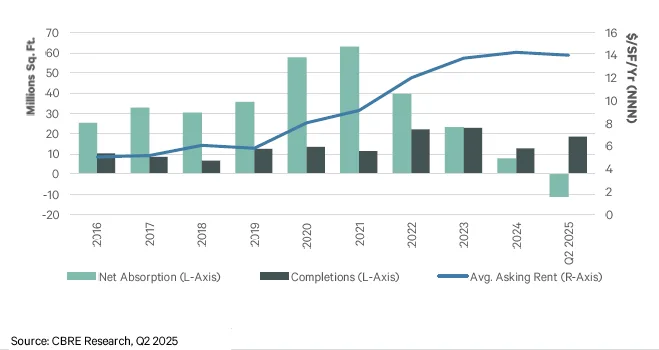

- The Northeast industrial market is experiencing a post-pandemic normalization, with leasing activity softening and vacancy rates edging higher.

- Despite the rising vacancy, asking rents have remained resilient across most markets, bolstered by limited new deliveries.

- Construction starts have declined significantly, suggesting a pullback in speculative development as market fundamentals stabilize.

A Market In Transition

Industrial real estate across the Northeast US is undergoing a shift, reports CBRE. The market is moving away from the breakneck growth seen during the pandemic-era boom. Leasing activity has moderated quarter-over-quarter, and vacancy rates are ticking upward. Still, fundamentals remain solid compared to historical norms, reflecting a market that’s finding its balance rather than faltering.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Vacancy Inches Up

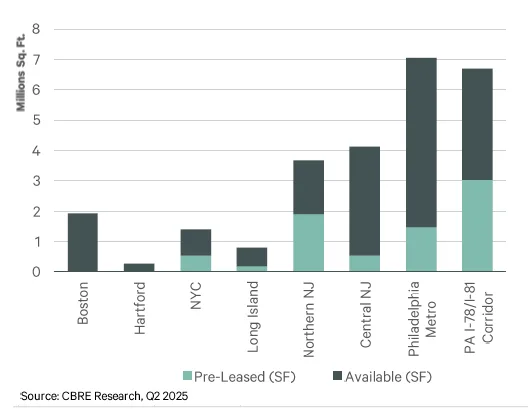

Vacancy rates rose slightly across most major metro areas, reflecting the influx of new supply and a cooldown in tenant demand. However, compared to national averages, the Northeast remains relatively tight. Key hubs like Northern New Jersey and Boston continue to see strong demand for Class A product.

Total Vacancy and Asking Lease Rates

Rent Growth Persists

Despite softening demand, asking rents continued to grow or hold steady, underscoring strong landlord confidence. Limited new supply—especially in land-constrained markets like New York and Boston—has helped maintain upward pressure on pricing.

Construction Pullback

Construction starts have declined significantly quarter-over-quarter. This signals that developers are hitting the brakes amid elevated financing costs and tempered demand. Much of the product currently underway was planned during peak demand periods, suggesting a more measured development pipeline ahead.

Under Construction Square Footage

Looking Ahead

As supply chains settle and e-commerce demand levels off, the Northeast industrial market appears headed for a period of equilibrium. Rent growth may decelerate, but fundamentals remain healthy. Markets like Philadelphia and Northern New Jersey are expected to stay resilient, with limited new construction likely supporting rental rates.

Net Absorption, Construction Completions & Lease Rates