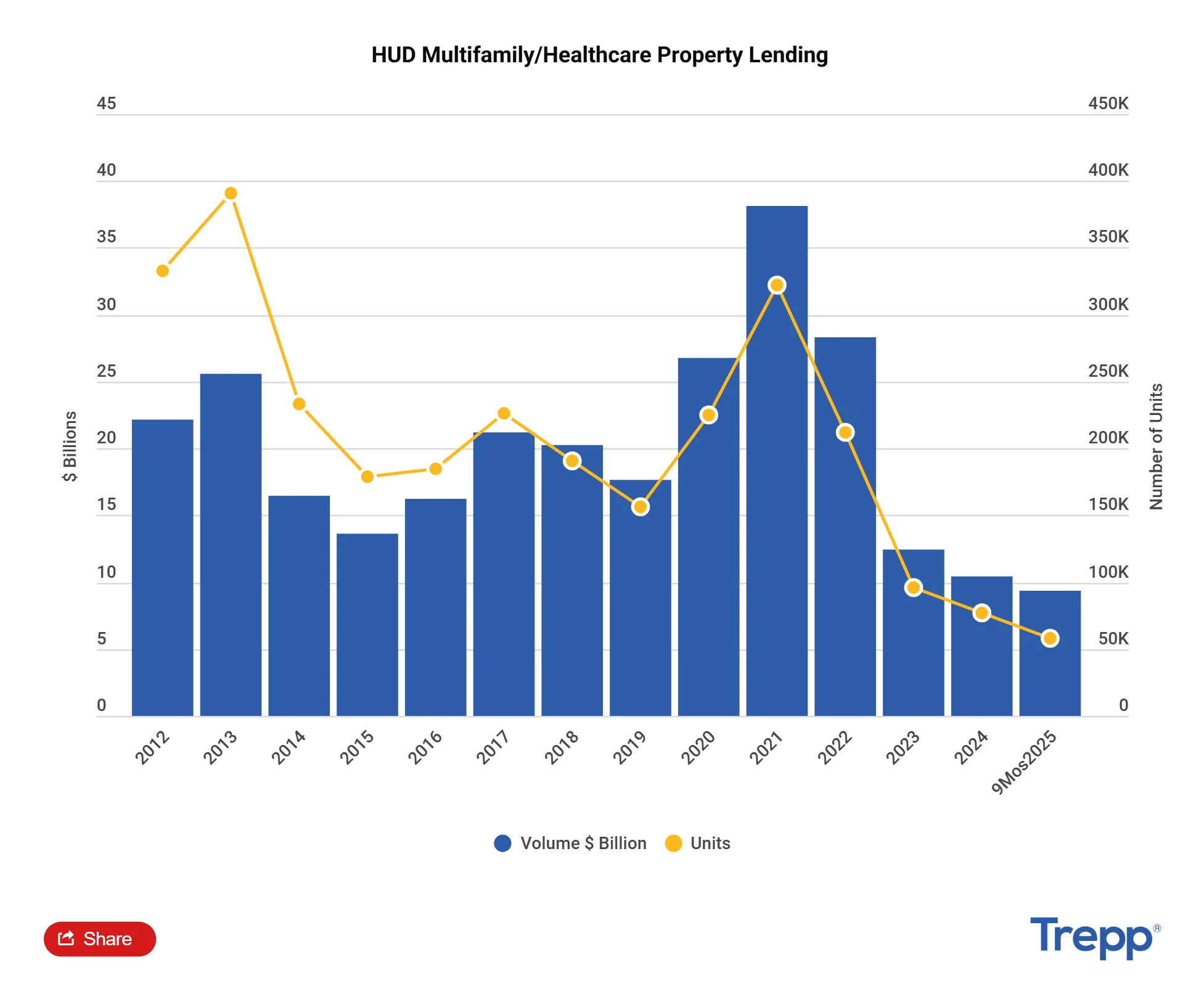

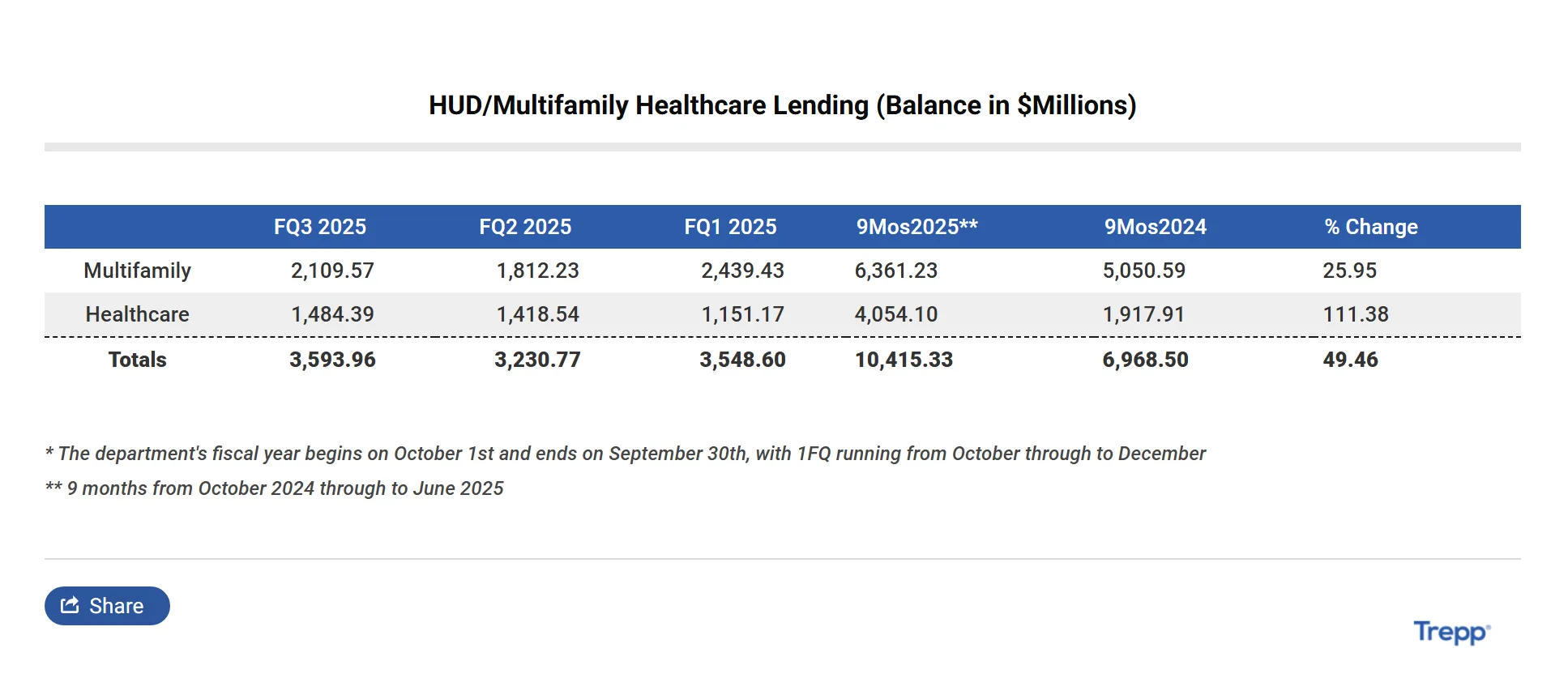

- HUD lending reached $10.42B through the first nine months of fiscal year 2025, up nearly 50% year-over-year.

- Healthcare properties—especially seniors housing—are driving demand, supported by higher occupancy rates and limited new construction.

- Greystone, Dwight Capital, and Berkadia remain the largest HUD lenders, while KeyBank led healthcare originations in the latest quarter.

Lending Momentum Builds

The US Department of Housing and Urban Development (HUD) recorded $3.59B in lending volume during its fiscal Q3, lifting total activity to $10.42B through June 2025. According to Trepp, that marks a sharp increase from the $6.97B funded during the same period last year. HUD’s fiscal year runs from October 1 through September 30.

Healthcare Properties Take the Lead

Much of the growth came from the seniors housing sector, which has seen fundamentals strengthen in 2025. According to the National Investment Center for Seniors Housing & Care (NIC), occupancy climbed 80 basis points quarter-over-quarter to 88.1% in Q2.

- Independent living units drove gains, with occupancy rising to 89.7%, the third straight quarter of outperformance versus assisted living.

- Assisted living occupancy edged up to 86.4%, while demand overall is being fueled by aging Baby Boomers nearing their 80s.

At the same time, construction remains muted: just 809 new units delivered in Q2, the lowest quarterly total since NIC began tracking in 2005. With limited supply, rents are rising—independent living units averaged $4,402/month (+4.25% year-over-year), while assisted living units averaged $6,979/month (+3.97%).

Leading HUD Originators

HUD’s appeal lies in its 30- to 35-year fully amortizing loans, which eliminate balloon risk and can be structured with favorable prepayment flexibility. However, the lengthy approval process often requires bridge financing until HUD takeout loans close.

- Greystone Funding Co. led originations with $1.41B across 67 loans.

- Dwight Capital followed with $822.29M, and Berkadia with $801.07M.

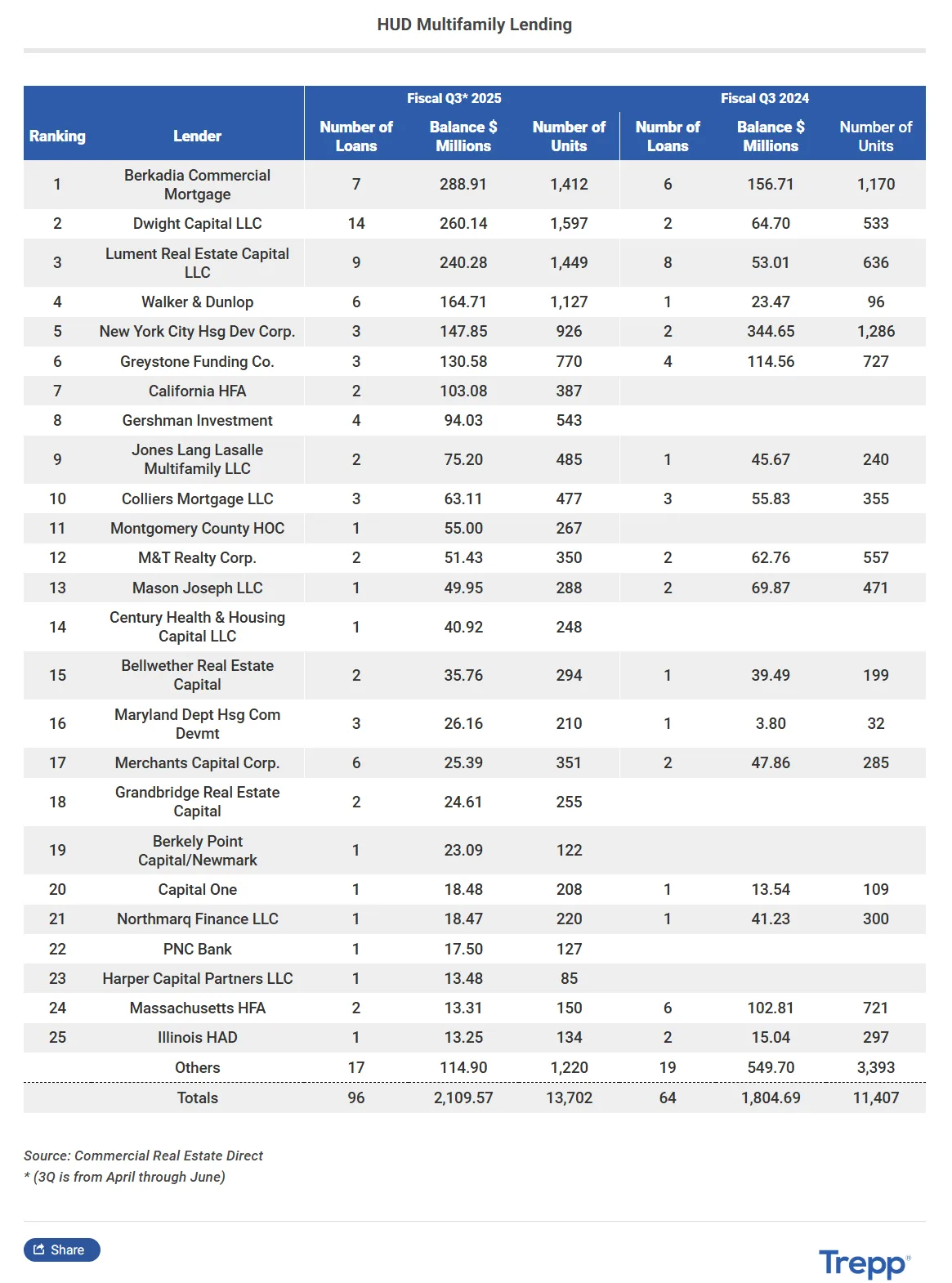

Multifamily Lending Leaders

- Berkadia ranked first in multifamily volume with $288.91M, nearly doubling its production from a year ago.

- Dwight Capital originated $260.14M, while Lument Real Estate Capital closed $240.28M.

Healthcare Lending Leaders

Healthcare financing saw strong competition in Q3:

- KeyBank topped the list with $344.72M across 10 loans.

- Greystone followed with $298.17M, and NewPoint Real Estate Capital with $161.82M.

NewPoint’s recent acquisition by Franklin BSP Realty Trust gives the REIT access to NewPoint’s HUD platform while providing NewPoint with additional balance-sheet capacity for short-term lending—creating a pipeline for permanent HUD takeouts.

Why It Matters

The surge in HUD lending underscores investor confidence in seniors housing and healthcare real estate, sectors buoyed by aging demographics, rising rents, and supply constraints. As Baby Boomers continue to drive demand, HUD programs remain a key financing avenue for long-term stability in the market.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes