- A majority (54%) of Fortune 100 employees are now required to work full-time in the office, a sharp increase from just 5% two years ago.

- Hybrid work arrangements are down to 41%, from a peak of 78% in 2022, according to a new report from JLL.

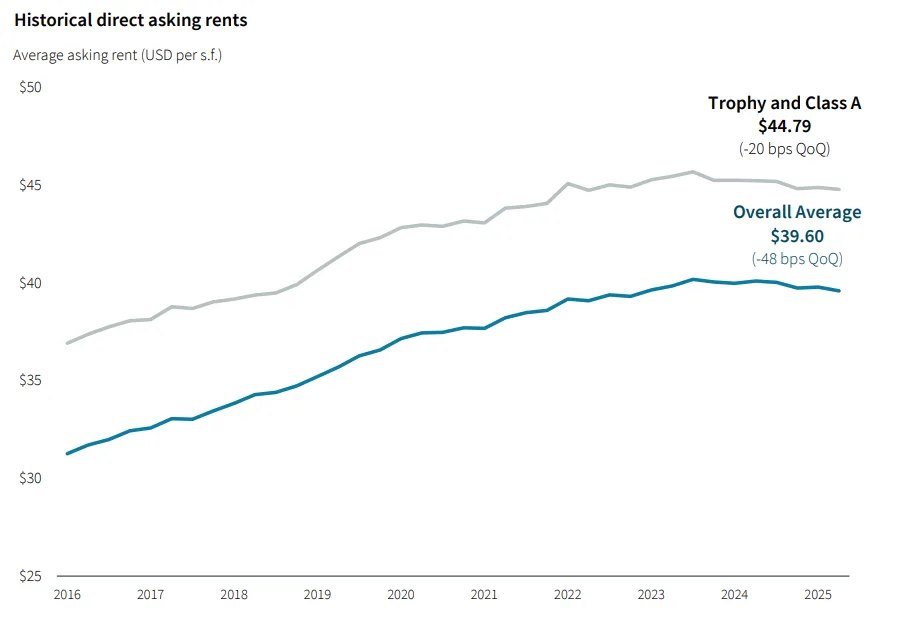

- The shift is impacting commercial real estate: trophy office buildings are achieving record-high rents while older buildings are being demolished or repurposed.

The Office Comeback

More than five years after the pandemic upended corporate work life, in-person work has made a definitive return, reports Bloomberg. According to Jones Lang LaSalle’s latest report, 54% of Fortune 100 employees now work under full-time in-office attendance policies—up from just 5% in 2022. The data reflects the number of employees affected, not the number of companies, to better represent office demand trends. Only 41% of these top US companies still offer hybrid work, down from 78% two years ago.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

CRE Implications

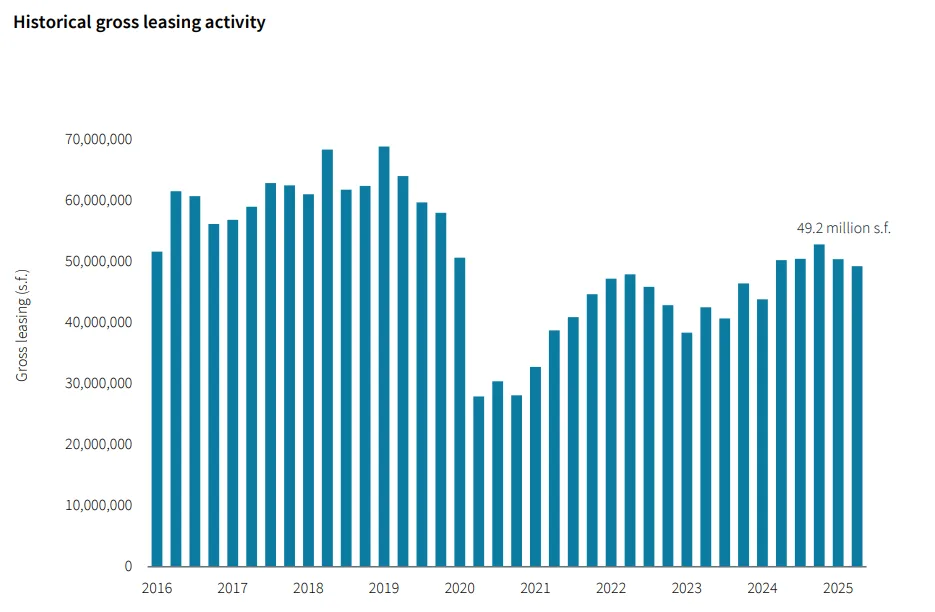

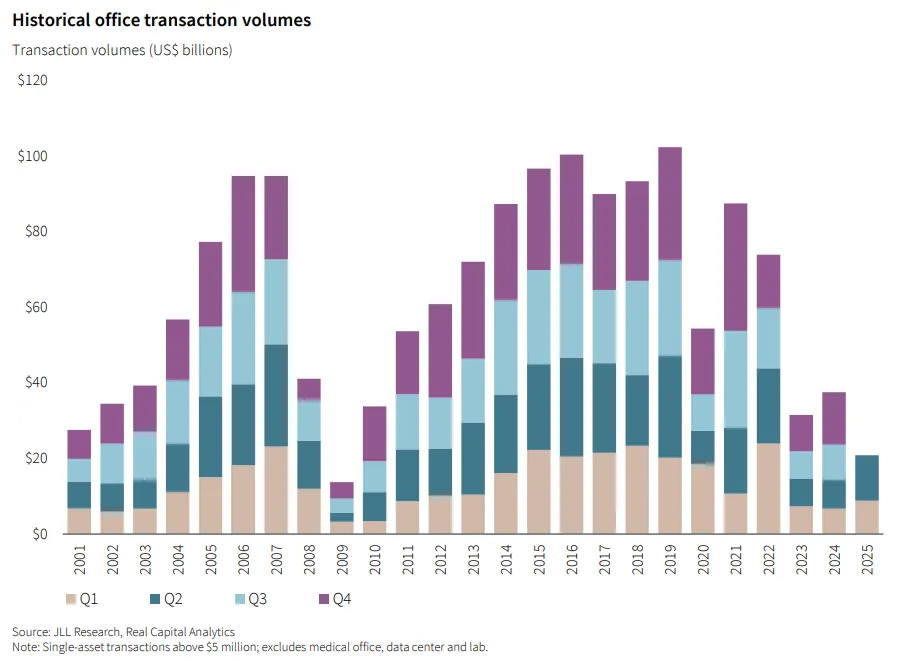

The push back to the office is having ripple effects across the commercial real estate market. In Q2 2025, office attendance rose by 1.3% year-over-year. JLL reports that new trophy assets in key markets — including Miami, New York City, and San Francisco — are commanding record prices. Asking rents for newly built properties reached an all-time high of $92.38 PSF.

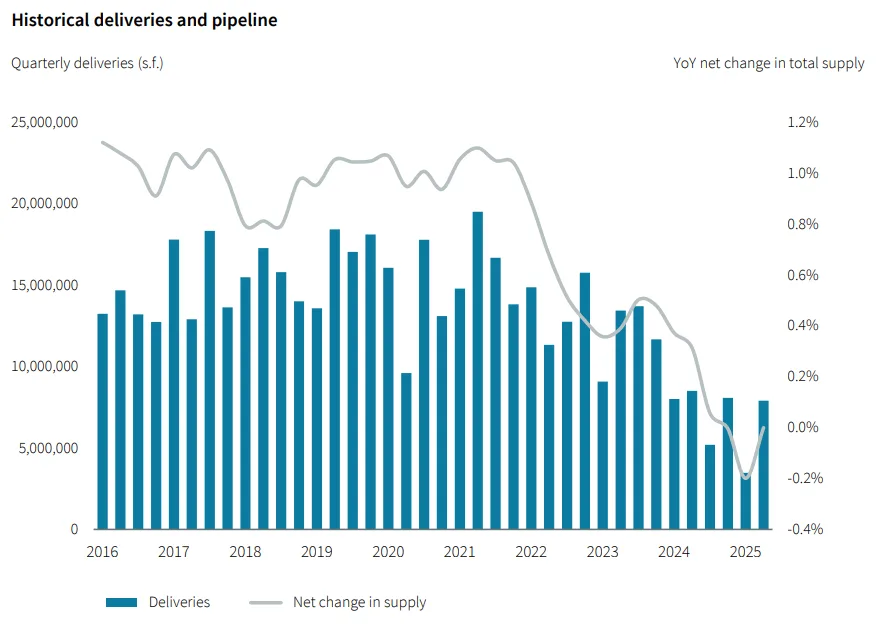

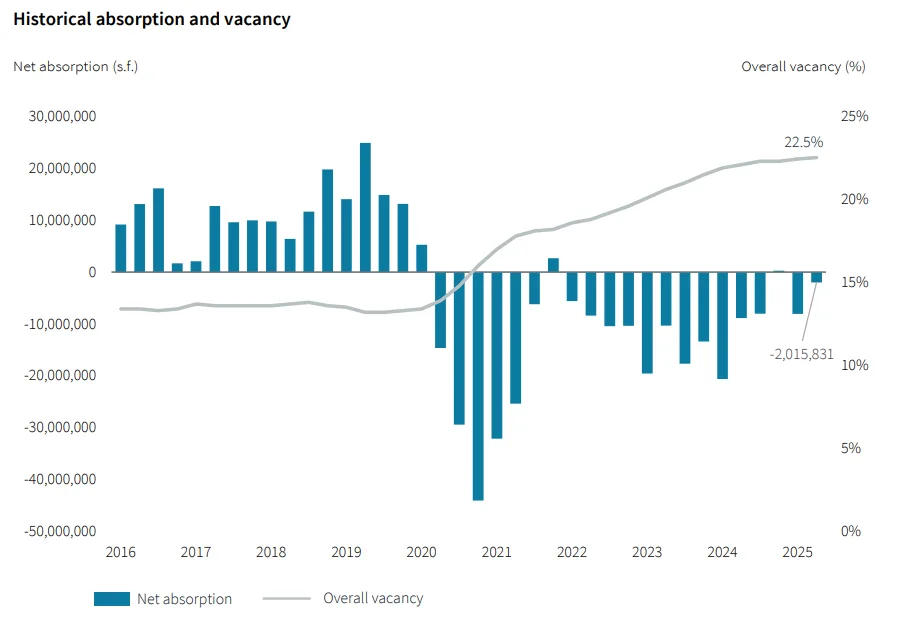

Meanwhile, the national office vacancy rate remains stubbornly high at over 22%. In response, developers are accelerating conversions and demolitions of underperforming buildings. JLL notes a net reduction of 700K SF of office inventory last quarter — the result of more buildings being taken offline than added.

Big Players, Big Shifts

Among the ten largest companies in the Fortune 100, seven now require at least four days per week of in-person work. The remaining three have implemented full-time return mandates. The average in-office requirement across all Fortune 100 firms has climbed to 3.9 days per week, up from 2.6 days in Q2 2023.

Notable examples:

- Amazon prepared its staff in 2024 for a full return by January 2025.

- JPMorgan Chase eliminated hybrid work in early 2025.

- Starbucks announced a four-day office minimum starting in September, with remote managers required to relocate or accept a buyout.

Why It Matters

This broad reversal marks the end of hybrid work as the dominant corporate structure — at least among the nation’s largest employers. As executives assert control over office attendance, they’re also justifying premium office leases, especially in new developments designed to attract high-value tenants.

What’s Next

Expect continued divergence in office demand. While top-tier buildings see record rents, older inventory will face increasing obsolescence. The transformation of unused office space into residential or mixed-use assets may accelerate — especially as companies double down on long-term office strategies and reshape urban work ecosystems.

Note: JLL tracks corporate attendance policies across Fortune 100 employers but does not monitor compliance or actual attendance rates. The figures represent stated policies affecting desk-based employees.