slows.

Analysts note a time lag between insurer profitability and rate changes, due to regulatory processes and reliance on historical data. While this can disadvantage consumers in the short term, they suggest it should balance out over longer cycles. Insurers remain cautious about lowering rates, mindful of missteps during the pandemic-related pricing shifts.

What’s Next

With insurance profits and affordability under the spotlight, further regulatory proposals and market reactions are likely. The debate over the right balance between consumer relief and industry stability appears set to continue.