- Industrial manufacturing activity remains strong, fueled by tax incentives in the One Big Beautiful Bill Act and reshoring efforts.

- National industrial rents rose 6.1% year-over-year to $8.72 PSF, though lease spreads are narrowing amid higher vacancies.

- Construction starts slowed to 186.1M SF YTD, signaling a shift toward build-to-suit and owner-occupied projects.

- Sales volume reached $52.5B, boosted by late 2024 interest rate cuts and strong investor demand in logistics-driven markets.

Manufacturing Realignment Under New Tax Regime

The passage of the One Big Beautiful Bill Act (OBBBA) this summer is reshaping industrial fundamentals, reports CommercialCafe. The legislation offers aggressive tax breaks — including full expensing for equipment and facilities and incentives for reshoring — which are beginning to redirect capital toward domestic production.

However, the bill also ended federal EV-related tax credits and curtailed green energy funding. Coupled with flagging electric vehicle sales, the industrial sector is seeing a shift away from EV-centric developments. Activity is pivoting back toward diversified manufacturing, including defense, semiconductors, and advanced logistics.

“The continued opportunity of secondary and supportive development that’s necessary to optimize large manufacturing facilities has been a constant across the last two major policy initiatives.”

— Peter Kolaczynski, Director, Yardi Research

Rents And Leasing Trends

Nationally, industrial rents continued their climb, averaging $8.72 PSF by the end of September. However, rent growth in legacy port markets is cooling, and tenants are gaining leverage. New leases signed in the past year averaged $10 — only $1.28 more than in-place rents, down from a $2.20 spread last year.

Still, some markets are commanding notable lease premiums:

- Bridgeport, CT: $5.13 PSF spread

- Tampa, FL: $4.56 PSF spread

- Miami, FL: $3.80 PSF spread

- Philadelphia, PA: $3.25 PSF spread

- Nashville, TN: $3.00 PSF spread

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Pipeline Contraction Signals Shift To Targeted Builds

The industrial development pipeline stood at 340.5M SF nationally, down from earlier years. New starts totaled 186.1M SF YTD, indicating a pivot from speculative builds to more tailored developments, particularly build-to-suit and owner-occupied facilities.

Notable examples include:

- PepsiCo’s 1.2 MSF plant near Denver International Airport

- Amazon’s 3.5 MSF robotics center in Loveland, CO

Western metros like Denver (+3.1% of stock) and Phoenix (16 MSF underway) are leading new supply, despite higher vacancies in several submarkets.

Activity Accelerates Following Rate Cuts

Industrial property sales hit $52.5B nationally through September. The average price rose to $142 PSF, aided by 2024’s three interest rate cuts totaling 100 basis points.

- Atlanta saw prices spike nearly 33% YoY to $140 PSF, despite a dip in volume, as 3PL firms expand regional hubs.

- Kansas City nearly doubled its YTD sales between August and September, thanks to multiple portfolio deals.

- California’s Central Valley posted a 123% YoY sales increase, reaching $972M in volume.

Regional Insights

Western Markets: Rebalancing Phase in Progress

- Los Angeles vacancies declined to 8.3%, down 90 bps YoY.

- Orange County rents lead the nation at $17.09 PSF, with new leases averaging over $19 PSF.

- Phoenix remains the region’s volume leader with $2.4B in YTD sales and 16 MSF of space under construction.

Midwestern Markets: Kansas City Tightens, Development Ramps in Twin Cities

- Kansas City: 4.3% vacancy (tightest in the US), $85.60 PSF pricing

- Minneapolis-St. Paul: 6.5 MSF under construction — a 250% YoY spike

- Columbus and Chicago still contend with high vacancy rates (13.5% and 12.6%, respectively)

Southern Markets: Rent Growth Outpaces National Average

- Miami and Atlanta recorded 8.5% rent growth, among the highest nationally.

- Dallas-Fort Worth pipeline swelled to 30 MSF, the largest in the US

- Houston maintained the lowest Southern vacancy rate at 6.4%, with a record-high pipeline of 18.2 MSF.

