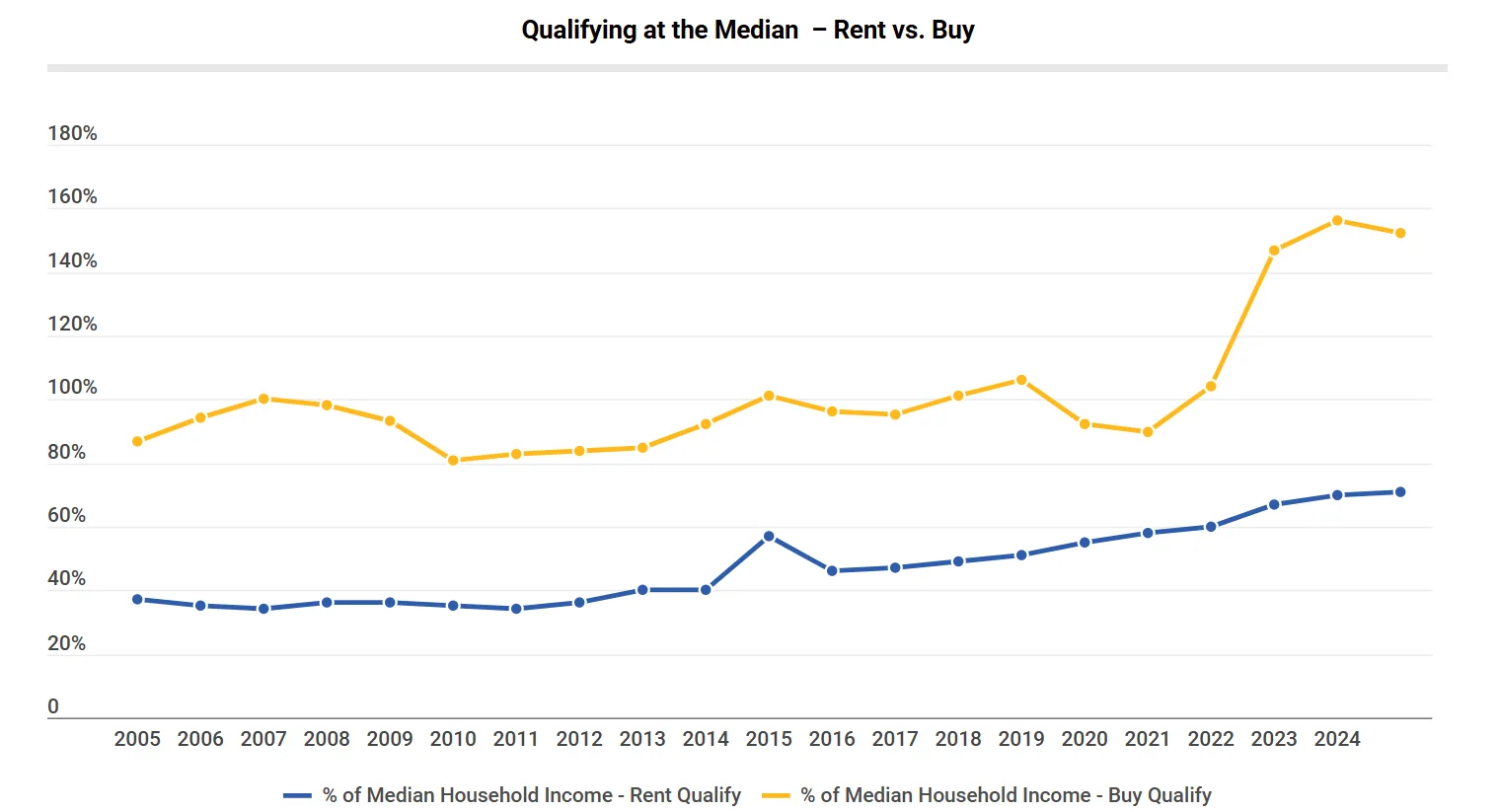

- In 2023, it took 71% of the median US household income to qualify to rent an average apartment—nearly double the share in 2004. Buying is even more out of reach, requiring 152% of median income, up from 87% two decades ago.rn

- The classic “rent vs. buy” equation is losing relevance as fewer Americans can afford homeownership. Long-term renting, even of single-family homes, is increasingly the norm.rn

- With constrained supply and rising costs, multifamily properties are positioned for sustained rent growth and investment performance, especially in lower-cost markets experiencing inbound migration.rnrnrn

The Decline of Homeownership Affordability

What was once a foundational part of the American Dream—owning a home—is increasingly out of reach. According to an analysis by Fordham University, the share of income needed to rent or buy has more than doubled in the past 20 years. While renters are more cost-burdened than ever, buyers are confronting what is effectively a luxury pricing model, particularly in high-cost cities and regions with restrictive housing affordability policies.

trepp reports that in 2004, renters needed just 37% of median income to qualify for the average apartment; by 2023, that number had risen to 71%. The picture for buyers is even more stark: a typical home required 87% of the median income in 2004, but that share had surged to 152% by 2023.

Economic Implications of a “Renter Nation”

This shift is more than a financial burden—it’s a reordering of economic behavior. A decline in homeownership can suppress consumption of durable goods tied to ownership, such as furniture and appliances, and shift spending toward services and experiences.

Renters also tend to be more mobile, which could benefit national economic productivity by allowing for geographic labor market flexibility. However, without the wealth-building power of homeownership, long-term renters could struggle to accumulate assets. In 2022, the median net worth of homeowners was 38 times greater than that of renters, per the National Association of Home Builders.

What This Means for Commercial Real Estate

This structural shift in housing affordability and consumer behavior is a tailwind for rental housing investment. Over the past 20 years, gross potential rent per unit grew at a compound annual rate of 4.00%, outpacing the 3.16% CAGR for home prices. That performance gap could widen as homeownership becomes less accessible.

Key trends include:

- SFR and Build-to-Rent Expansion: Lifestyle-driven renters are fueling demand for single-family rentals and build-to-rent communities, pushing these asset types further into the institutional investment mainstream.

- Geo-Arbitrage Drives Demand in Lower-Cost Markets: Americans are increasingly relocating to secondary and tertiary markets with more affordable housing and pro-growth policies. These migrations are inflating demand—and prices—in markets like Texas, Florida, and parts of the Midwest and Southeast.

- CRE Opportunity in High-Growth Markets: Investors focused on multifamily and mixed-use developments in affordable, high-migration regions may benefit from stronger long-term returns and lower acquisition costs compared to traditional gateway cities.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Final Thoughts

If housing continues on its current trajectory, becoming more luxury than necessity, multifamily and rental housing will remain in high demand—for both consumers and investors. While luxury assets may command price premiums, broader volatility in multifamily values could also rise due to sensitivity to local economic and employment conditions.

Still, for CRE stakeholders, the message is clear: long-term housing constraints and affordability challenges will keep the rental market resilient—and increasingly central to investment strategy.