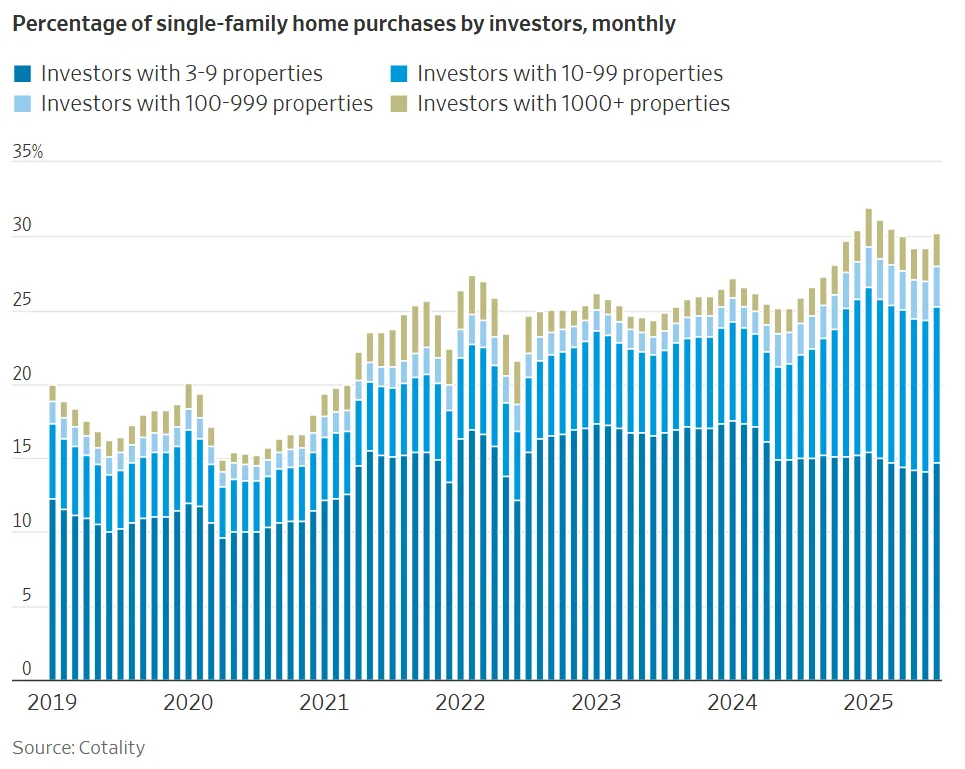

- Investors now make up 30% of all single-family home purchases—the highest share on record.

- Small investors are outpacing large firms, fueled by discounts and less competition from traditional buyers.

- Major players like Invitation Homes and Amherst are offloading homes instead of acquiring new ones.

Buyers Step Back, Investors Step In

The WSJ says that high prices and interest rates continue to push many homebuyers out of the market. Home investors, however, are stepping in to fill the gap.

In 2025, investors bought 30% of all single-family homes—both new and existing—according to real estate firm Cotality. This marks the highest share since Cotality began tracking data 14 years ago.

Small Investors Take the Lead

Once dominated by giants like Blackstone and Starwood Capital, the market is now led by small investors. In the first half of 2025, small investors accounted for 25% of investor purchases, while large firms made up just 5%.

This shift comes as big firms scale back, leaving space for smaller buyers to act. Sellers are also more willing to negotiate with these investors to clear growing inventory.

How They’re Winning

Small investors often buy homes around $250,000, invest up to $15,000 in renovations, and charge $2,000 to $2,200 in monthly rent. They typically pay in cash and close deals quickly—sometimes in weeks, not months.

Rajan Bhatt, president of Strand Capital, says his firm has bought about 100 homes in markets like Chattanooga and Indianapolis. They expect 5% annual home appreciation and aim to sell at a profit in three years.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Big Firms Pull Back

Large investors are scaling down due to rising costs and regulatory pressure. Firms like Invitation Homes, Progress Residential, and Amherst are now selling more homes than they are buying.

Chris Avallone, CFO of Amherst, says high interest rates have slowed their acquisitions significantly.

Builders Offer Deals

In markets like Texas and Florida, builders face a surplus of homes. To move inventory, companies like Lennar and D.R. Horton are offering discounts and other incentives.

In July, 38% of homebuilders reduced prices—the highest rate since 2022, according to the National Association of Home Builders. Smaller investors are now benefiting from deals once reserved for large firms.

More Players Enter the Market

Casey Sherman of JLL has helped several clients enter the single-family space over the past 18 months. These include small funds backed by wealthy individuals and multifamily investors looking to diversify.

Bruce McNeilage, who invests across the Southeast, sees new players arriving every week. “Some are dipping their toes,” he says. “Some are putting their whole foot in.”

Why It Matters

Investor-owned homes are increasing, making it harder for traditional buyers to compete. With fewer people able to afford homeownership, long-term affordability and equity-building are at risk.

What’s Next

Unless interest rates drop or new regulations emerge, small investor activity will likely remain high. Their growing presence could reshape housing access for years to come.