- Weekend demand lifted hotel performance, with RevPAR up 0.9% nationally and strong gains Friday through Saturday.

- Detroit, Chicago, and Charlotte led market growth, driven by major events like Automate 2025 and the PGA Championship.

- Smaller markets surged on graduations and festivals, with some seeing RevPAR rise over 100%.

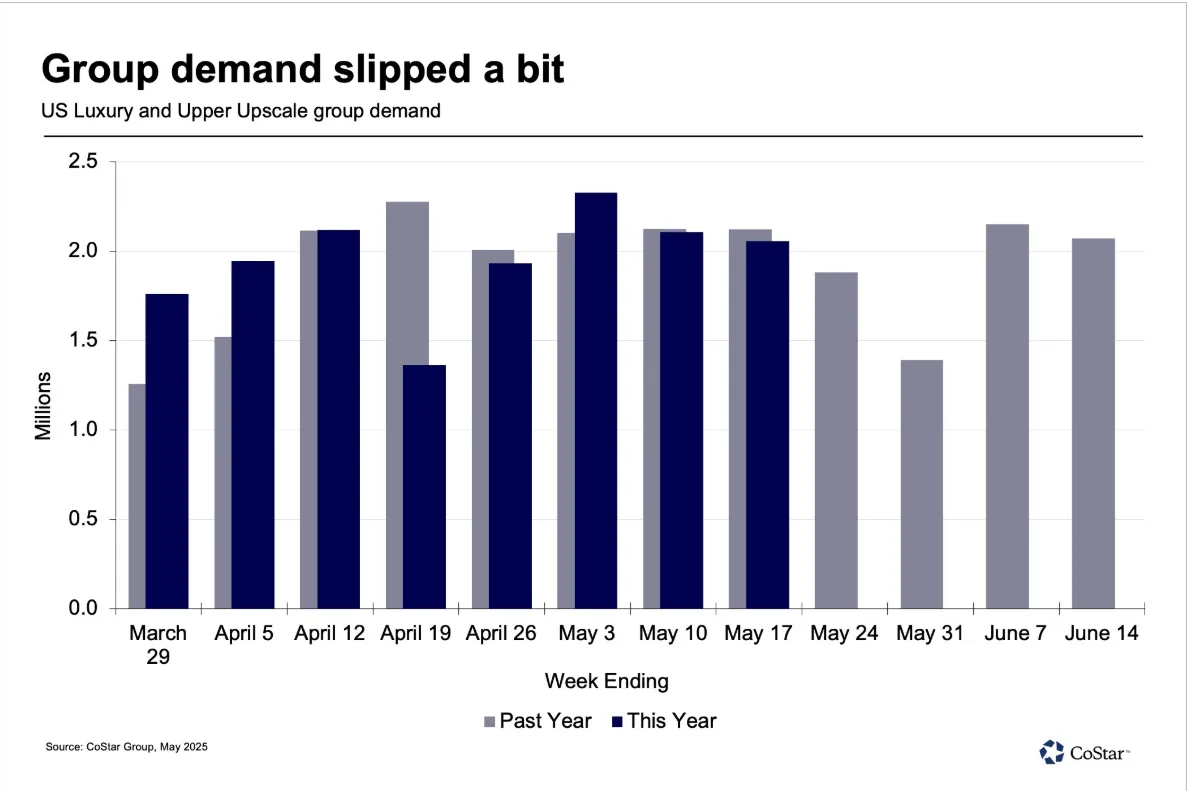

- Group demand declined, especially in luxury segments, while transient ADR and demand posted modest gains.

Weekend Turnaround Fuels National Gains

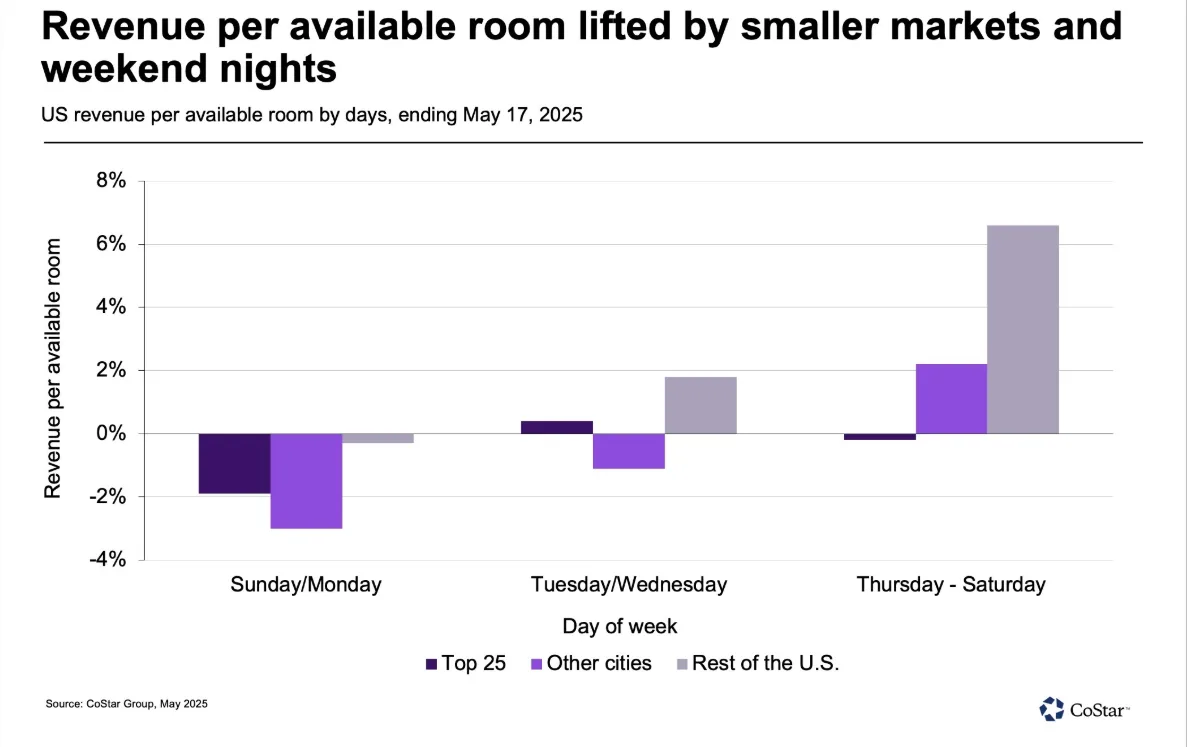

After a sluggish start to the week, US hotel performance rebounded strongly over the weekend, as reported by CoStar. RevPAR improved 0.9% for the week ending May 17, supported by a 1.3% gain in average daily rate (ADR). Occupancy declined slightly, but the Thursday-to-Saturday stretch saw RevPAR jump 2.4%, reversing a rare dip in weekend performance seen the previous week.

The weekend flip may be due to rescheduled high school and college graduations following delayed semester starts after the winter holidays.

Detroit And Chicago Stand Out In Top 25 Markets

While top 25 US markets saw an overall 0.4% RevPAR decline, 11 posted gains. Detroit led the pack with a 26.1% increase, boosted by the Automate 2025 conference.

Chicago posted a 13.5% RevPAR rise, with all submarkets showing gains. The Chicago North submarket led with a 27.6% increase, and the downtown business district rose 14.4%, driven solely by ADR growth.

Other double-digit gainers included Los Angeles and San Diego. In contrast, Las Vegas and Atlanta experienced double-digit RevPAR declines, with Atlanta impacted by weakening group demand.

Smaller Markets Thrive On Events and Graduations

Markets outside the top 25 saw stronger performance, with a 2.2% RevPAR increase. Charlotte saw a boost from the PGA Championship, while Daytona Beach benefited from the Welcome to Rockville festival.

College towns like Blacksburg (Virginia Tech), Binghamton (RIT), and Champaign-Urbana (University of Illinois) each saw RevPAR rise over 100% during graduation weekend, highlighting the power of academic calendars on hotel performance.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Group VS. Transient Trends

Group demand declined 3.2% year-over-year in luxury and upper-upscale segments, particularly over the weekend. However, ADR for both group and transient travelers rose around 2.3–2.4%. Transient demand rose modestly at 1.4%.

Only five major markets—Detroit, Oahu, Las Vegas, San Diego, and Anaheim—posted gains in group demand. Over the past four weeks, Atlanta leads in group demand decline, down 15.6%, though it remains flat year-to-date.

