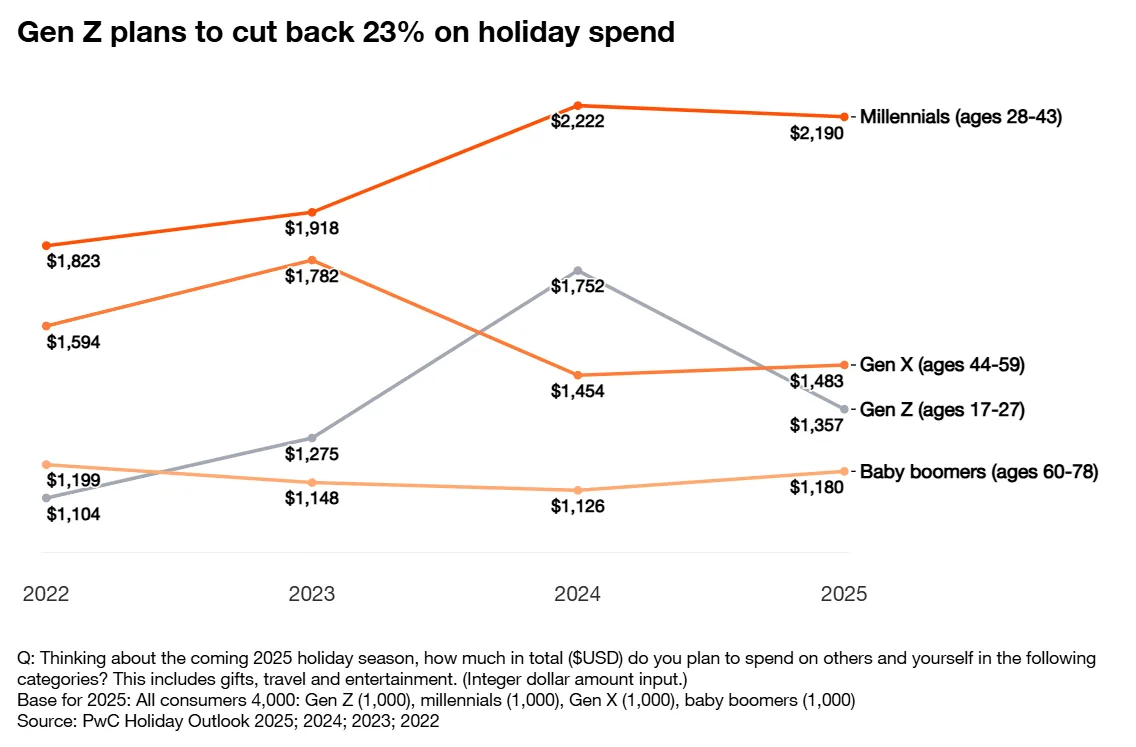

- Holiday spending is expected to drop 5% in 2025, the first significant decline since 2020.

- Gen Z plans to reduce budgets by 23%, while baby boomers are increasing their spend.

- Value is the top priority, with 78% of consumers seeking lower-cost options and deeper discounts.

- Nearly 80% of gift budgets will be spent by Cyber Monday, tightening the holiday shopping window.

A New Tune For The Season

Holiday shopping in 2025 is taking on a more complex rhythm, reports PwC. According to their annual Holiday Outlook survey, average holiday spend is expected to fall to $1,552 per person, a 5% drop from 2024. It’s a shift fueled by inflation, tariffs, and rising everyday expenses — but also by evolving consumer priorities.

Amid the cautious climate, shoppers aren’t just trimming their lists. They’re redefining what matters. Experiences, sustainability, emotional resonance, and value are shaping choices more than ever — with Gen Z leading the change.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Generational Divergence

The sharpest pullback comes from Gen Z, whose average holiday spending is expected to fall 23% year-over-year. Many are navigating early career stages in a turbulent job market, with limited savings and rising living costs. Notably, 39% of Gen Z’s holiday budget will go toward self-gifting, and 63% plan to buy resale or upcycled products — signaling a strong alignment with sustainability and personal wellness.

By contrast:

- Millennials expect to keep spending nearly flat, down just 1%.

- Baby boomers are increasing spending by 5%, prioritizing family gifting.

- Households with children will spend over $2,300 on average, more than double those without kids.

This divergence reflects not just economic pressure but distinct life stages and priorities.

Value > Volume

Consumers are prioritizing value over volume, with 78% looking for cheaper alternatives and 65% expecting post-holiday markdowns. Gift cards have become a go-to: 52% plan to give them to friends, 47% to family. They offer flexibility and budget control — and still carry emotional weight, even if the dollar doesn’t stretch as far.

Tariff anxiety is also weighing on spending. Those concerned about tariffs plan to spend 10% less on gifts and are more likely to cut overall.

Still, spending isn’t disappearing — it’s shifting. Consumers are being deliberate, often saving for what feels meaningful, whether that’s a shared meal, wellness item, or small indulgence.

Tech, Touchpoints & Trust

The search for value is increasingly digital:

- 43% of Gen Z now use social media as much as search engines to discover gifts.

- 15% of Gen Z and millennials plan to use AI for gift ideas.

- Consumers still lean heavily on real customer service, especially for resolving issues: 64% prefer phone support, rising to 82% among baby boomers.

Retailers must straddle both worlds — tech-enabled discovery and human-driven service — to meet consumers where they are.

A Compressed Calendar

Thanksgiving, Black Friday, and Cyber Monday fall later in 2025, shrinking the post-holiday window. Yet nearly 80% of all planned gift spending is expected to happen by the end of Cyber Monday — emphasizing the critical importance of early-season promotions and well-timed campaigns.

Many retailers are responding by launching earlier: “Summerween” Halloween sales began in July. Expect similar seasonal creep across holiday categories as brands aim to stretch margins and front-load demand.

The Rise Of Food And Feel-Good Gifting

Food is emerging as a top-performing gift category, driven by wellness trends and a desire to give without clutter. “Consumables” rank high for both self and family gifting, and 45% of consumers expect to spend more on groceries for holiday celebrations.

- 72% plan to gather for a home-cooked holiday meal.

- Gen Z and millennials are drawn to functional beverages and low-sugar treats, while boomers opt for traditional indulgences.

This reflects a broader shift: snacks over sweaters, as consumers double down on emotional value, shared moments, and personal care.

Travel: Reconnecting, Cautiously

Holiday travel is holding steady at 44%, with most trips motivated by a desire to visit family. Younger generations are more likely to travel, often to save on lodging by staying with relatives. Still, Gen Z travel intent dropped to 55%, down from 61% in 2024, largely due to cost.

Final Note

The 2025 holiday season is not about pushing more — it’s about connecting deeper. Consumers may say they’re cutting back, but their actual behavior points to a more curated, intentional approach to holiday spending.

Retailers that listen closely, adjust quickly, and deliver value wrapped in meaning will be best positioned to succeed — not just during peak season, but well beyond.