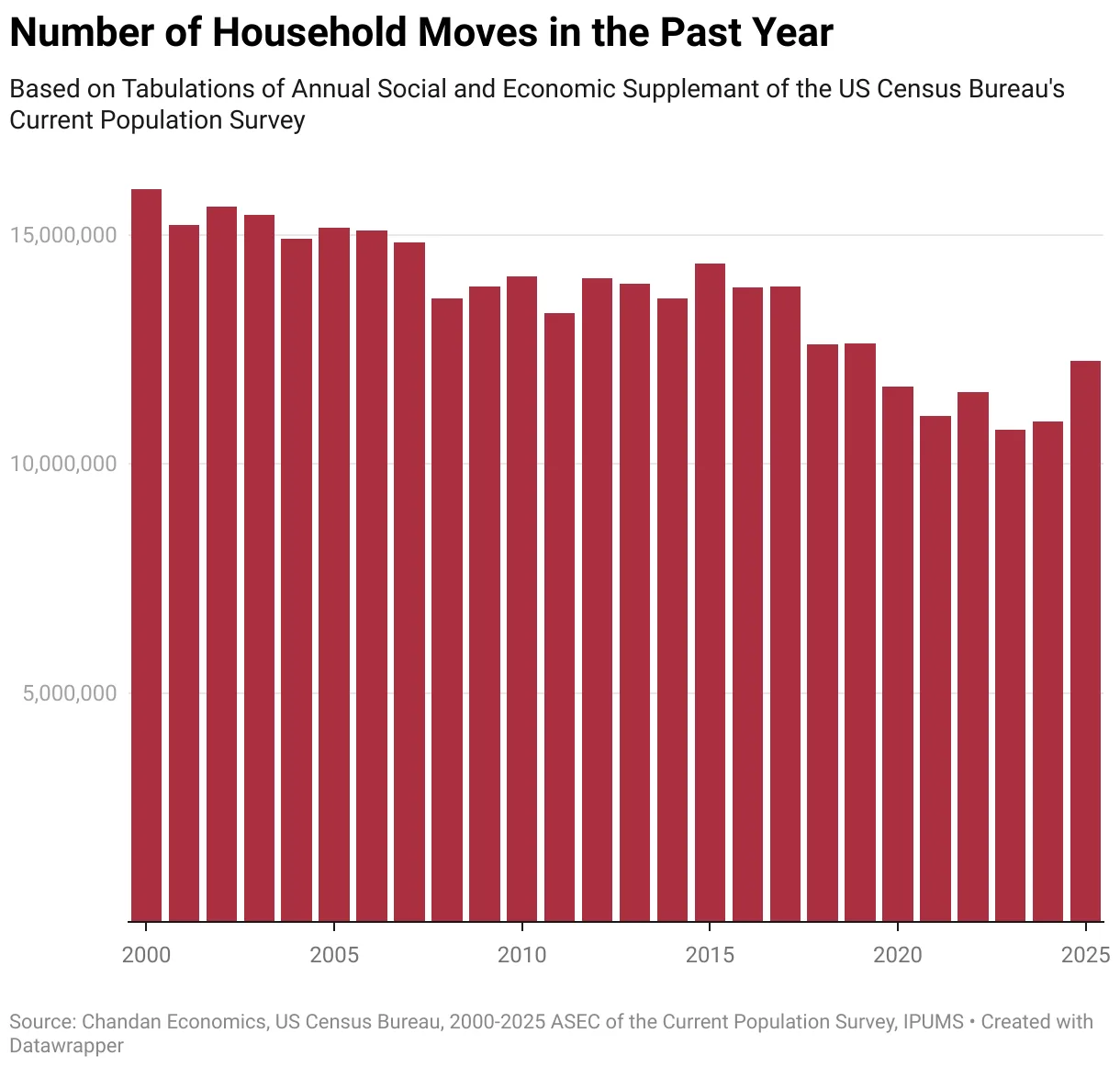

- Household moves rose 12.1% year-over-year to 12.3M, marking the highest level since 2019.

