- Hillenbrand is being acquired by Lone Star Funds in a deal valued at $3.8B, or $32 per share, with the transaction expected to close by Q1 2026.

- The company will go private following the deal, transitioning from a publicly traded firm on the NYSE to private ownership under the Dallas-based private equity firm.

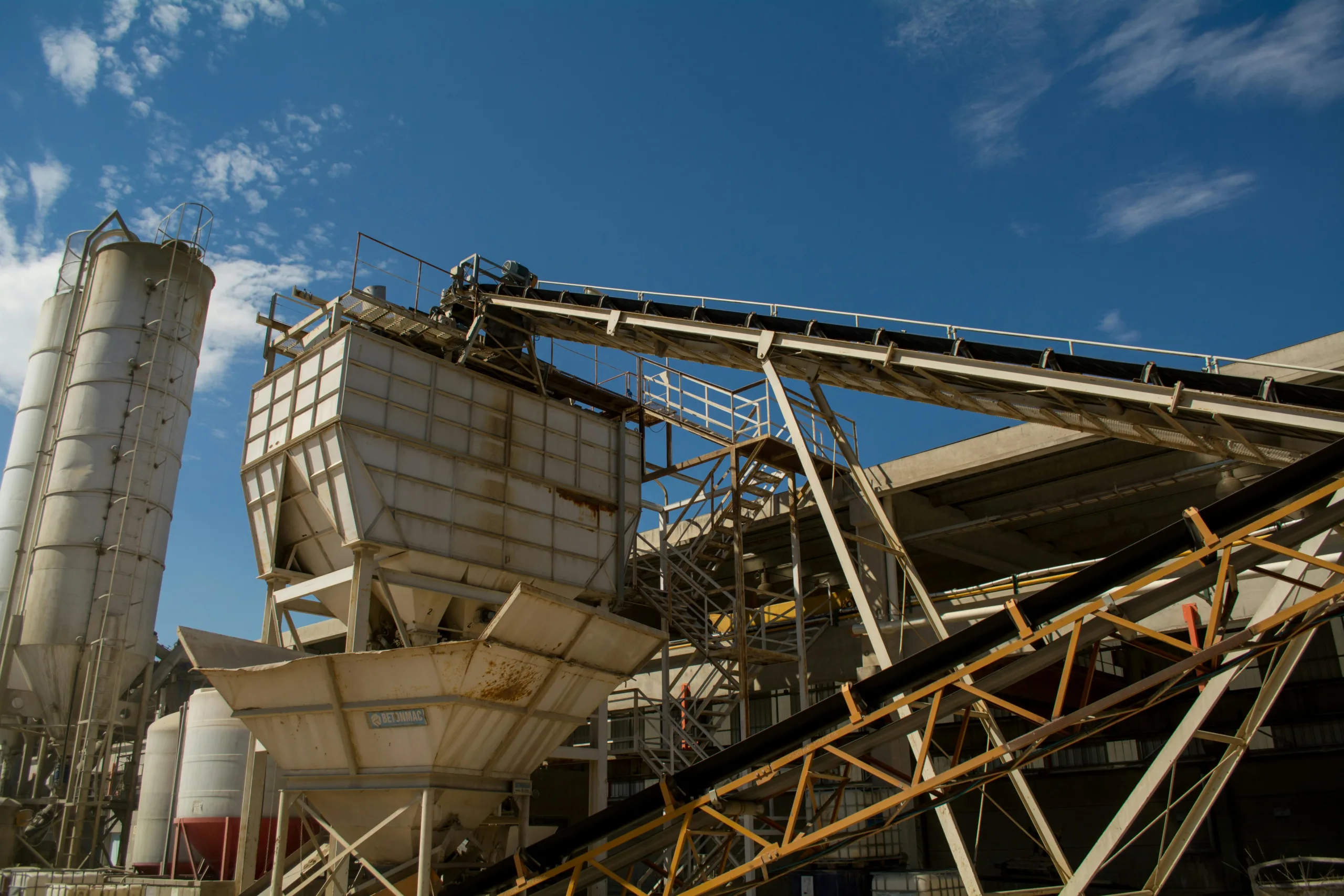

- Hillenbrand has been reshaping its business around core industrial sectors such as plastics, food, and recycling, recently divesting non-core units and expanding through strategic acquisitions.

A Strategic Exit

Hillenbrand will be acquired by Lone Star Funds in a $3.8B deal, ending its public company status, reports Manufacturing Dive. The board of directors unanimously approved the sale after evaluating multiple strategic alternatives. The decision reflects confidence in the benefits of private ownership under the global investment firm.

A Refocused Industrial Strategy

The transaction follows years of active portfolio reshaping at Hillenbrand. The company has zeroed in on becoming a pure-play industrial player, concentrating on the plastics, food, and recycling sectors. That transformation included the sale of its long-standing casket division, Batesville, to LongRange Capital for $761.5M in 2022.

In parallel, Hillenbrand expanded its food processing capabilities through several deals:

- $730M acquisition of Schenck Process’ food and performance materials business in 2023

- Purchase of Peerless Food Equipment for $59M in 2022

- Acquisition of Linxis Group, a France-based food equipment maker

It also exited other non-core assets this year, including its stakes in TerraSource Holdings and Milacron’s injection molding and extrusion business.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Financials And Operational Scope

Hillenbrand reported nearly $3.2B in revenue last year, with operations across 23 global facilities and about 10,500 employees. However, economic headwinds and tariff pressures have weighed on performance. Revenue dipped 24% year-over-year in Q3 2025 to $599M, reflecting customer delays and cautious capital spending.

Private Equity’s Next Industrial Bet

Lone Star Funds, known for its focus on industrial assets, sees long-term growth potential in Hillenbrand’s repositioned portfolio. “Our expertise will be brought to bear in partnering with Hillenbrand’s management team to invest in the business and help foster continued growth and innovation,” said Lone Star CEO Donald Quintin.

Lone Star’s previous industrial investments include companies such as Kidde Global Solutions and Binks, showing the firm’s ongoing interest in manufacturing-related assets.

Why It Matters

The deal further underscores the broader private equity interest in niche industrial manufacturers with streamlined operations and strong growth runway. In particular, for Hillenbrand, the move could provide greater capital flexibility and insulation from market volatility as it continues to double down on its industrial focus.

Looking ahead, the transaction is expected to close by early 2026. At that point, Hillenbrand’s next chapter will be shaped in the private markets. As a result, going private could give the company more freedom to scale, acquire, and innovate.