- Industrial fundamentals in 2025 showed moderated rent growth and rising vacancies after a multiyear supply boom.

- Tariff policy changes and new tax laws contributed to tenant caution and reevaluation of supply chains.

- Data centers and outdoor storage experienced notable growth as sectoral demand evolved.

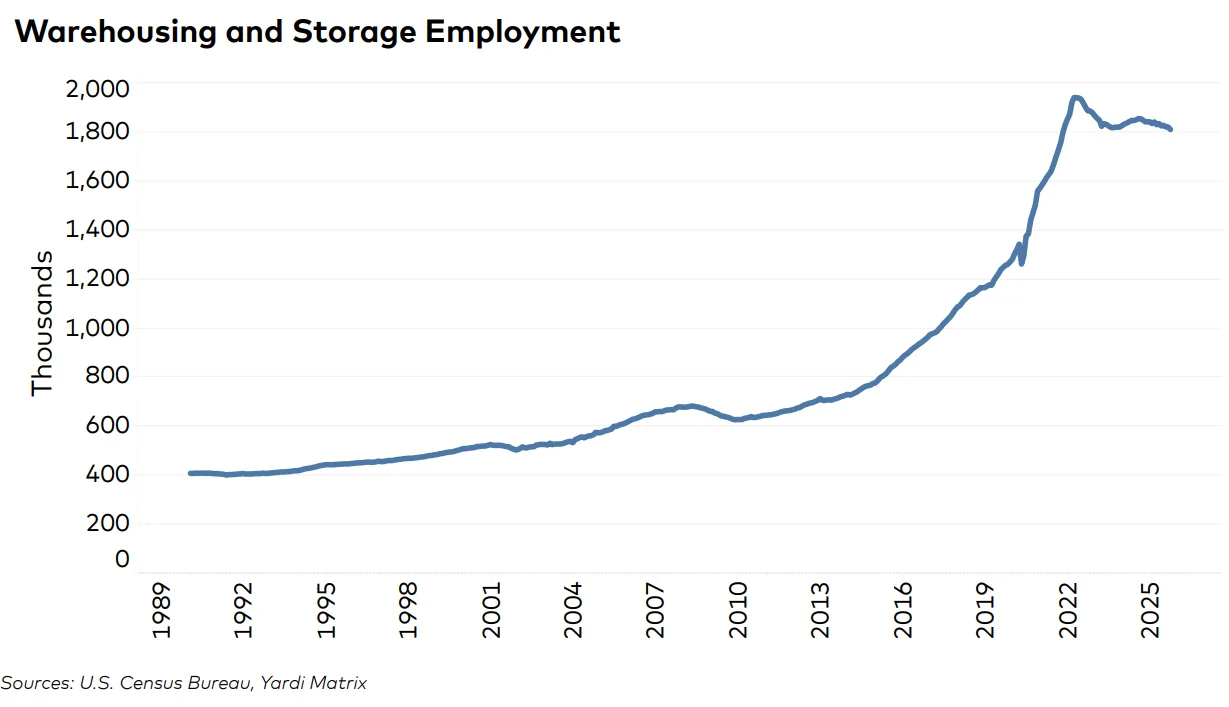

- Warehouse employment declined as automation gained traction, amid ongoing labor shortages.

Moderation Defines Industrial Markets

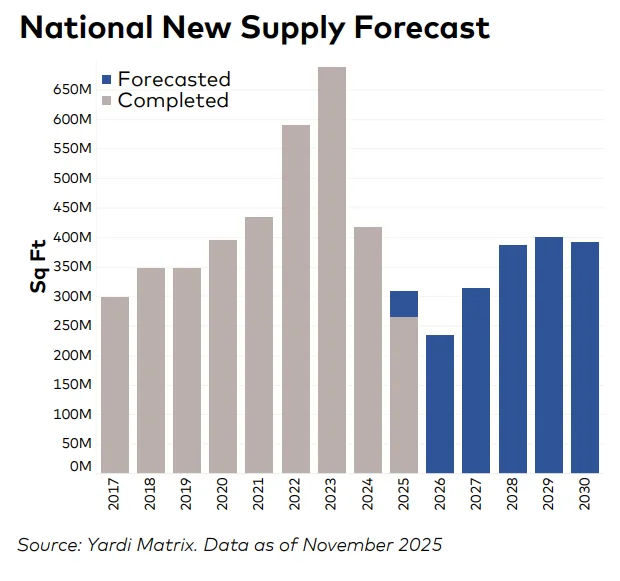

According to Yardi Matrix, the US industrial sector entered a transitional phase in 2025, absorbing the effects of historic new supply and significant policy shifts. Over 2.5B SF of space delivered since 2020 led to rising vacancies and more subdued rent growth in most markets. Development held steady, mirroring 2024’s totals, as developers and investors gauged the market’s next moves.

