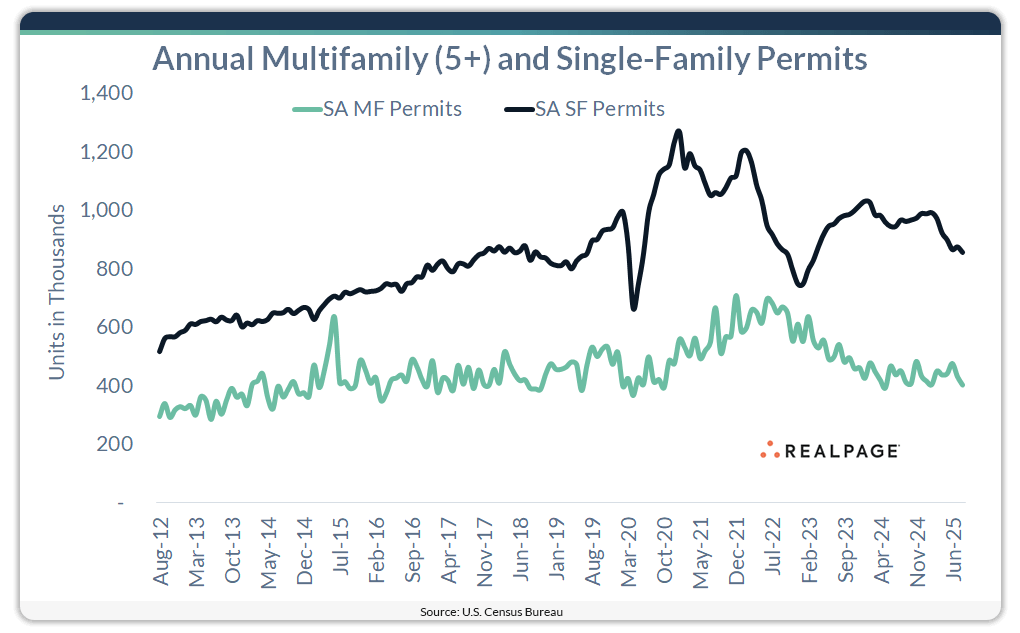

- Single-family permits dropped to 856K units in August, the lowest level since 2023 and the fourth straight month under 900K.

- Multifamily activity remains more stable, with 403K starts—up nearly 16% from last year despite a month-over-month decline.

- High mortgage rates and cost pressures continue to drag on overall residential development, with total permits down 11% year-over-year.

Builders Tap The Brakes On New Housing

Despite widespread affordability challenges, new residential construction continues to slow, reports RealPage. The national shortage of homes has done little to reverse the trend, especially in the single-family segment. August saw declines in both permitting and starts as developers navigate higher financing costs and tighter buyer demand.

Single-Family Construction Hits New Lows

Permitting for single-family homes fell to an annualized pace of 856K units. That’s a 2.2% decline from July and an 11.5% drop from a year ago. It’s the weakest permitting figure since late 2023, when mortgage rates last peaked above 7.6%.

Starts also fell sharply to 890K units—a 7% monthly decline and nearly 12% below August 2024 levels. This marks just the second time since April 2023 that starts have dropped below the 900K-unit threshold.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Multifamily Holds Steady, But Slips From Peak

The multifamily sector, while also cooling from its pandemic-era highs, remains more resilient. Both permits and starts came in at 403K units in August—each down around 11% from July. However, multifamily starts were still 15.8% higher than one year ago, suggesting continued investor appetite, especially for rentals.

Completions told a mixed story: multifamily deliveries dropped nearly 29% year-over-year, while single-family completions rose more than 5%, reaching 1.09M units.

Construction Pipeline Continues To Thin

The number of homes under construction is also trending downward. Multifamily units in progress declined more than 20% from last year, while single-family homes under construction were down nearly 5%.

Regional Shifts Highlight Growing Divergence

Multifamily trends varied sharply by region:

- West: The only region to see permitting growth, up 35%, and a 94% jump in starts.

- Midwest: Permitting fell nearly 14%, but starts increased 36%.

- South and Northeast: Both saw declines in permits and starts, with the South posting the largest drop in permitting at 26%.

Why It Matters

The slowdown in new housing supply comes at a time when affordability remains strained and inventory scarce in many markets. Elevated mortgage rates are making it harder for both buyers and builders. New starts are being suppressed, even though underlying demand remains strong.

What’s Next

Unless mortgage rates ease or construction costs come down, housing development is likely to stay subdued into 2026. The shift toward multifamily construction may continue, especially in the West. Developers are focusing more on rental demand and urban infill strategies.