Northeast Markets: Spreads Persist as Construction Slows

- Bridgeport held the tightest vacancy rate in the region at 5.5%

- Philadelphia new leases averaged $11.84 PSF, a 14% YoY increase

- Boston was the only major Northeast market where recent rents declined

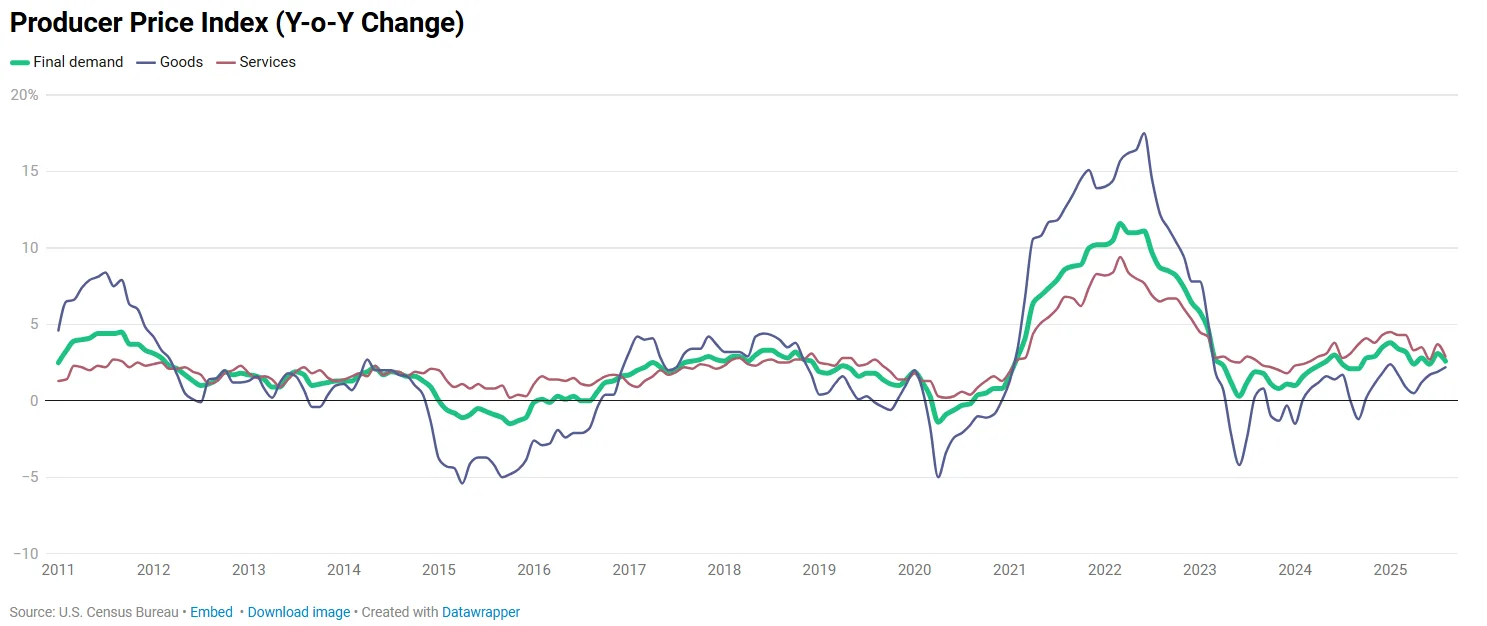

PPI Cools Before Data Freeze

- The Producer Price Index dipped by 0.1% in August, bringing annual inflation to 2.6%.

- Data flow from federal agencies is expected to pause due to the government shutdown, complicating near-term monetary policy decisions.

- National employment stood at 159.5M in August, with 0.9% YoY growth.

Manufacturing’s New Normal Is Just Beginning

The industrial sector continues to digest both the long-term impact of supply chain localization and short-term volatility from policy changes. With the OBBBA now active and reshaping capital flows, expect further adjustments in tenant demand, asset pricing, and development strategies.

Even as rent growth moderates and vacancies normalize, the sector remains in high demand — especially in regions with pro-growth tax structures, population inflows, and logistics infrastructure.