Summer Uncertainty

With Memorial Day marking the unofficial start of summer, business and group travel is expected to ease. Forward bookings show mixed signals—growth in May, flat in June, and softening in July and August. Shorter booking windows may be affecting visibility.

Despite lower TSA screenings in mid-May, early indicators suggest a recovery. AAA projects a record 45.1M Americans will travel domestically over Memorial Day weekend.

Growth Slows, But Momentum Continues

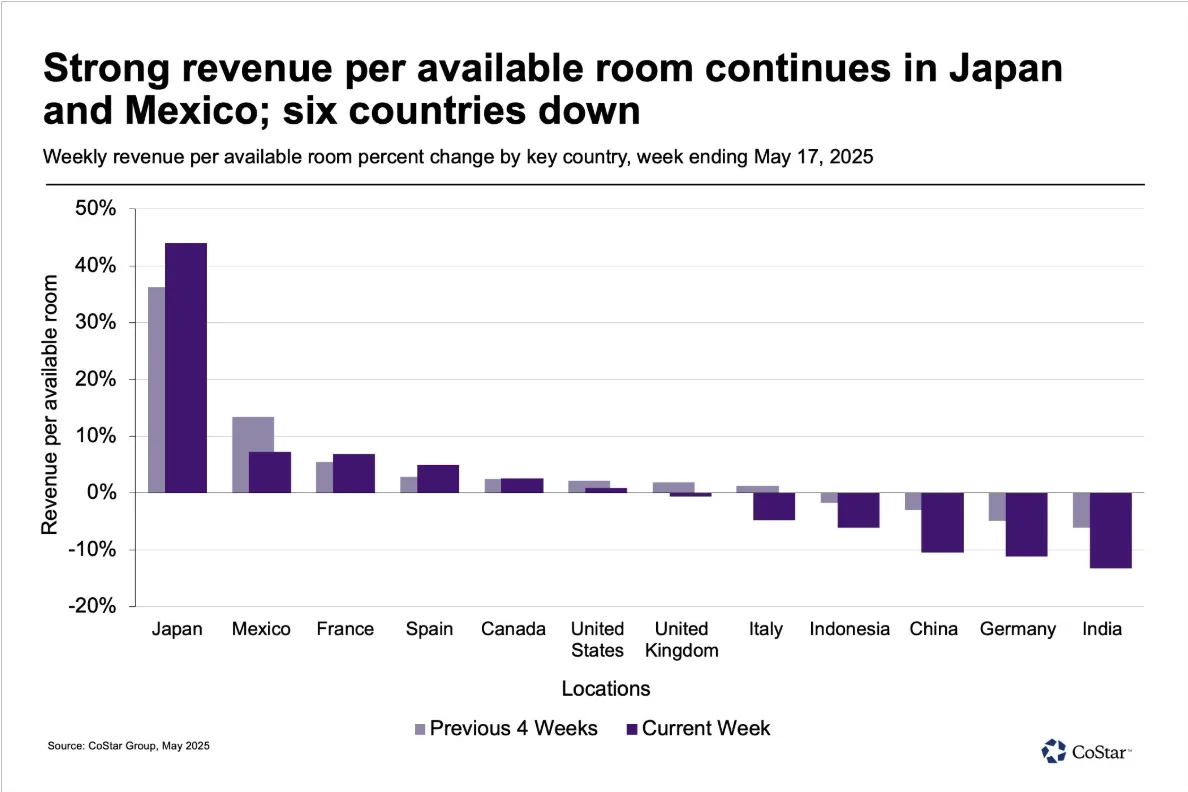

Globally, hotel RevPAR rose 3.2% outside the US, driven by a 4.7% rise in ADR. Japan led with a 44% surge, fueled by strong rate growth and nearly 80% occupancy.

Elsewhere, France, Spain, Mexico, and Canada posted gains, while China saw its steepest RevPAR drop in over a month due to falling ADR and increasing room supply. Germany and India also saw double-digit retreats.

With major international events like the Olympics and Taylor Swift’s tour not recurring this year, global comps will be tough. Meanwhile, international outbound US travel continues to climb, but a weakening dollar could slow momentum.

Why It Matters

The return of weekend strength and event-driven demand offers a positive signal for hotel operators as summer approaches. However, group demand softness and mixed global performance reflect ongoing market volatility and changing travel patterns.