- Family formation drove the biggest gains, with nearly 27% more moves linked to changes in relationships and new households.

- Housing preference moves remain strong, led by affordability, neighborhood upgrades, and homeownership transitions.

- Retirement-related relocations jumped 57.8%, reflecting demographic shifts and delayed post-pandemic lifestyle changes.

A Jump In Mobility

Americans are on the move again. According to new data from the US Census Bureau’s 2025 Annual Social and Economic Supplement, 12.3M households relocated over the past year, reports Chandan. This marks a level of mobility not seen since the pre-pandemic era.

Not only is that a significant volume, but the 12.1% year-over-year growth also marks the largest annual increase since at least 2000. It’s also the first time since 2010 that household moves have risen in two consecutive years — a clear sign that mobility trends are rebounding.

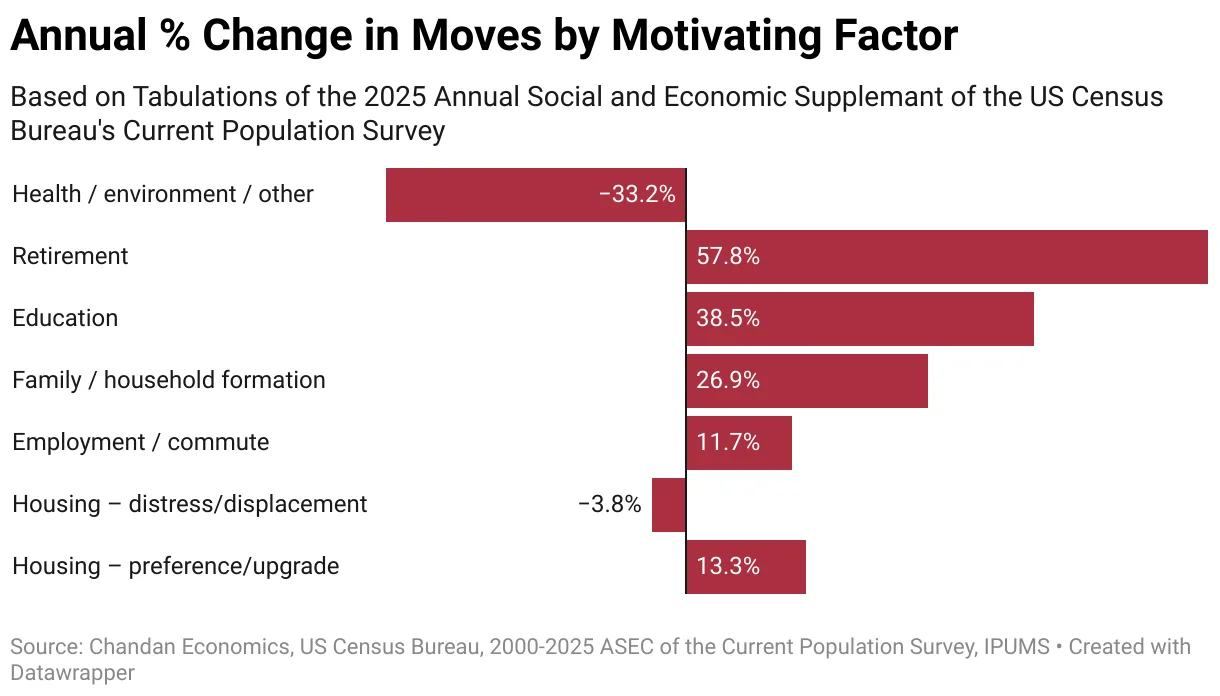

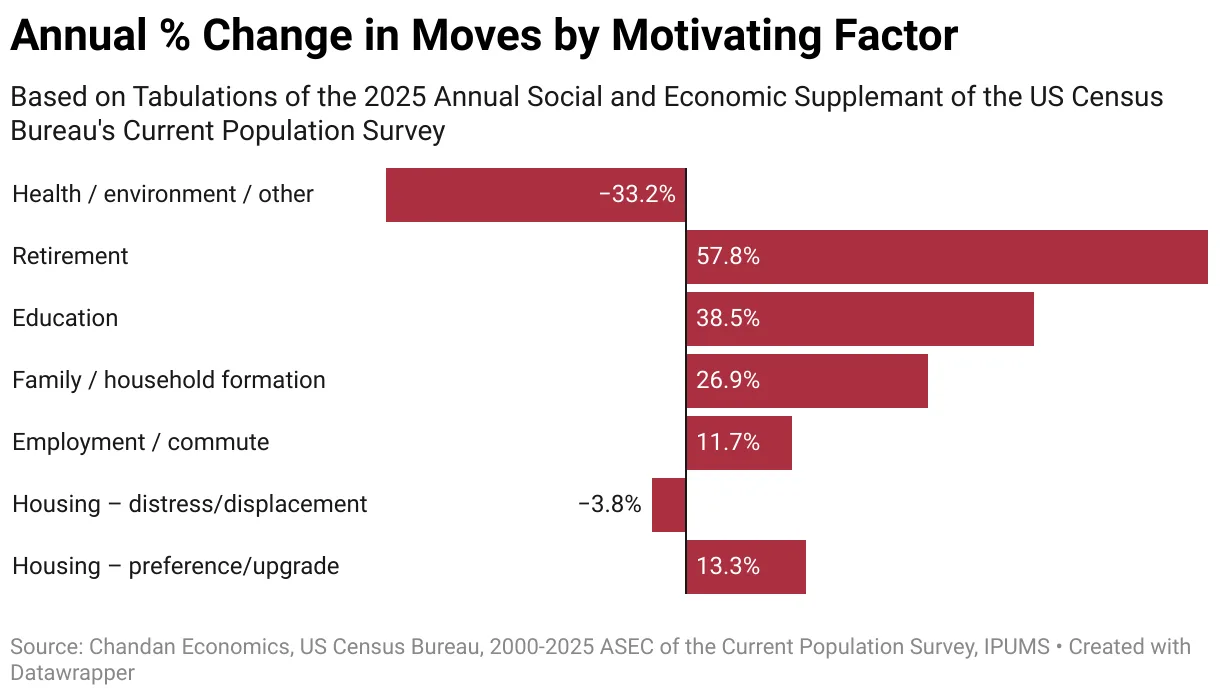

Why People Are Moving

Lifestyle upgrades and family changes are fueling the surge.

- Housing-related motives — such as trading up, seeking affordability, or entering homeownership — accounted for 4.68M moves, a 12.1% increase from 2024.

- But family formation reasons were the biggest growth driver, jumping 26.9% year-over-year to 3.65M moves, as more people moved in with partners or started their own households.

- Retirement moves also saw a sharp increase of 57.8%, as Baby Boomers continued to hit retirement milestones amid lingering post-pandemic adjustments.

Notably, distress- or displacement-driven moves remain minimal, totaling just 60K over the past year — a positive sign that current migration is mostly voluntary and opportunity-based.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

What It Means For Real Estate

Rising mobility means higher household churn, which is generally good news for residential real estate markets.

- Rental Impacts: Faster leasing velocity and turnover-driven CapEx are likely to rise, especially in Class B/C and suburban assets that align with affordability and lifestyle preferences.

- Home Sales: Increased mobility could begin to loosen the housing market gridlock caused by high mortgage rates. If rates ease further, expect more resale and new home transaction activity.

- Entry-Level Demand: With household formation driving moves, demand should remain solid for attainable multifamily and entry-level single-family rentals, especially in lower-cost metros.

Looking Ahead

With more Americans on the move for lifestyle and family reasons — not out of necessity — the residential market is entering a healthier, more active phase. If mortgage rates soften heading into 2026, mobility-driven momentum could carry over into stronger for-sale and rental housing performance.