Tariffs, Tax Changes Spur Strategic Shifts

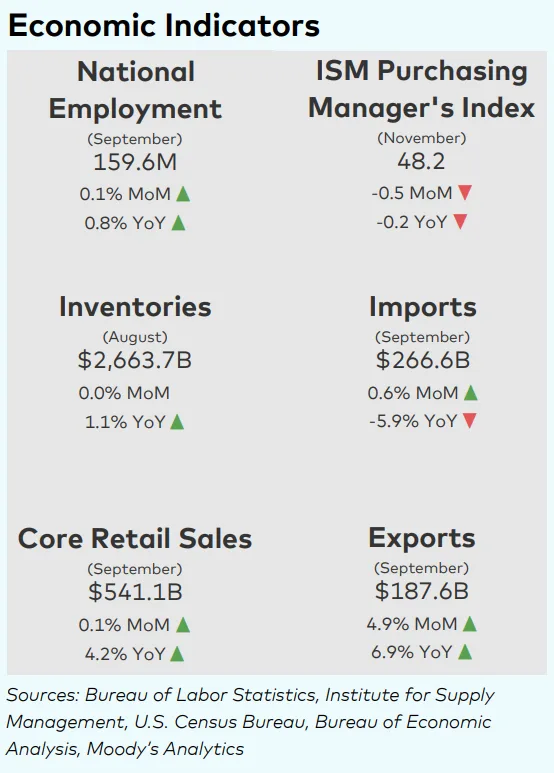

Tariff uncertainties and a major policy overhaul kept firms on edge, with delayed implementation and inconsistent rates through much of the year. The result was tenant hesitation, delayed leasing, and widespread supply chain reassessment. The passage of new tax provisions encouraging domestic production but ending EV credits further shaped manufacturing activity and spurred interest in automation, reshoring, and nearshoring to mitigate rising costs—especially for materials like steel and aluminum. These changes come as the manufacturing sector shows signs of contraction, influenced by broader economic pressures and CRE market volatility.

Data Centers Move Center Stage

Data centers emerged as a headline growth story in the industrial sector, as tech firms funneled investments into facilities supporting generative AI and cloud expansion. Concerns of a potential bubble have surfaced, but development momentum has yet to slow. Outdoor storage also grew in use, offering low-cost, operationally flexible options for a broader tenant base.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Rents and Vacancy Trends by Market

National in-place rents averaged $8.76 PSF in November—up 5.7% year-over-year. The gap between new and in-place leases narrowed compared to 2024. Atlanta led for annual rent growth at 9.7%, while Miami, Tampa, and the Inland Empire also posted strong gains. Houston remained resilient, seeing 5.5% year-over-year rent growth despite a surge of new stock and a notable 6.2% current vacancy rate—helped by robust port activity and new anchor tenants like PepsiCo.

Supply Pipeline Remains Robust

Nationally, 382.7M SF (1.9% of inventory) was under construction as of November. Major active markets include Phoenix and Memphis, while Indianapolis continued to evolve beyond logistics with major manufacturing investments from Eli Lilly and Cadillac. Completions in 2025 are expected to keep pace with recent years but may drop off as developers monitor absorption rates.

Warehouse Employment Suffers Amid Tech Shifts

The warehouse and storage sector continued job losses, with employment dropping 1.5% year-over-year and reaching the lowest point in over four years. Labor shortages and rising operational costs have pushed firms further toward automation and robotics, suggesting the employment peak of 2022 may not return soon.

Investor Activity Focuses on Growth Markets

Industrial transactions totaled $68.4B through November, with an average price of $134 PSF. Phoenix remained a top investment market despite elevated vacancies—demonstrating investor confidence in underlying demand drivers. Major transactions, such as the $152M sale of a 1.3M-SF warehouse in Glendale to Walmart, highlight ongoing capital interest in key growth corridors.