- Bipartisan housing measures from the “ROAD to Housing Act” were initially included in the Senate’s defense bill but were later dropped in a House-Senate compromise, signaling continued tension over legislative vehicles.

- Proposed reforms focus on boosting housing supply through zoning incentives, expanded definitions of manufactured housing, and faster environmental reviews for small developments.

- White House support for housing legislation may keep momentum alive, even as budget negotiations and political divisions stall broader progress.

- Privatization of Fannie Mae and Freddie Mac is being considered by the administration, with a decision potentially coming in late 2025 or early 2026—an action that could reshape housing finance markets.

The Policy Landscape: A Mixed Bag

As 2025 winds down, housing has found its way into some of Washington’s most high-profile legislative fights, per Chandan Economics. The Senate’s inclusion of parts of the “ROAD to Housing Act” in the National Defense Authorization Act (NDAA) signaled strong bipartisan interest in addressing housing supply issues. But the compromise version stripped those provisions, with House Financial Services Chair French Hill vowing to address housing separately.

While a setback, the removal may just redirect, not derail, federal housing efforts.

What Was on the Table

The “ROAD to Housing” proposal included several supply-side solutions:

- Grants for local zoning reform

- Expanded federal definitions of manufactured housing to include modular and prefabricated units

- Streamlined environmental reviews for small-scale housing developments

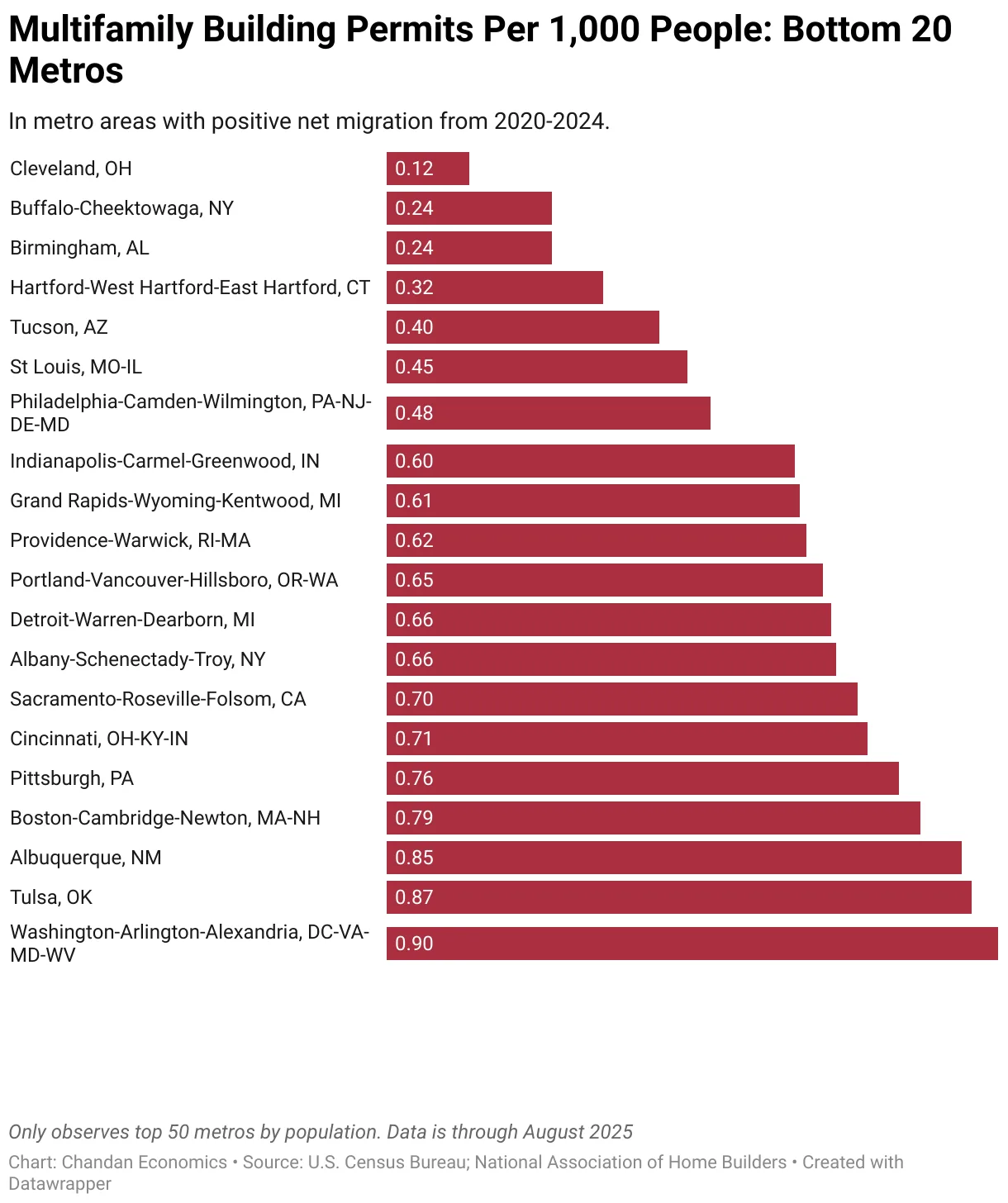

These proposals aim to address supply constraints in fast-growing metros strained by post-pandemic migration and underbuilding.

White House Weighs In

Despite the legislative stall, the White House has signaled openness to advancing housing policy before year-end. That gives lawmakers an incentive to either revive bipartisan provisions in a standalone bill or include them in another must-pass legislative package.

Fannie & Freddie Back in Focus

A separate housing-finance development gaining quiet traction is the potential IPO of Fannie Mae and Freddie Mac. FHFA Director Bill Pulte hinted that a presidential decision could come by late 2025 or early 2026.

The structure of such a move would have far-reaching implications for mortgage rates, market liquidity, and private capital flows into the housing market. It could be the most consequential policy change in housing finance in over a decade.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Budget Tensions Over HUD Funding

Another key flashpoint is funding for the Department of Housing and Urban Development (HUD). A continuing resolution passed in November funds HUD through January 2026, but long-term funding levels remain up in the air.

Pre-shutdown budget proposals showed flat or reduced funding for rental assistance. Internally, HUD has also been exploring major structural changes to address budget constraints, which could have downstream impacts on housing program capacity.

Looking Ahead: Will Compromise Emerge

While larger debates over SNAP and the ACA dominated headlines, housing—and the broader cost-of-living crisis—has become a critical pressure point for policymakers. With both parties under pressure to act, the bipartisan ROAD provisions may represent the most viable path to legislative success in 2026.

As budget and housing negotiations continue into the new year, Washington’s next steps will shape the affordability landscape for millions of Americans.