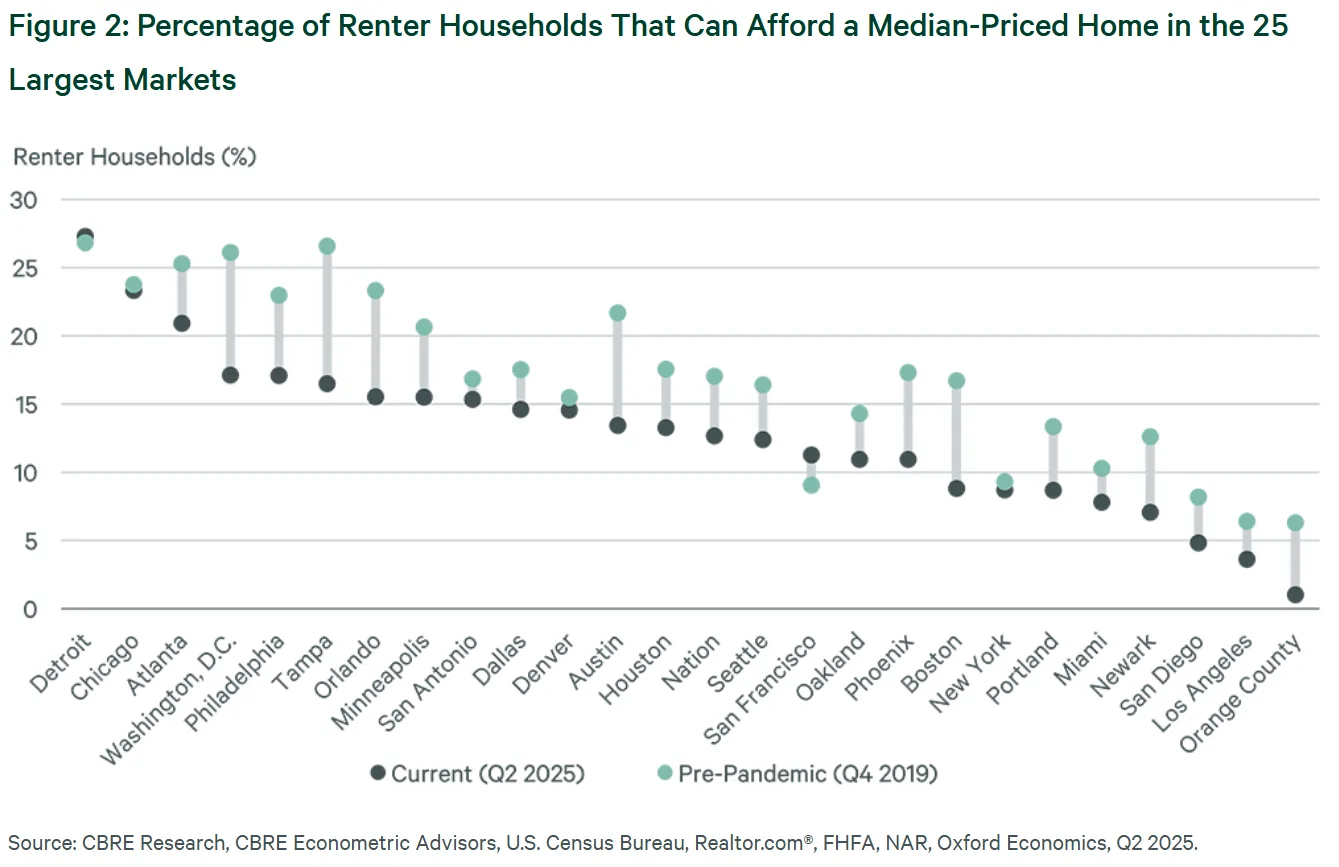

- Only 12.7% of renter households can afford a median-priced home as of Q2 2025, down from 17.0% in 2019.rn

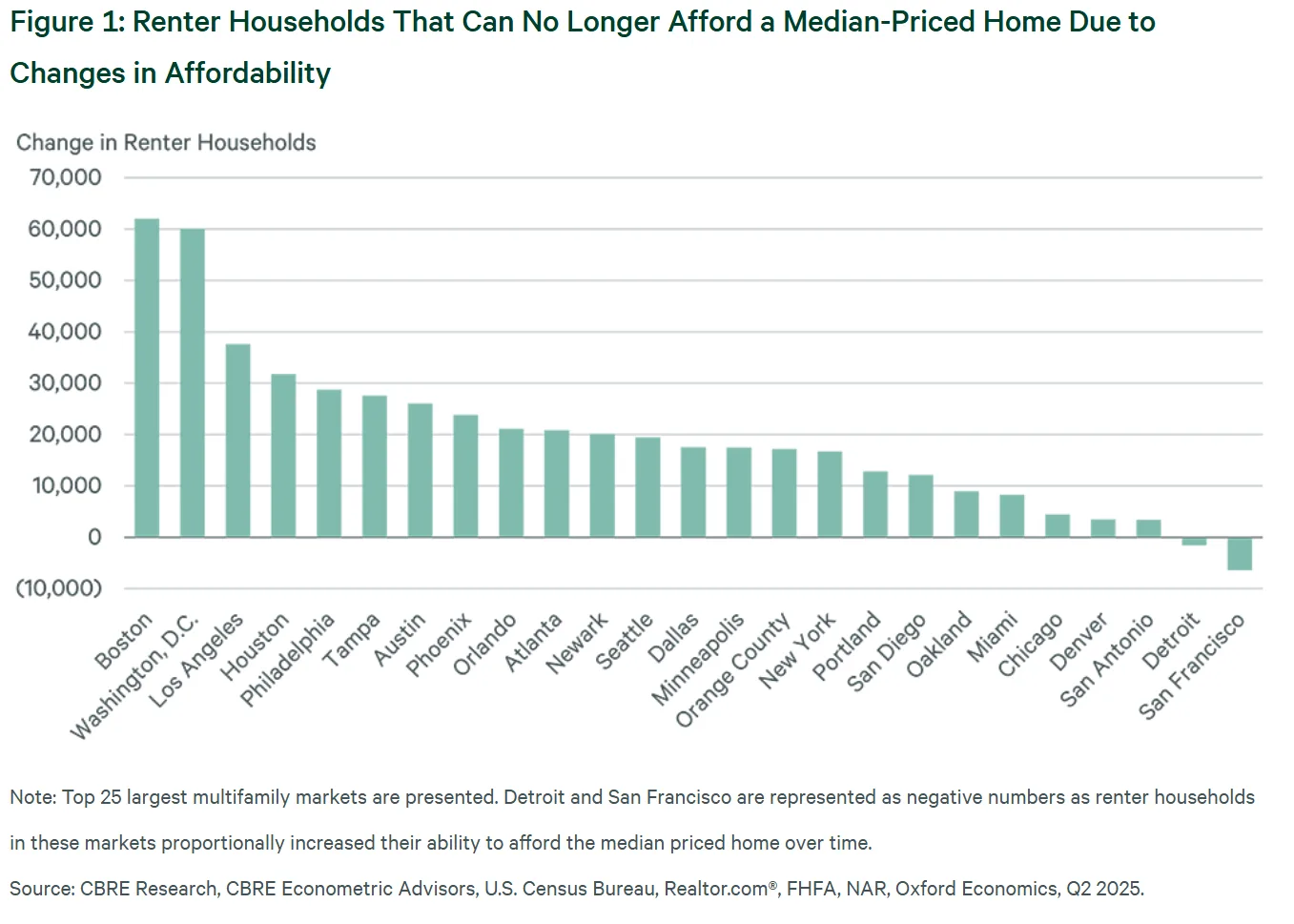

- 1.8M renter households have lost the ability to afford homeownership in just over five years.rn

- Markets like Boston, Washington, D.C., Los Angeles, and Sun Belt metros such as Tampa and Austin have seen the steepest affordability declines.rn

- With the cost gap between renting and owning still wide, multifamily occupancy rates are expected to remain above average and keep near-term rent growth elevated.rnrnrn

Homeownership Slips Further Out of Reach

Approximately 1.8M renter households that could afford a home in 2019 are no longer able to do so, according to new CBRE research. Persistently high mortgage rates combined with sharply higher home prices have eroded affordability, pushing the share of renters able to buy a median-priced home down to 12.7% from 17.0% in just five and a half years.

Markets Hit the Hardest

Boston and Washington, D.C. top the list of metros with the largest number of renters priced out of ownership. Other large coastal markets such as Los Angeles and Philadelphia also saw steep declines, along with Sun Belt cities that boomed during the pandemic. Tampa, Austin, Phoenix, Orlando, and Atlanta posted some of the biggest affordability losses as migration-driven demand pushed prices sharply higher.

In contrast, markets like Denver, New York, and Chicago showed more stability due to higher incomes and relatively flat or declining home prices.

