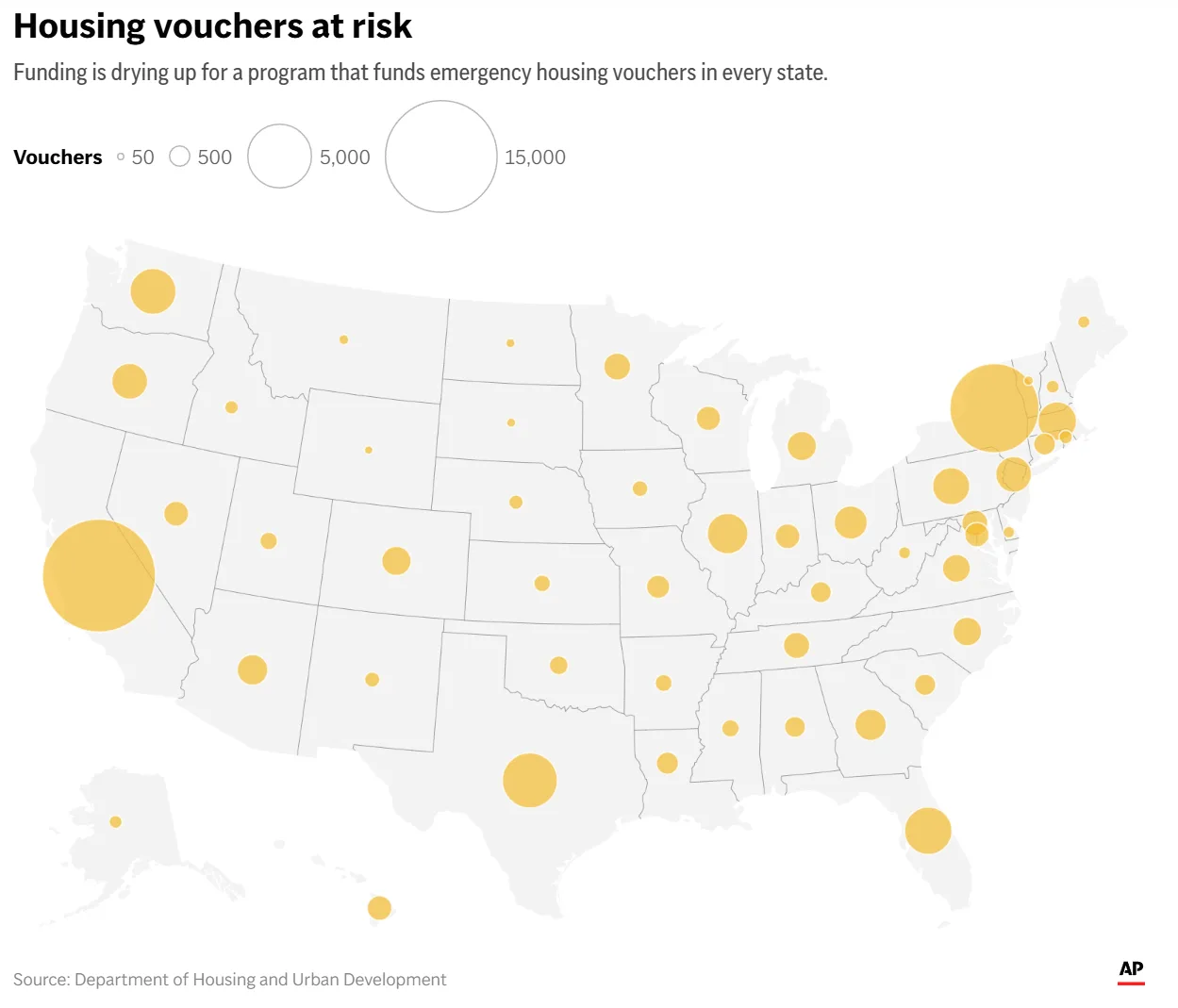

- The Emergency Housing Voucher (EHV) program, funded through the American Rescue Plan in 2021, is expected to run out of money by the end of 2025, impacting around 60,000 households.rn

- EHV was created as a temporary pandemic response, but many of its recipients faced housing insecurity long before COVID-19 — highlighting deeper, pre-existing issues in the US housing system.rn

- Advocates warn of a wave of evictions and return to homelessness or unsafe conditions if the program is not extended, though bipartisan support for continued funding appears unlikely.

- Experts emphasize the need for permanent housing solutions — not temporary vouchers — including reforms to zoning, permitting, and funding to accelerate affordable housing development.

A Temporary Fix for a Long-Term Problem

According to AP News, the Emergency Housing Vouchers program started in 2021 as a crisis response. Congress allocated $5B to help people facing homelessness, domestic violence, and other urgent challenges worsened by COVID-19.

But many who benefited from the program were already struggling long before the pandemic hit. The vouchers helped people like Daniris Espinal, a Brooklyn mother fleeing abuse and homelessness, find stability. These housing vouchers gave her and thousands of others a critical second chance at rebuilding their lives. “I gained my worth, my sense of peace, and I was able to rebuild my identity,” she said, recalling her relief after moving into her new apartment.

Her experience shows that this wasn’t just a COVID-era issue — it reflected deeper, long-standing gaps in the housing safety net.

A Looming Deadline, A Vanishing Safety Net

hud estimates that the Emergency Housing Voucher funds will run out by late 2025. The agency has warned housing authorities not to expect additional funding.

Rising rent prices have drained the program’s resources faster than expected. Although the program was supposed to last through the decade, the math no longer adds up.

Congress would need to allocate more funds to keep it going. However, many lawmakers are focused on cutting spending, not adding to it.

A Predictable Policy Expiration

This crisis didn’t catch experts off guard. From the beginning, EHV was pitched as a short-term fix — not a long-term answer.

Researchers warned back in 2020 that early estimates of eviction risk were likely exaggerated. While the need was real, the scale was sometimes overstated. Even then, there was little momentum for making the program permanent.

The core issue remains unchanged: the US has a major shortage of affordable homes. Temporary programs like EHV don’t address the root problem — not enough housing and too many barriers to building more.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What Comes Next

About 60,000 households face losing rental help when the money runs out. That includes domestic violence survivors, seniors, and low-income families. If the program ends, they could be pushed into homelessness or unsafe living situations. Losing access to these housing vouchers would undo years of progress for some of the most vulnerable Americans.

Representative Maxine Waters wants Congress to approve another $8B. But with Republican leaders prioritizing tax cuts and budget reductions, support is unlikely.

Advocates are already preparing for disappointment.

The Bottom Line

EHV helped thousands during a crisis, but it was never meant to last forever. Its end highlights a hard truth: the US needs deeper, long-term fixes for its housing crisis.

Building more housing — and making it easier, faster, and cheaper to do so — is the only way to solve the root problem. Stopgap programs can only do so much. Permanent change takes commitment, not just funding.