- Industrial real estate in 2026 faces reduced new supply and high policy uncertainty.

- Vacancy rates plateaued at 9.2% but are forecast to tighten in late 2026.

- Atlanta leads in rent growth while Texas drives new industrial construction.

- Power access is rising as a key factor in site selection due to data center demand.

Industrial Pipeline Slows Amid Policy Uncertainty

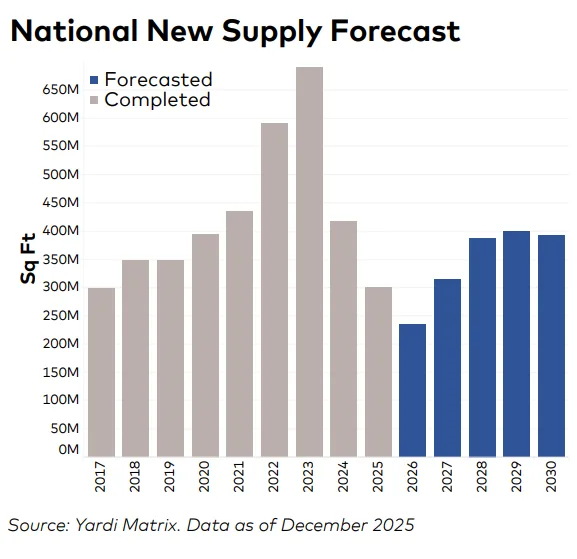

Industrial trends in 2026 are shaped by geopolitical factors and a notably thinner supply pipeline, reports Yardi Matrix. Tariffs and ongoing uncertainty around the US-Mexico-Canada Agreement (USMCA) have added risks for occupiers and investors. The agreement’s upcoming review may introduce further volatility, particularly for firms relying on nearshoring strategies. Production delays and fewer project starts mean that 2026 will record the lowest level of new industrial product delivered in a decade, a reversal from prior years’ supply surges.

Vacancies Stabilize, Rent Growth Persists

The national vacancy rate rose to 9.2% in December 2025, but has now plateaued. As supply slows and demand steadies, analysts expect vacancies to hold steady through midyear and tighten gradually in late 2026. National industrial in-place rents averaged $8.87 PSF, up 5.4% year-over-year. Atlanta is the frontrunner in rent growth, posting an 8.8% annual gain to $6.70 PSF, buoyed by logistics and manufacturing demand. Miami, Tampa, and other Sun Belt markets also outpaced the national average, while large Midwestern cities like Detroit and St. Louis trailed with under 3% growth.

Texas and the Sun Belt Lead New Supply

Supply trends spotlight Texas, with Dallas and Houston jointly accounting for over 18% of industrial starts in 2025. Nationwide, 357.4 MSF is under construction, equal to 1.7% of national stock. Other fast-growing markets include Phoenix and Columbus. In most metros, planned and under-construction totals now represent a smaller share of local inventory compared to recent cycle highs, reflecting more cautious development.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Change in Site Selection and Growing Energy Priorities

Industrial trends highlight a shift in site selection priorities. Companies now weigh access to reliable, affordable power alongside traditional factors such as proximity to transport networks and population centers. Advanced manufacturing and the ongoing data center boom—despite pushback over community and environmental impacts—are fueling this trend. Nearly 90% of surveyed supply chain executives reported energy disruptions in the past year, underscoring energy as a potential chokepoint.

Transactions and Investment Market Overview

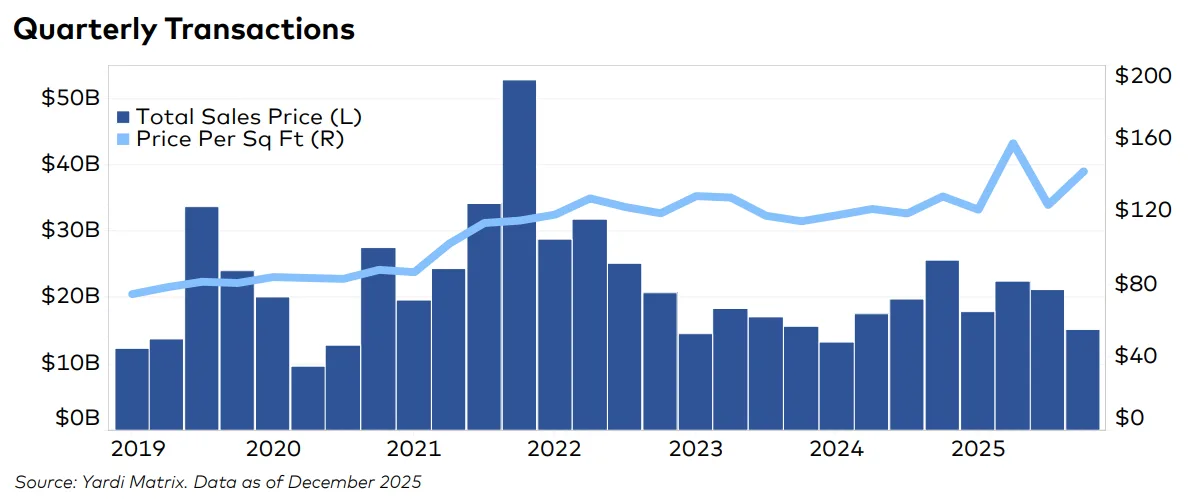

Industrial investment hit $76.3B in 2025, matching levels seen in 2024, but average pricing climbed 10% to $135 PSF. New Jersey outperformed with an 8.5% increase in deal volume and a 7.6% price gain, averaging $226 PSF. Limited land and strong distribution demand continue to drive investor interest in New Jersey, even amid vacancy and rent growth challenges.

E-Commerce Drives Demand

Robust e-commerce activity continues to underpin industrial trends. Q3 2025 e-commerce sales reached $310B, comprising 19.2% of core retail sales, the highest since early pandemic quarters. Holiday retail data confirmed ongoing growth and sector resilience, particularly as online-driven logistics demand helps offset the drag from global trade disruptions and shifting tariff landscapes. Distribution and fulfillment centers remain a key driver of space needs, even amid broader economic uncertainty.