- Hybrid work is here to stay, with 66% of US companies offering some form of flexibility, leading to persistent underutilization of office space.

- National office vacancy stood at 18.7% in August 2025, with Seattle hitting 27.2%, driven by tech layoffs and shrinking office footprints.rn

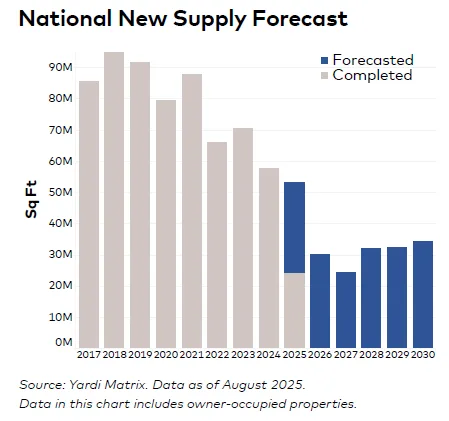

- New office development remains muted, with just 40.2M SF under construction, near post-GFC lows.rn

- Dallas saw the sharpest price jump in office transactions, with sales prices more than doubling to $240/SF in 2025.

Remote Work Becomes A Fixture

More than five years after COVID-19 disrupted traditional office life, hybrid work has become the standard. Two-thirds of companies now offer some flexibility, most following a structured hybrid model, as reported by yardi matrix. Occupancy data from Kisi and Kastle Systems show offices still sit half-empty on average, with Friday usage dropping as low as 44%.

Retention pressures are keeping hybrid models alive. A 2024 Pew survey found that 46% of remote workers would consider leaving their job if required to return to the office full-time. That number jumps to 61% among employees who work fully remotely.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Office Vacancies Remain Elevated

Despite slow gains in attendance since 2023, office utilization remains well below pre-pandemic norms. As companies continue to prioritize cost-efficiency, the sector is seeing long-term structural change.

Seattle exemplifies the crisis. Once a fast-growing hub for tech, the city now has the highest vacancy rate among major metros at 27.2%. Contributing factors include a 10% drop in information-sector jobs since 2022 and a broader shift toward investing in data centers over hiring.

Market-Level Snapshot

August 2025 data shows listing rates at $32.63/SF nationally, slightly down from last year. Markets with the highest listing rates include:

- Manhattan: $67.98/SF (Vacancy: 13.6%)

- San Francisco: $64.15/SF (Vacancy: 25.9%)

- Miami: $55.77/SF (Vacancy: 14.3%)

Vacancy rates remain particularly high in:

- San Diego: 22.6%

- Dallas: 22.4%

- Houston: 20.2%

- San Francisco: 25.9%

Supply Pipeline Nears Standstill

New office construction is near its lowest levels since the Great Financial Crisis. Just 10.7M SF of new projects started in 2025 through August, following only 11.7M SF in 2024.

Top markets for construction starts:

- Manhattan: 2M SF

- West Palm Beach: 1.4M SF

- Dallas: just under 1M SF

Nationally, only 0.6% of total stock is under construction.

Job Growth Stalls In Key Office-Using Sectors

The office-using employment base has flattened. While there was a modest 0.1% YoY increase nationally, key markets like San Diego, the Bay Area, and San Francisco saw job declines of 2.2% to 2.5%—driven by cooling demand for tech workers.

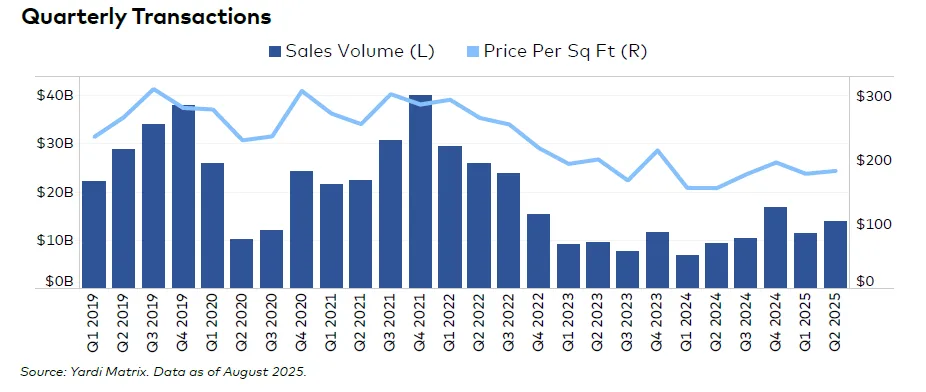

Office Sales Still Sluggish, But Dallas Shines

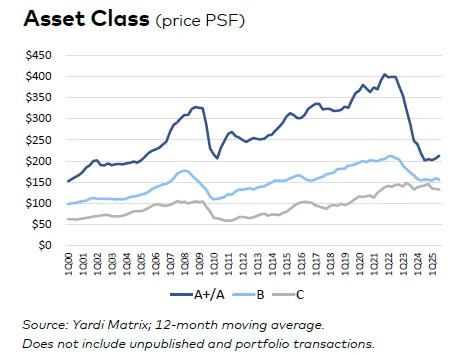

Total office transaction volume reached $33B YTD, with an average price of $190/SF—still well below the $277/SF seen pre-pandemic in 2019.

Dallas led the way in pricing gains, with average sales up from $107/SF last year to $240/SF in 2025. The standout deal: The Link at Uptown, a 25-story tower, sold for $218M, the city’s largest deal in recent memory.

Why It Matters

The continued lag in office occupancy underscores a fundamental shift in how companies use space. While some gateway markets like New York are bucking the trend, others—particularly tech-heavy metros—remain under pressure. With hybrid work now the norm and new construction limited, a full recovery for the office sector remains distant.