- Calls from President Trump and FHFA Director Bill Pulte for large builders to increase housing output overlook deeper structural issues driving up home prices.

- Publicly traded builders like Lennar are already facing margin pressure amid soft demand, despite aggressive incentives and production levels.

- Policymakers should focus on reducing land, labor, and material costs instead of pushing more supply onto an already fragile market.

- Flooding the market could backfire by destabilizing prices and squeezing out smaller builders who can’t compete.

The Political Optics

Homebuilders have become an easy political target. President Trump and housing regulator Bill Pulte are publicly urging major firms to “step up” and address America’s housing shortfall, reports Bloomberg. They argue that the industry’s expanding market share gives these companies greater responsibility. In their view, big builders should do more to help fix the nation’s housing challenges.

But Profits Tell A Different Story

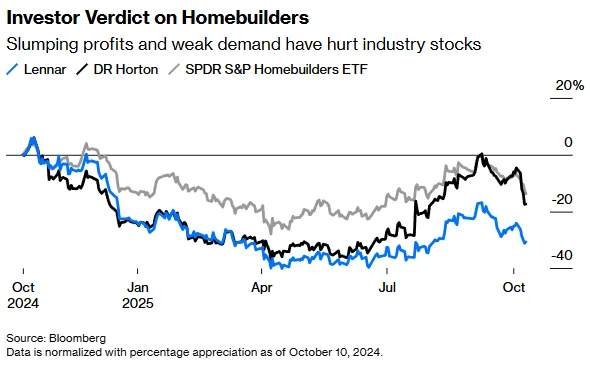

Despite the rhetoric, big builders aren’t rolling in cash. Companies like Lennar have kept production high, even in the face of weakening demand. The result? Shrinking profit margins, sluggish stock performance, and the highest inventory of unsold new homes since 2009.

More Homes ≠ More Affordability

Increasing supply is only part of the solution — and it’s the most expensive part for builders. The real bottlenecks are upstream: tariffs on materials like lumber and cabinetry, immigration policies that reduce construction labor, and high land costs all add to the final price tag of a home.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

A Blunt Tool With Risks

Forcing production may sound politically appealing, but it risks further consolidating the market. Large developers can absorb tighter margins; smaller builders can’t. An oversupply in regions already experiencing softening prices could also lead to housing market instability and erode homeowner equity.

The Smarter Fix

Lasting affordability comes from lowering input costs and boosting buyer purchasing power. If policymakers want builders to lower prices, they need to focus on what’s driving costs up. Targeting companies that are already struggling to manage those costs misses the real issue.

Looking Ahead

As housing affordability dominates political debates, expect more headline-grabbing pressure on developers. But unless federal policy tackles the root causes of rising construction costs, asking builders to do more with less won’t work. It’s a losing strategy — both for the builders and for the broader housing market.