- Industrial development is rebounding as the sector stabilizes post-correction, supported by resilient NOI growth and steady tenant demand.

- New construction has pulled back sharply, with pipeline levels down nearly 70%, creating favorable conditions for strategic development by 2026–27.

- Modern facilities outperform older stock, generating up to 90% more NOI PSF and commanding premium rents in top-tier markets.

- Targeted investment is critical, with success hinging on high-quality assets, strong locations, and alignment with evolving supply chain needs.

Recovery In Progress

The US industrial sector is emerging from a correction that began in 2022 and continued beyond 2023, reports PrincipalAM. This correction affected real estate valuations across the board. It was triggered by aggressive interest rate hikes implemented to combat rising inflation. While commercial values dropped an average of 20% nationally, industrial assets saw a more muted 12.3% decline—second only to retail in resilience.

Despite macroeconomic headwinds, industrial demand has held steady. Supply chain restructuring, resilient trade volumes, and the ongoing strength of e-commerce have kept fundamentals intact. Rents have generally outpaced inflation, and existing leases have marked to market by nearly 40% over the past five years—supporting NOI growth in the 6% range.

A Pipeline Reset Creates Room To Build

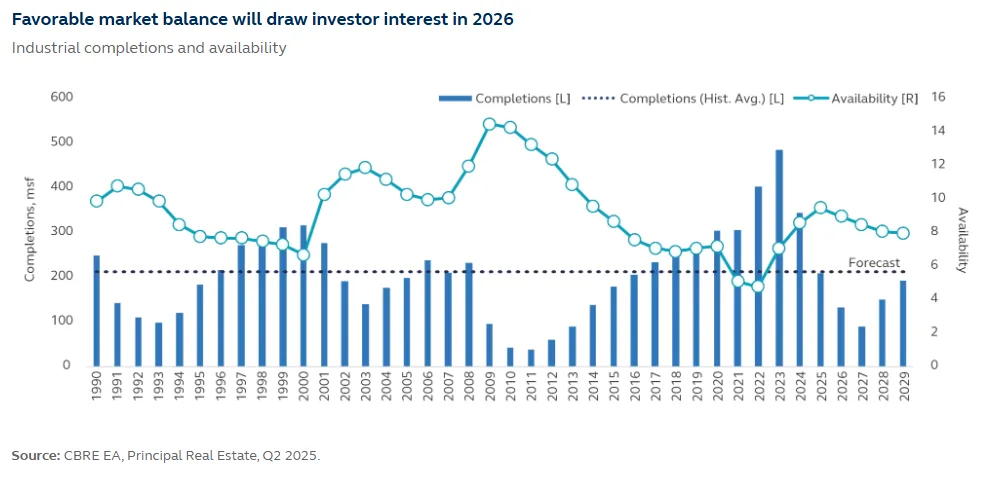

One of the clearest signals of a potential new development cycle: the sharp slowdown in new construction. The industrial pipeline has shrunk by nearly 70% from its peak, with delivery levels on track to hit a post-Global Financial Crisis low by 2027, according to CBRE EA.

This contraction in supply, combined with resilient demand, could set the stage for a favorable development window. Importantly, newer facilities are commanding premium rents and experiencing stronger absorption. Only 25% of the current industrial stock was built after 2010. This has created a gap between what tenants need and what is currently available.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Winners And Losers

The industrial sector is becoming increasingly bifurcated. Assets in prime logistics hubs and those built to modern standards are generating significantly better returns than older or non-strategic properties.

- Top-quartile properties now command 90% higher NOI PSF than bottom-quartile assets.

- The pricing spread between top and bottom quartiles has widened by 66% since 2020.

- Rent growth is increasingly concentrated in select Tier 1 markets—many weaker locations are experiencing stagnant or even negative rent growth.

This widening performance gap underscores the need for targeted strategies focused on market quality, tenant profile, and facility standards.

A Strategic Development Opportunity

Despite elevated replacement costs, disciplined investors are beginning to identify compelling opportunities in industrial development. As speculative construction recedes and demand for new-generation logistics space grows, the limited pipeline could create supply-demand imbalances in key markets by 2026–27.

Investors with the ability to deliver modern, well-located assets could benefit from:

- Faster lease-up periods driven by demand from 3PLs and e-commerce.

- Higher rental premiums and stronger tenant retention.

- Long-term value creation through differentiated exposure in a sector still undergoing transformation.

Conclusion: Not All Industrial Is Created Equal

While industrial real estate remains a core allocation for institutional investors, blanket exposure is no longer enough. The recovery is underway—but uneven. The best returns in the coming cycle will likely go to those who take a selective approach: focusing on next-generation assets in high-conviction markets with sustainable demand drivers.

With new supply slowing and structural tailwinds still in play, targeted development in the industrial sector presents a compelling opportunity. Long-term investors looking to lead the next phase of the real estate cycle are well-positioned to benefit.