The Ownership Premium Widens

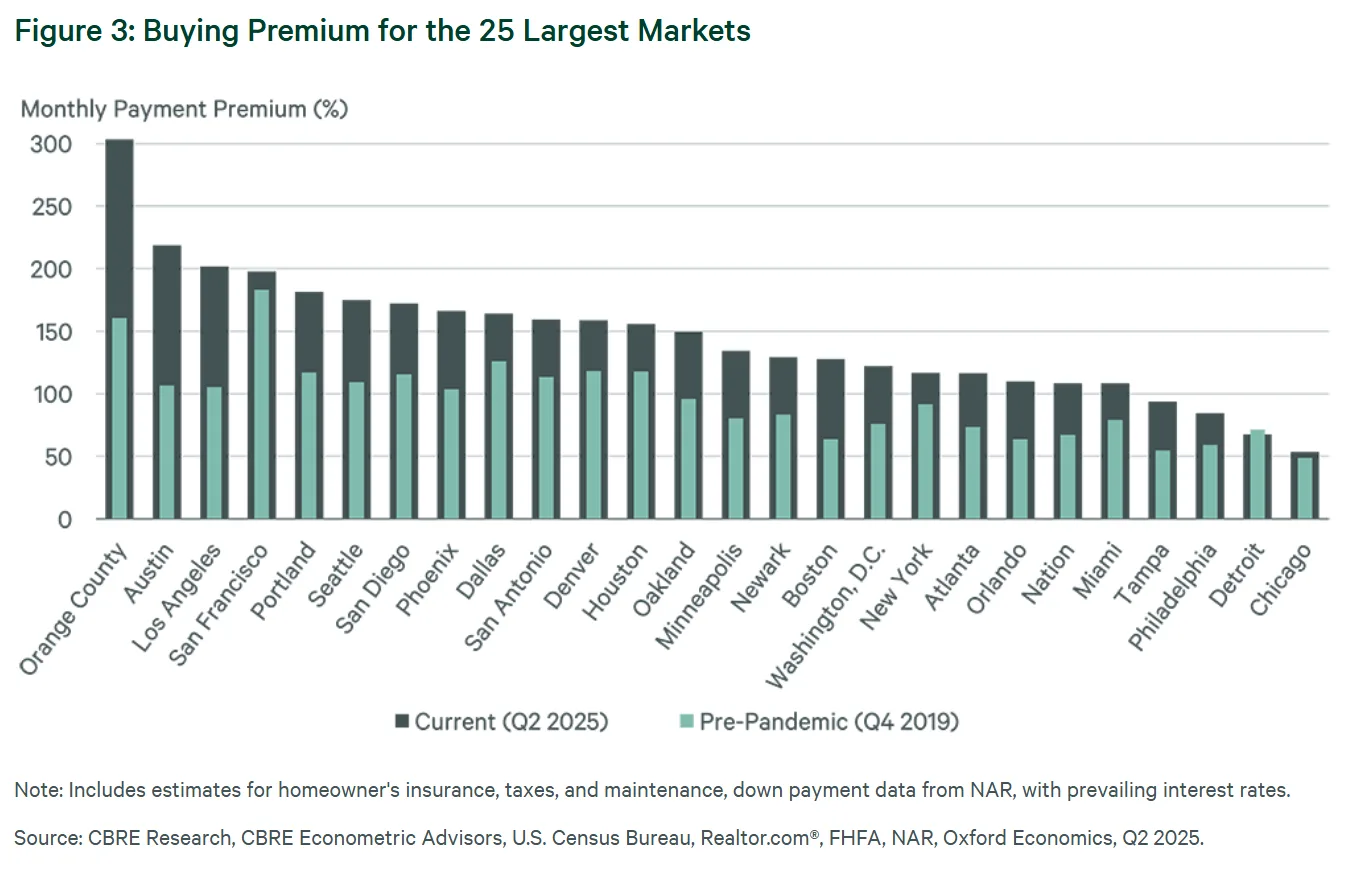

The financial gap between renting and buying remains stark. Nationally, the average monthly cost of owning a median-priced home reached $4,643 in Q2 2025, more than double the average rent of $2,228. That translates into a 108% “buying premium” compared with renting—well above the 68% pre-pandemic average.

Some markets are even more extreme. Orange County’s premium hit 303%, requiring more than eight years of rent to match the down payment for a home.

Why It Matters

The growing affordability barrier means multifamily occupancy rates are expected to stay above historical averages, supporting steady rent growth even as new supply delivers. CBRE notes that it will take years of lower interest rates, rising incomes, or falling home prices for the ownership-to-rent gap to normalize.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes