- CBRE forecasts a widening gap in industrial rent growth between top- and bottom-performing US markets through 2029, with smaller markets like Charlotte and Omaha expected to outperform.

- Historically strong distribution hubs like Riverside, CA and Miami are likely to underperform due to recent overbuilding and supply overhangs.

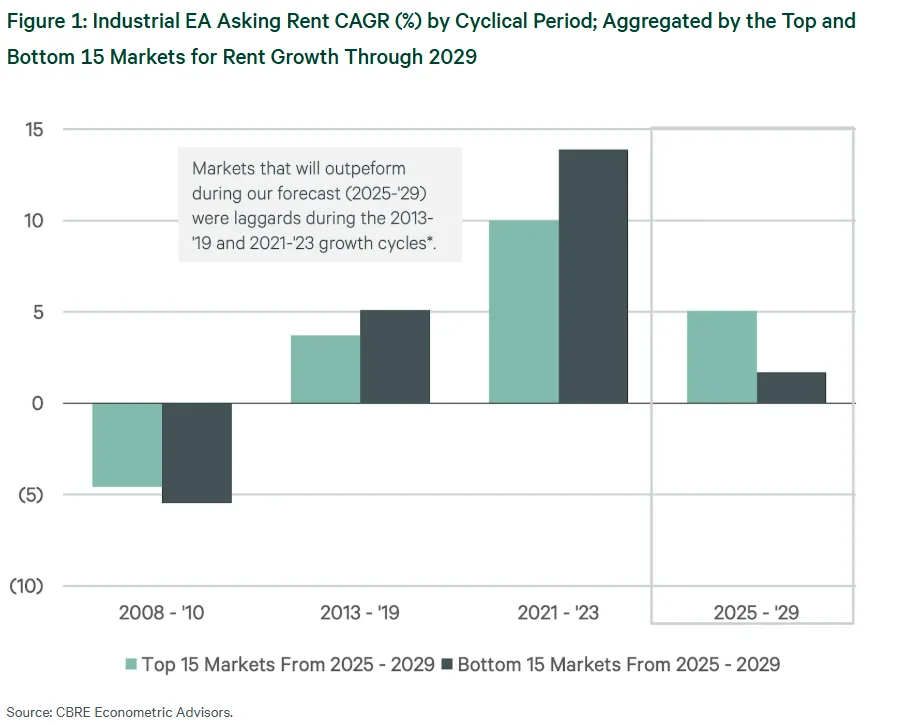

- Industrial rent growth has consistently varied by market across cycles, and past underperformers are now projected to lead the next growth wave.

A Shift In Performance Dynamics

The top 15 markets forecast to see the strongest industrial rent growth from 2025 to 2029 were previously underperformers, reports CBRE. These markets lagged during the 2013–2019 and 2021–2023 growth cycles. Meanwhile, some of the best-performing markets from the last decade are facing mounting headwinds that may constrain future rent gains.

The Supply Overhang Drag

Industrial hubs such as Riverside, CA—once major winners during the post-COVID logistics boom—are now seeing asking rents decline. Developers heavily targeted these markets, triggering a construction surge that created significant supply overhang. Combined with their sensitivity to macroeconomic conditions, these factors are expected to suppress rent growth over the next several years.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Smaller Markets, Bigger Potential

In contrast, smaller markets like Louisville, Charlotte, and Omaha have more favorable supply-demand dynamics. These areas saw less construction than major hubs and remain more insulated from economic swings and supply-demand imbalances. As a result, these markets offer stronger potential for steady rent growth and increased investor interest through 2029.

Historical Resilience Points To Future Strength

Figure 1 illustrates that the top 15 markets forecast to lead from 2025 to 2029 experienced milder downturns during the 2008–2010 Global Financial Crisis, further supporting their long-term resilience. Meanwhile, markets like Miami and Los Angeles, which saw robust growth during the 2010s and early 2020s, may now be nearing a cyclical peak.

Why It Matters

The industrial sector plays a vital role in commercial real estate, but growth will vary widely across markets in the coming years. Investors and developers should take a more targeted approach, prioritizing smaller markets with stable fundamentals and avoiding those at risk of oversupply.