- Housing affordability is declining in Columbus as rapid job growth outpaces the supply of new homes.

- Home prices have surged 51% since 2020, while rents continue to climb, squeezing middle-income buyers and renters.

- New construction isn’t keeping up due to zoning challenges, infrastructure limits, and high mortgage rates.

- Investor activity is rising, increasing competition in lower-priced neighborhoods and pushing ownership further out of reach.

A Booming Economy, A Tight Housing Market

Columbus, once known for balanced growth and affordability, now shows how economic success can strain housing markets, reports WSJ. Columbus’s 17% population growth since 2010 and rising corporate investment are outpacing housing supply, straining the real estate market.

Defense tech firm Anduril and biopharma giant Amgen have announced thousands of new jobs and hundreds of millions in investments. JPMorgan Chase expands its major Columbus hub, but job growth is far outpacing the city’s housing development.

Prices Climb, Middle Class Feels The Pinch

According to Zillow, home values in the metro have jumped 51% since early 2020—one of the steepest increases in the Midwest. Rents followed suit, with the average apartment asking $1,405 in June, up nearly 7% in 18 months.

For many lifelong residents, the affordability that once defined Columbus is fading. Rachel and Matt Rinella, both Columbus natives, spent over a year searching for a home they could afford. After tightening their budget and cutting back on spending, they finally purchased a $309K home in Westerville. It was a rare find in a market that has priced out many middle-income buyers.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Supply Bottlenecks And Investor Pressure

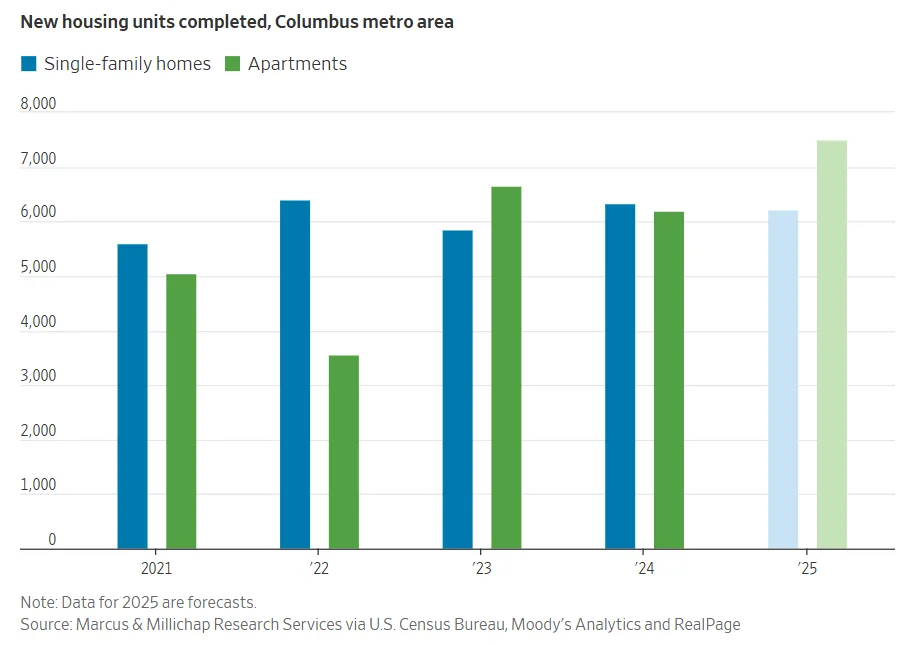

Despite increased apartment construction, homebuilding in Columbus has stagnated over the last five years. Builders cite limited infrastructure (such as the city’s single interstate loop), local opposition to new development, and high interest rates as major barriers.

At the same time, institutional and individual investors are buying up single-family homes. As of June, they owned over 15% of Columbus’s single-family stock, up from 13.7% just 15 months earlier. These buyers are particularly active in lower-income neighborhoods, where properties can be acquired for $200K or less—putting further pressure on the for-sale market.

Policy Moves And Outlook

City leaders have taken steps to respond. In 2025, Columbus approved sweeping rezonings to allow for denser development in nearly half the city. A $500M affordable housing bond and tax breaks for developers building below-market units aim to accelerate supply.

Still, industry experts caution that new home construction—particularly at prices within reach of average residents—remains limited. Most new homes are priced well above $500K, far outpacing what many Columbus households can afford.

Why It Matters

Columbus is emblematic of a broader national challenge: how to balance economic growth with housing affordability. Without enough reasonably priced homes, the city risks losing its appeal as a place where both companies and workers can thrive.

As Columbus continues to evolve into a Midwestern boomtown, the pressure is on to ensure that success doesn’t come at the expense of the very affordability that helped build it.