- US industrial vacancy could hit 8.6% by the end of 2026, following a three-year construction surge.

- Oversupply is concentrated in large buildings and a few fast-growing metros, while smaller assets show strong demand.

- Investment remains solid, especially for small bay and infill properties in markets with limited new supply.

Construction Eases After a Surge

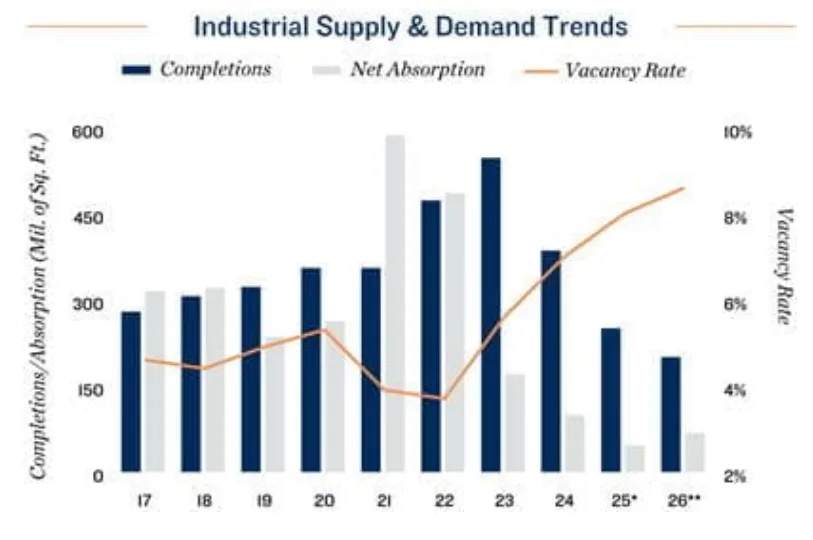

The US industrial market saw a wave of development between 2022 and 2024, with 1.4B SF delivered. That boom pushed vacancy rates up to 7.8% by September 2025.

Although construction is slowing—with only 200M SF expected in 2026, the lowest total in eight years—vacancy could still rise to 8.6% by year-end, according to Marcus & Millichap’s 2026 Industrial Outlook.

Large Buildings Drive Vacancy Rates

The elevated vacancy rate reflects a surge in large-format supply across a few key markets, not a sector-wide slowdown. Just 10 metros accounted for nearly half the new inventory over the past five years.

Much of this space came from buildings larger than 500,000 SF. For example, Austin’s industrial footprint expanded by nearly 60%. Phoenix grew by 40%, followed by Charleston, Las Vegas, and San Antonio, which saw increases between 21% and 36%.

These areas now hold most of the vacant space, especially in larger buildings. As of Q3 2025, vacancy in big-box properties reached 11.5%.

In contrast, smaller buildings and less-developed markets remain tight. Properties sized between 10,000 and 50,000 SF posted a 5.2% vacancy rate in Q3. Buildings between 50,000 and 200,000 SF saw 7.0%. Cleveland and Minneapolis-St. Paul reported vacancies below 4.0% earlier this year.

Small Bay Assets Draw Steady Investment

Despite lower transaction volumes compared to 2021, investment activity in 2025 remained strong—19% above the average from 2014 to 2019. Notably, several high-profile industrial portfolio deals in major metros underscored ongoing confidence in the sector’s long-term fundamentals.

Cap rates held steady in the high-6% range. Investors generally accepted lower cap rates for large properties due to newer construction and stronger tenant credit.

Smaller infill and small bay assets outperformed in markets with limited new supply. These assets remain attractive thanks to stable occupancy and strategic locations near end-users.

Outlook: Bifurcated Market Ahead

Uncertainty around US trade policy could affect industrial demand in regions that rely heavily on Asian imports. However, investor interest in the sector remains strong.

If trade conditions stabilize, demand could improve, helping slow the rise in vacancy and possibly lifting property values.

For now, expect a divided market. Large buildings in overbuilt metros will continue to face pressure, while smaller properties in stable markets should remain resilient.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes