- The US industrial sector is undergoing realignment—not deglobalization—as trade policies, tariffs, and reshored manufacturing reshape supply chain and port dynamics.

- Despite recent performance headwinds, the sector remains resilient, with 2024 posting 6.8% NOI growth, bolstered by strong leasing spreads and continued demand for modern logistics facilities.

- Regional divergence is accelerating, with port markets like Los Angeles softening while demand shifts to secondary inland hubs and infill locations.

- Long-term prospects hinge on adapting to new trade flows, managing tariff uncertainty, and targeting assets aligned with reshored high-tech manufacturing growth.

A Sector In Transition

The US industrial real estate sector stands at a turning point as global trade dynamics evolve, reports Principalam. While some argue that globalization is in retreat, data suggests a more nuanced reality: global supply chains are not unraveling—they are reorganizing. As tariffs, trade agreements, and political friction reshape where and how goods move, the implications for investors, developers, and operators in industrial real estate are significant.

Mixed Signals: Demand Normalization And Capital Pressure

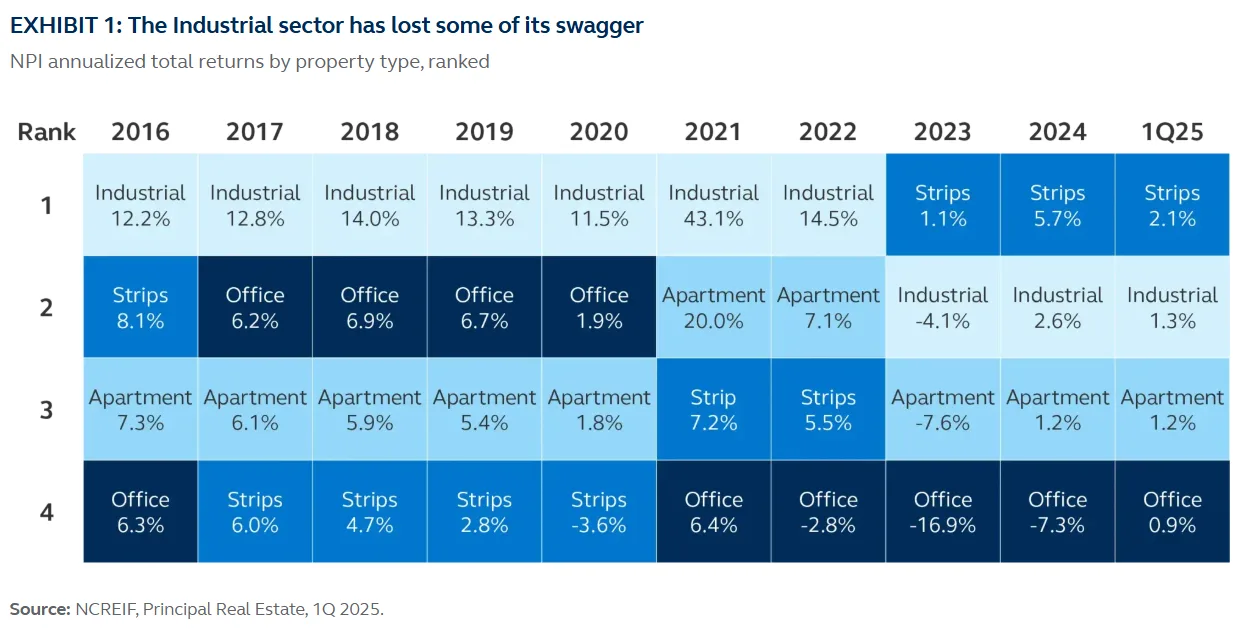

Industrial real estate has been one of the standout sectors since the pandemic, delivering total returns of more than 12% annually. But the post-2022 cycle has introduced new challenges. Capital markets have tightened, development pipelines remain active in some metros, and demand has cooled from its frenzied peak.

In 2024, industrial private market valuations fell 12.3% from 2022 highs. Meanwhile, industrial REITs underperformed, ranking last among the 18 tracked REIT subsectors, hinting at broader investor caution.

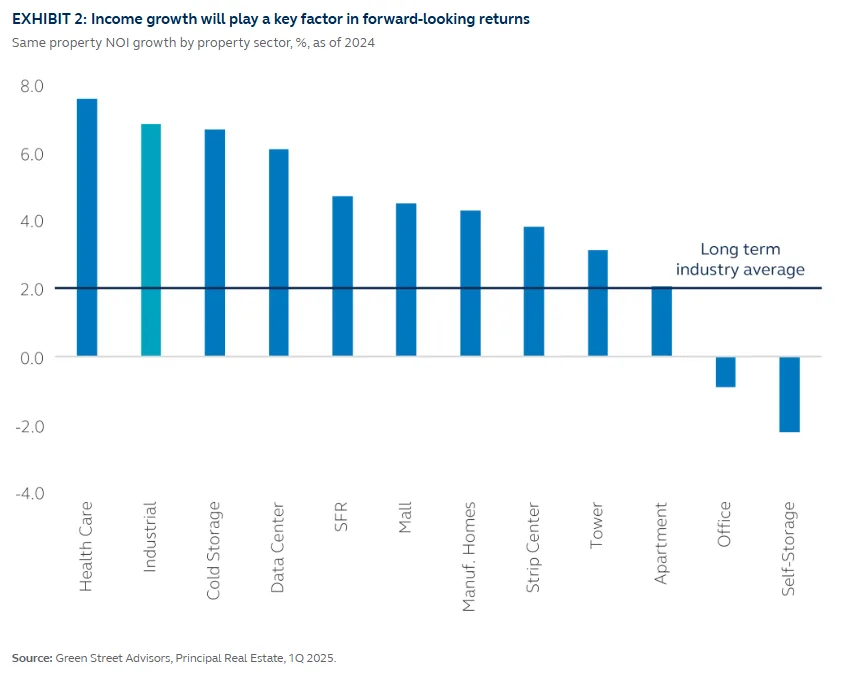

Yet fundamentals remain resilient. Net operating income grew 6.8% year-over-year in 2024—more than double the long-term average—driven by an 8% rent spread between in-place and market rents. This supports ongoing income growth, even amid slower leasing velocity.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Tariffs, Ports, And Shifting Trade Lanes

The most pressing risk to the industrial outlook lies in evolving trade policies. The reimplementation of broad tariffs has not yet fully impacted industrial data but looms large over coastal port markets. Los Angeles, for example, saw availability rise to 7% in early 2025, up from just 1.8% post-pandemic, driven by falling imports and negative net absorption.

East Coast and Gulf Coast ports, on the other hand, have gained import share since 2017 due to rising trade with Mexico and Europe—partially offsetting losses from decreased imports from China.

This eastward shift in trade flows has elevated inland markets and reinforced the value of modern, well-located distribution space, particularly those serving last-mile logistics and e-commerce.

Flight To Quality And Urban Infill Resilience

Not all industrial assets are equal in the current climate. Demand has remained strong for newer, larger logistics centers and urban infill facilities that serve the last mile. Smaller warehouses in densely populated areas continue to perform well, with tighter vacancies and pricing power. Conversely, older, less functional big-box spaces—particularly in oversupplied regions—are facing longer lease-up times and pressure on rents.

As supply chains reorient and reshoring gains momentum—especially in high-value manufacturing sectors like semiconductors, EVs, and solar—secondary and tertiary markets with ample land and labor are poised for long-term gains.

Looking Ahead: Strategic Selectivity Required

With global trade in flux and domestic industrial dynamics increasingly shaped by geopolitical and technological forces, the days of broad-based, passive returns in industrial real estate may be behind us. The sector still offers opportunities—but requires sharper focus on market fundamentals, quality of build, and alignment with future demand drivers.

Globalization may be shifting, but it’s far from over. Instead, we’re witnessing a strategic realignment, with implications stretching from the docks of Los Angeles to the distribution corridors of the Midwest. For investors, success will depend on navigating complexity—not avoiding it.

Conclusion

The US industrial sector remains a cornerstone of the modern economy, but it is entering a more selective and complex phase. Trade policy, technological evolution, and global supply chain shifts are redrawing the investment map. For savvy investors and operators, the next decade won’t be about chasing broad trends—it will be about finding opportunity in the details.