- The FTSE EPRA Nareit Developed Extended Index rose 3.7% in August, with Asia up 6.5% and North America up 4.3%.

- Asia leads year-to-date returns at 26.6%, followed by Europe at 18.5% and North America at 3.7%.

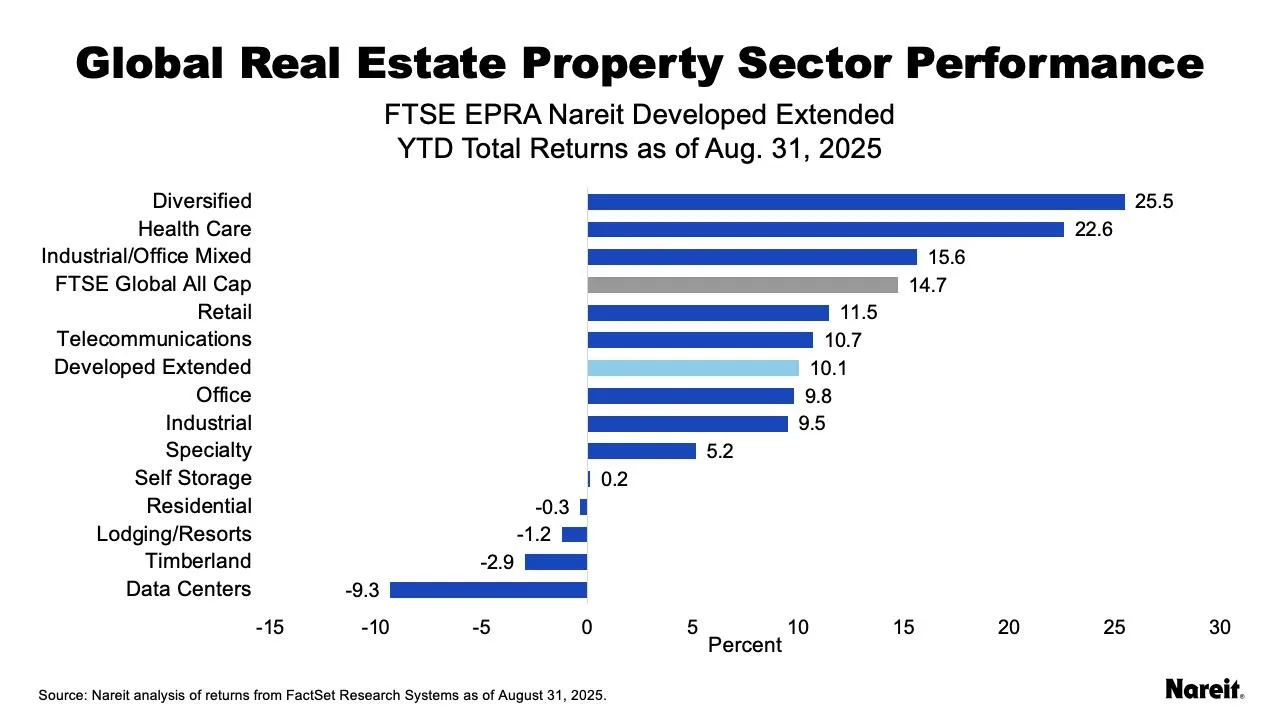

- Diversified, health care, and industrial/office mixed sectors outperformed, while data centers lagged, especially in North America.

August Performance Snapshot

The global real estate market rallied in August, as the FTSE EPRA Nareit Developed Extended Index climbed 3.7%. Developed Asia led with a 6.5% gain, followed by North America at 4.3%, and Europe at 1.3%, according to Nareit.

Investor sentiment was buoyed by growing confidence that the Federal Reserve may be nearing an interest rate cut, as labor markets show signs of softening. However, uncertainty around global trade policy continues to be a headwind.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Sector and Regional Trends

On a year-to-date basis through August 31, the Developed Extended Index has gained 10.1%. Asia remains the strongest performer, returning 26.6%, followed by Europe at 18.5%. North America lags behind, with a 3.7% YTD gain. Meanwhile, the FTSE Global All Cap Index is outperforming real estate slightly, with a 14.7% YTD return.

Across sectors, diversified (25.5%), health care (22.6%), and industrial/office mixed (15.6%) have posted the highest returns in 2025. In contrast, data centers are down 9.3% globally, led by a 10.8% decline in North America, while Asia’s data centers are up 13.7%.

Regional Breakdown

Diverging sector weightings across regions continue to shape performance:

- In North America, the diversified sector is up 21.7% but makes up just 2% of the region’s market cap. Office REITs in North America remain under pressure, down 2.5% YTD.

- In Asia, diversified REITs make up 67% of the market and have gained 27.3%, while office REITs surged 34.0%.

- In Europe, diversified accounts for 32% of the region and is up 19.7%, with office REITs also performing positively at 11.3%.

Overall, Asia and Europe have seen positive returns across all property sectors so far in 2025, while North America’s performance has been mixed, with standout strength in diversified and health care.

Outlook

The data paints a picture of growing divergence between global regions, with Asia and Europe benefiting from broad-based sector gains, while North American REITs continue to face headwinds.

Still, with expectations that rate cuts may be on the horizon, there’s potential for improved performance in North America heading into the final quarter of 2025. For global investors, understanding regional sector exposure will be key as real estate markets evolve.