- CRE loan balances are still growing, suggesting sustained liquidity in the debt markets despite broader economic uncertainty.

- CMBS delinquencies remain elevated, especially in the office sector, but other lender types show far fewer signs of distress.

- CMBS spreads are tightening, and issuance is on pace for its strongest year since 2007, indicating renewed investor confidence.

CRE Lending Stays Resilient

The Federal Reserve’s October minutes show that commercial real estate loans continued to grow modestly in July and August. This aligns with broader strength in corporate and private credit markets, per Principal Asset Management.

The Mortgage Bankers Association also reported a $47.1B rise in commercial/multifamily mortgage debt in Q2 2025, pushing total debt to $4.88T. Most lender types expanded activity, supported by attractive yields and conservative loan structures.

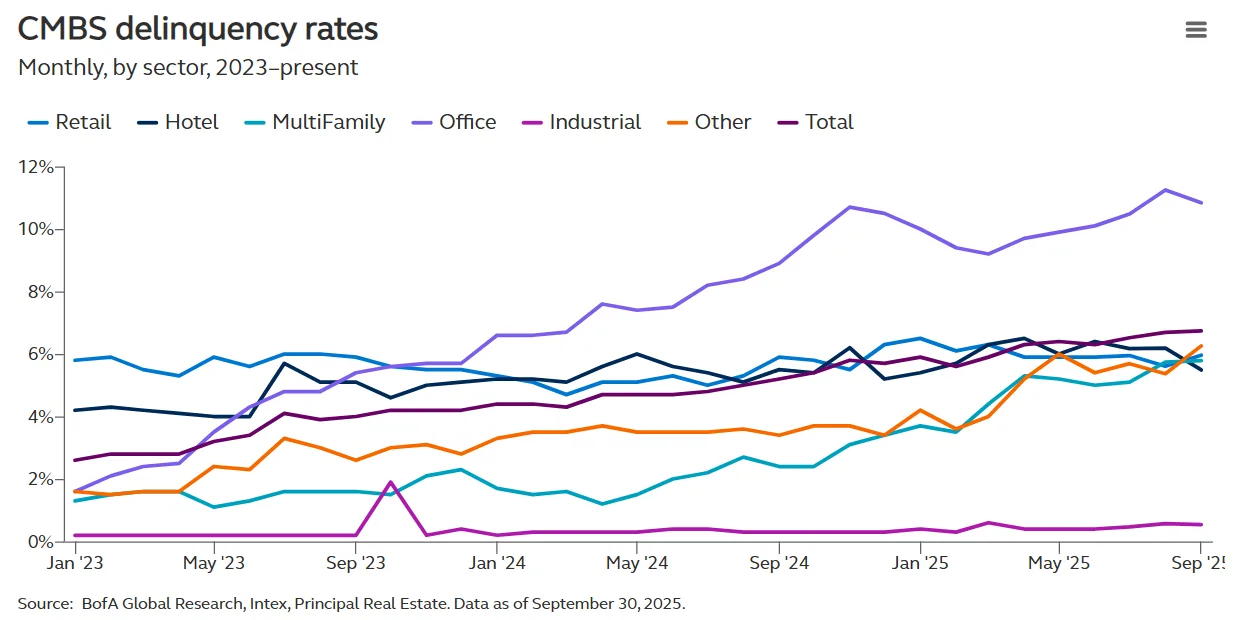

Delinquencies Concentrated in CMBS

The Fed noted that CMBS delinquencies remained elevated through August, reaching 6.7% in September, with office loans near 11%. Retail (6.0%) and multifamily (5.8%) also showed strain. Conduit deals are seeing the most stress (8%+), while SASB deals are holding up better.

By contrast, delinquencies are far lower among traditional lenders:

- Life insurers: 0.5%

- Banks: 1.3%

- GSEs: 0.6%

This gap underscores how risk is concentrated in securitized markets, which often finance riskier assets. Importantly, CMBS delinquencies are lagging indicators, often reflecting past market stress.

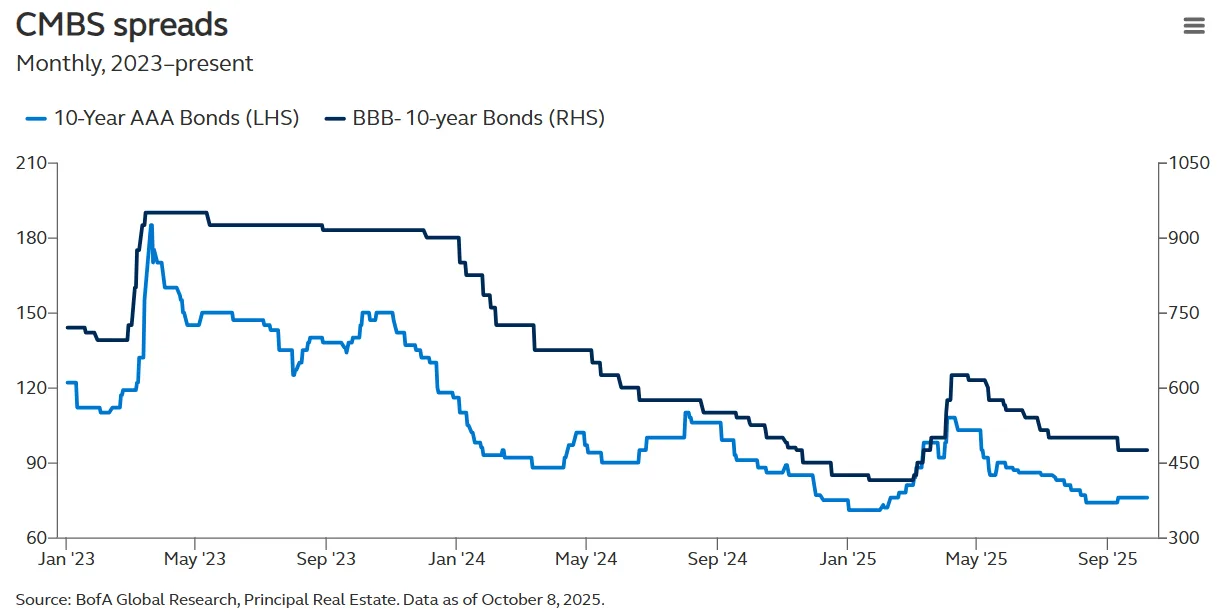

Spreads Tighten, Issuance Surges

While delinquencies point backward, spreads and issuance show forward momentum.

- AAA CMBS spreads tightened to 76 bps, down from 108 bps in April.

- BBB- tranches rallied, tightening by 80 bps since June.

Investor appetite has returned, pushing private-label cmbs issuance above $90B year-to-date, setting the stage for the strongest year since 2007 if trends continue.

Why It Matters

The Fed’s message is clear: don’t overreact to backward-looking delinquency data. Instead, focus on leading indicators like spreads and issuance. Liquidity remains healthy, and investors willing to look past short-term stress may find long-term value.

What’s Next

CRE debt markets are showing surprising resilience. If momentum holds, expect a strong close to 2025, particularly for those able to separate short-term headlines from long-term fundamentals.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes