- National in-place industrial rents rose to $8.66 PSF in August, up 6.1% year-over-year, but rent growth has notably slowed in key markets like Southern California.

- Vacancy rates ticked down to 8.7% nationally, although they remain 200 basis points higher than a year ago as a result of 2024’s supply glut.

- IOS sector emerges as a standout, with rents increasing 123% since 2020 and major institutional investors committing over $900M to the space in 2025.

Investors Turn to Industrial Outdoor Storage

As industrial rent growth slows from its pandemic-era highs, capital is flowing into alternative subtypes like industrial outdoor storage (IOS). Once considered a fringe asset class, IOS has emerged as a target for institutional players due to limited supply, flexible uses, and surging demand, per CommercialCafe.

Since 2020, IOS rents have increased by 123%, fueled by constraints on developable land and the versatility of these assets — from fleet parking to staging areas for logistics operations. Recent high-profile transactions include:

- Peakstone Realty Trust’s $490M acquisition of a 51-asset IOS portfolio,

- Realterm’s $277M purchase of 13 IOS properties, and

- A $150M investment plan from a Barings-Brennan JV.

Estimates now place the total IOS market valuation at $200B, as institutional investors push toward standardization and increased transparency.

Rents and Vacancies Rebalance Nationwide

August’s $8.66 average in-place rent reflects a modest monthly gain of $0.03, but the rate of increase is slowing in traditionally hot markets. For instance, Los Angeles in-place rent growth slowed to 4.2% Y-o-Y, and new lease spreads have flattened, signaling a stabilization in demand.

Nationwide, vacancy rates dropped 30 basis points in August to 8.7%, suggesting absorption is picking up, though vacancies remain elevated compared to 2023 due to a flood of new supply.

Supply Pipeline Shrinks

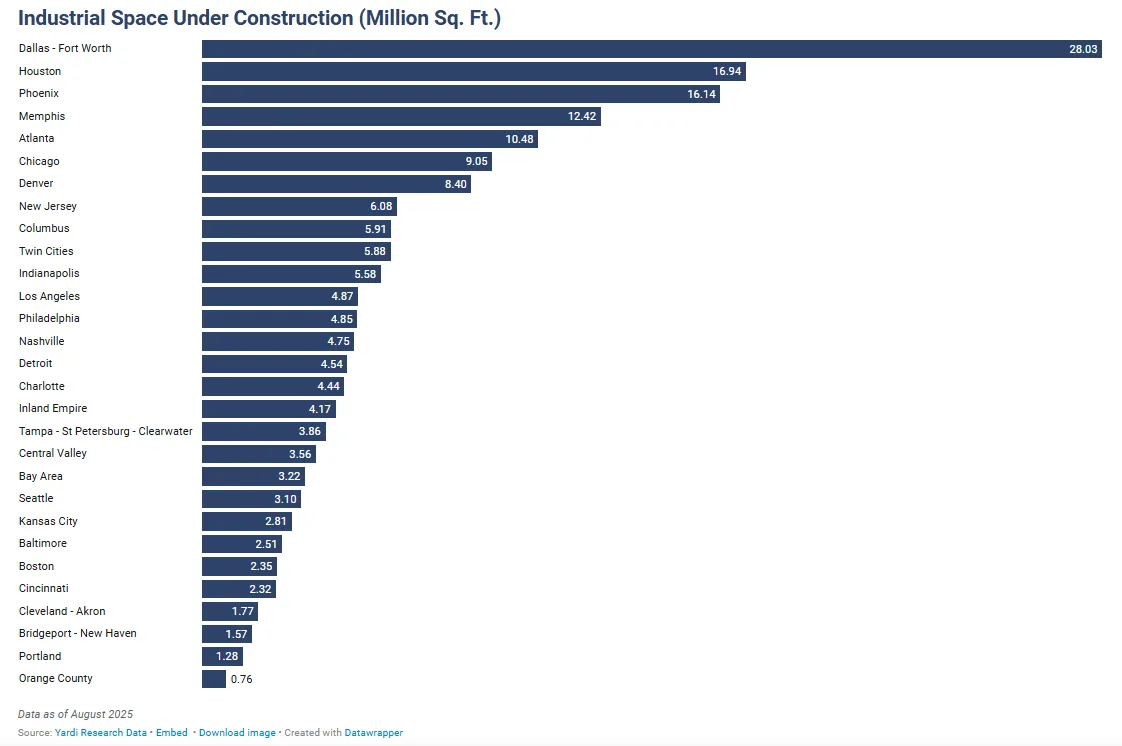

The industrial pipeline continues to shrink from its post-pandemic highs. As of August, 338M SF were under construction nationwide — a slowdown compared to the record volumes in 2024.

- Manufacturing now accounts for 28% of projects in progress, despite making up just 14% of starts since 2023.

- New manufacturing starts have plunged to less than 20M SF in 2025, compared to 200M SF between 2021–2024.

- Spending on manufacturing construction is down 7% Y-o-Y, though still triple the 2020 level.

Regional Insights

West: Central Valley Leads in Growth and Investment

California’s Central Valley saw $914M in industrial sales YTD, more than double the prior year. Phoenix and the Inland Empire led the West in rent growth (9% each), while Los Angeles and the Bay Area posted among the lowest gains at just 3–4%.

Midwest: Detroit Tops Sales Charts

Detroit was second nationally in sales volume, driven by LG’s $2B acquisition of GM’s share in the Ultium EV battery plant. Meanwhile, Columbus faces the nation’s highest vacancy rate at 13.5%, reflecting oversupply concerns.

South: Sales and Development Surge

Dallas-Fort Worth leads the country with $3.9B in YTD industrial sales. Four of the top five markets by development pipeline — DFW, Houston, Memphis, and Atlanta — are in the South, signaling investor confidence in long-term regional growth.

Northeast: High Lease Premiums Persist Despite Flat Rents

Bridgeport, Boston, and Philadelphia posted the highest new lease spreads in the US, ranging from $3.42 to $5.81 PSF. However, overall rent growth has slowed, and construction lags behind national trends.

Labor Trends

Warehouse employment remained relatively unchanged in August, adding just 800 jobs. The sector has shed nearly 27,000 positions over the past year. Persistent labor shortages — not weak demand — are driving the trend, with many operators investing in automation and robotics to fill the gap.

What’s Next?

With national vacancies slowly stabilizing and rent growth plateauing, the industrial market is shifting from hypergrowth to normalization. Investors are becoming more selective, favoring resilient subtypes like IOS and key logistics hubs. Looking ahead, expect further consolidation in niche sectors, more attention to standardized pricing models, and a cautious return to development as demand recalibrates.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes