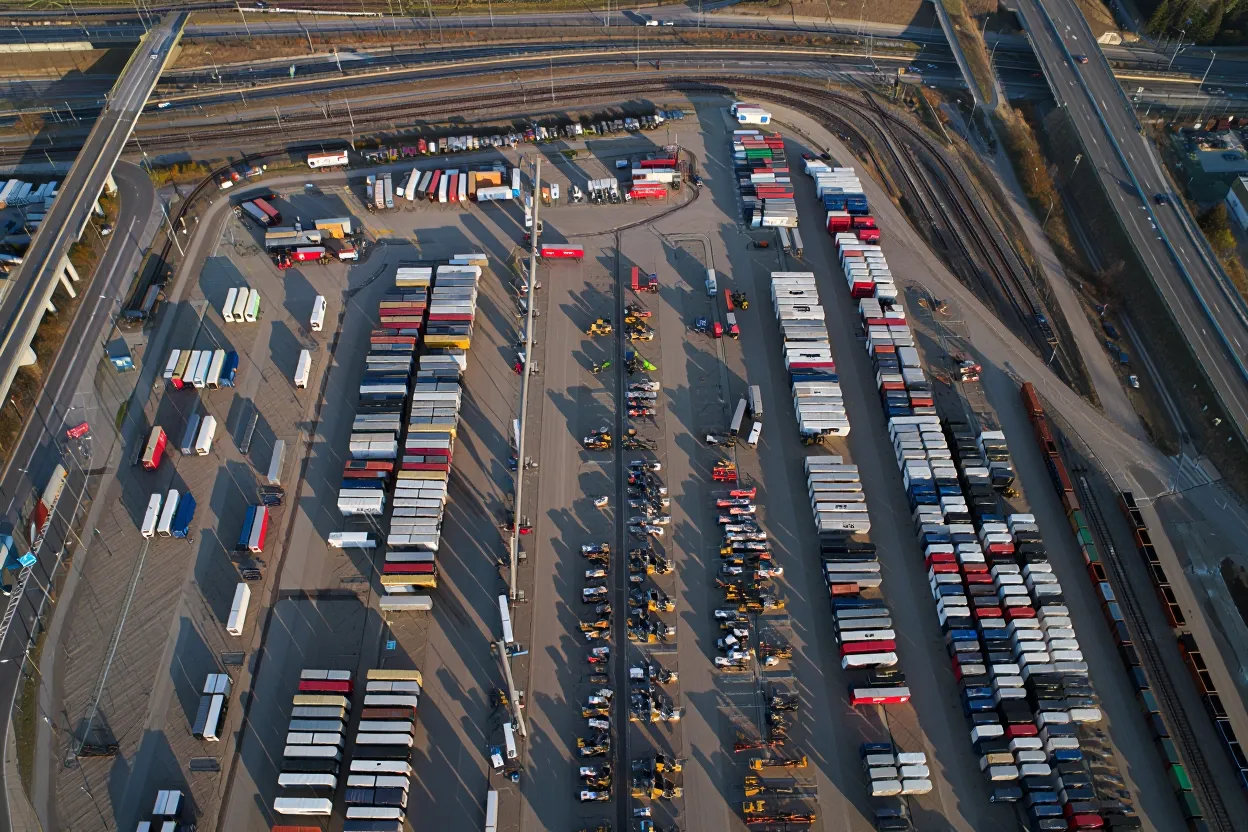

- Heitman and Open Industrial recapitalized a 25-property industrial outdoor storage (IOS) portfolio totaling 105 acres.

- The partnership earmarked $200M in equity for the current deal and further IOS investments over the next year.

- Sites are located near major transit nodes in Virginia, Maryland, North Carolina, and South Carolina, targeting logistics and equipment users.

- IOS fundamentals remain strong, with rent growth outpacing warehouses and vacancies lower across key US markets.

Joint Venture Targets IOS Growth

Heitman and Open Industrial have joined forces to recapitalize a 25-property IOS portfolio. They also plan to scale new acquisitions. The partnership brings $200M in equity to expand their footprint in the industrial outdoor storage sector across the Mid-Atlantic and Southeast US, reports the Commercial Property Executive.

The portfolio’s sites are in infill locations near major transportation and population hubs. These properties support tenants in logistics, equipment rental, and construction sectors. Park Madison Partners advised Open Industrial on the transaction.

Investor Momentum Builds

Industrial outdoor storage (IOS) properties continue to attract strong investor interest, driven by high demand and limited supply. A Newmark report found IOS rents grew 122.8% over five years through July 2025—more than twice the rate of bulk warehouses. IOS vacancies also remain lower at 4.9%, compared to 10.5% for warehouses, reinforcing the sector’s appeal.

The Heitman and Open Industrial deal follows other major IOS partnerships. Recent examples include Barings and Brennan’s $150M venture, and Realterm’s seven-property, 74.2-acre acquisition with J.P. Morgan-advised investors. Several institutional investors have also launched larger platforms targeting the space, signaling long-term confidence in IOS as a scalable asset class.

What’s Next for IOS Investment

Heitman, managing $48B in assets as of September, continues to strengthen its alternative industrial allocations alongside traditional warehouse strategies. Open Industrial, using proprietary technology for asset and leasing decisions, remains focused on expanding IOS holdings across the US. Industrial outdoor storage is expected to remain a favored subsegment for institutional capital through 2026. Strong rent growth, low vacancies, and industry-tailored locations continue to drive investor interest.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes