- The Trump administration is proposing a $27B—or 43%—cut to federal rental-assistance programs, including Section 8 vouchers.rn

- These cuts are causing lenders to pull back, delaying or canceling new affordable housing developments.rn

- Experts warn the cuts could destabilize the housing market. Up to $50B in HUD-backed loans may be at risk.rn

- Tax credit expansions have helped development. But without rental assistance, many projects could be financially unviable.rnrnrn

Uncertainty Hits the Brakes

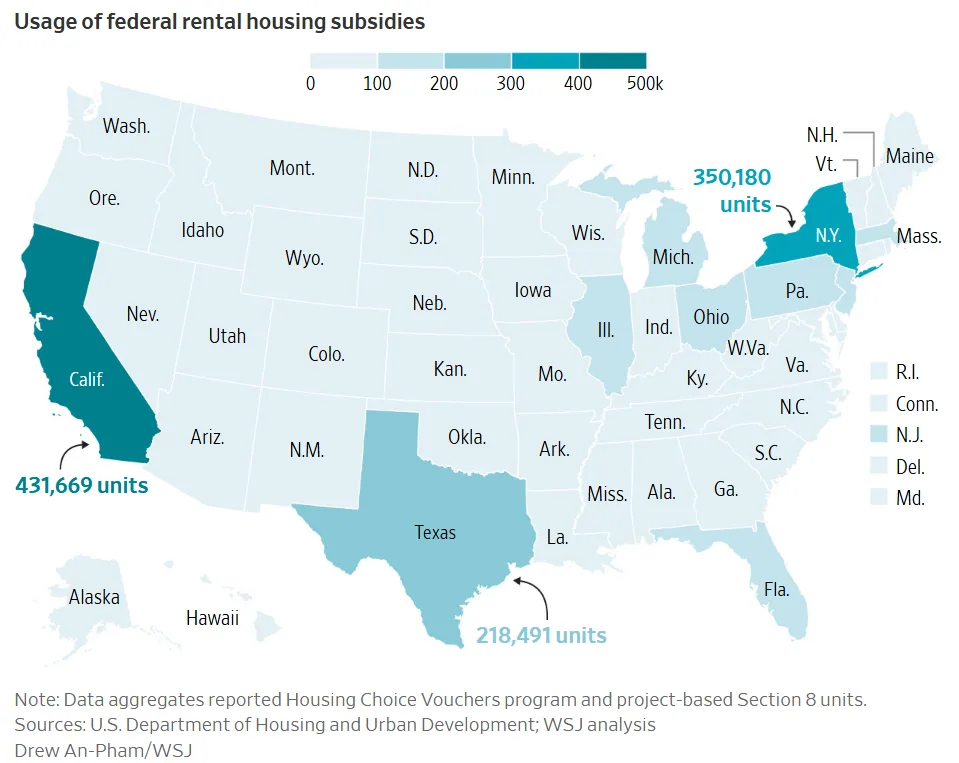

The WSJ reports that affordable housing projects across the US are stalling. The Trump administration’s plan to cut hud funding by $27B has created widespread uncertainty. The proposal includes deep reductions to Housing Choice (Section 8) vouchers, which support over 5M low-income renters.

Real-World Impact

Developer Jeff Fox had planned to break ground this fall on a senior housing project in Queens, New York. That plan changed in June. City housing officials called to say the July Section 8 subsidy round was postponed due to a lack of federal funds. The project is now on hold.

“No one knows what’s going to happen,” said Fox. “Rather than overcommit, they’re pumping the brakes.”

Lenders Pull Back

Many lenders are becoming risk-averse. Deborah La Franchi, CEO of SDS Capital Group, said her firm is “gun-shy” about relying on HUD funding. Michael Dury, CEO of Merchants Capital, reported delays on several deals. Lenders are unsure if federal support will materialize.

System-Wide Threat

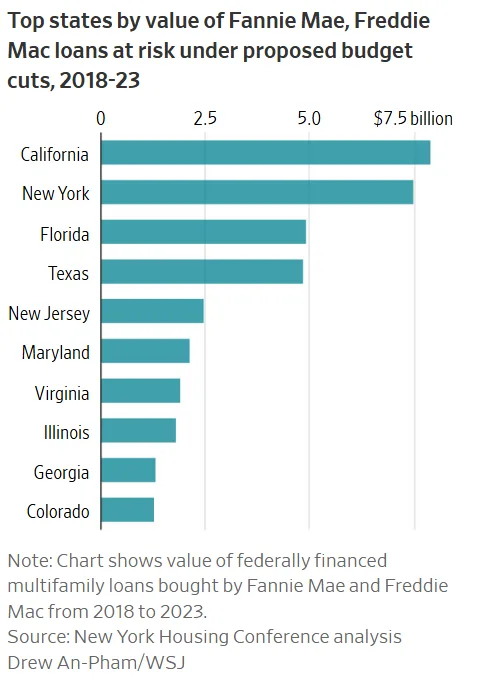

A report from the New York Housing Conference estimates that $50B in multifamily loans could be at risk. These loans, backed by HUD and purchased by Fannie Mae and Freddie Mac, may default if voucher support disappears.

“This would be destabilizing to the entire housing system,” said Rachel Fee, the group’s executive director.

Tax Policy Contradictions

The administration has passed policies that favor development. Changes to the Low-Income Housing Tax Credit (LIHTC) could create over a million new units in the next decade. Opportunity Zones and the New Markets Tax Credit have also been made permanent.

But developers say that without rental assistance, those tools won’t be enough. Amy Albery, CEO of Wallick, said nearly all of her firm’s 10,000 units rely on HUD aid. Without it, projects can’t cover operating costs or debt.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What’s Next

Congress is divided on the cuts. The House Appropriations Committee removed the proposal from its draft budget. Still, HUD is lobbying lawmakers to reinstate the cuts. The Senate is expected to review the plan later this week.

Why It Matters

The US already faces a severe shortage of affordable housing. Without stable federal support, developers say the gap will grow. Projects will stall. Existing units may default. And millions of low-income renters could be left without options.