- Private real estate funds have accumulated $250B in dry powder targeting North America, ready to deploy as market fundamentals stabilize.

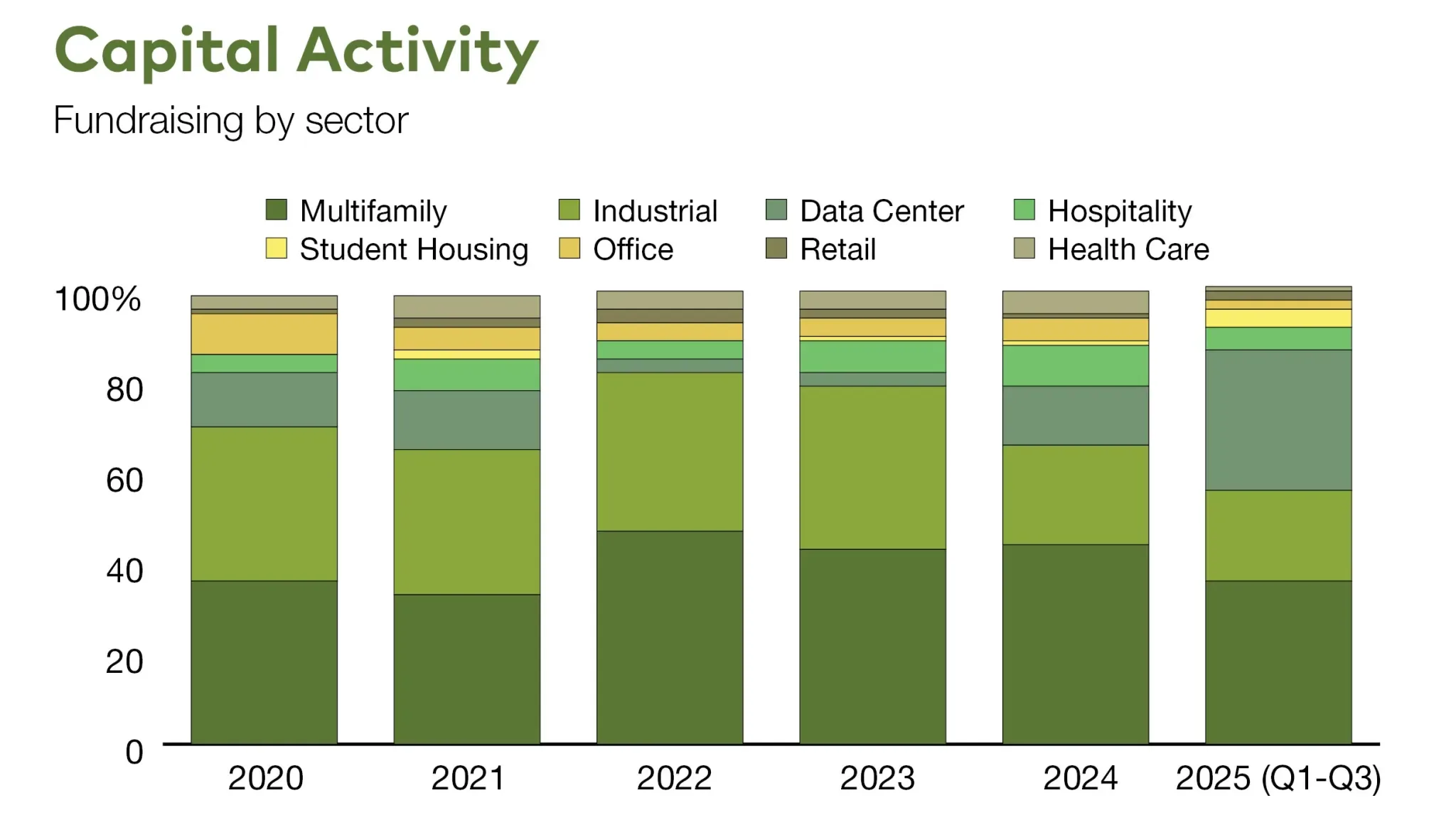

- Fundraising momentum is favoring opportunistic and value-add strategies, but interest in core assets is rebounding among institutional investors.

- Industrial, multifamily, and select retail properties are leading investment activity, with increased attention on alternative assets like medical office and self storage.

- Bidding activity and sales volume are up as more investors anticipate distressed opportunities and loan maturities in 2026 and 2027.

Investor Momentum Builds

The Commercial Property Executive reports that private real estate fund sponsors have amassed significant dry powder since the pandemic, facing recent challenges from high interest rates and redemption waves. Now, optimism is returning as 2025 saw $164.4B in new fundraising globally, with $115B targeting North America. Institutional investors are showing renewed interest in deploying capital, with a focus on both traditional and alternative real estate assets.

Capital Deployment Strategies

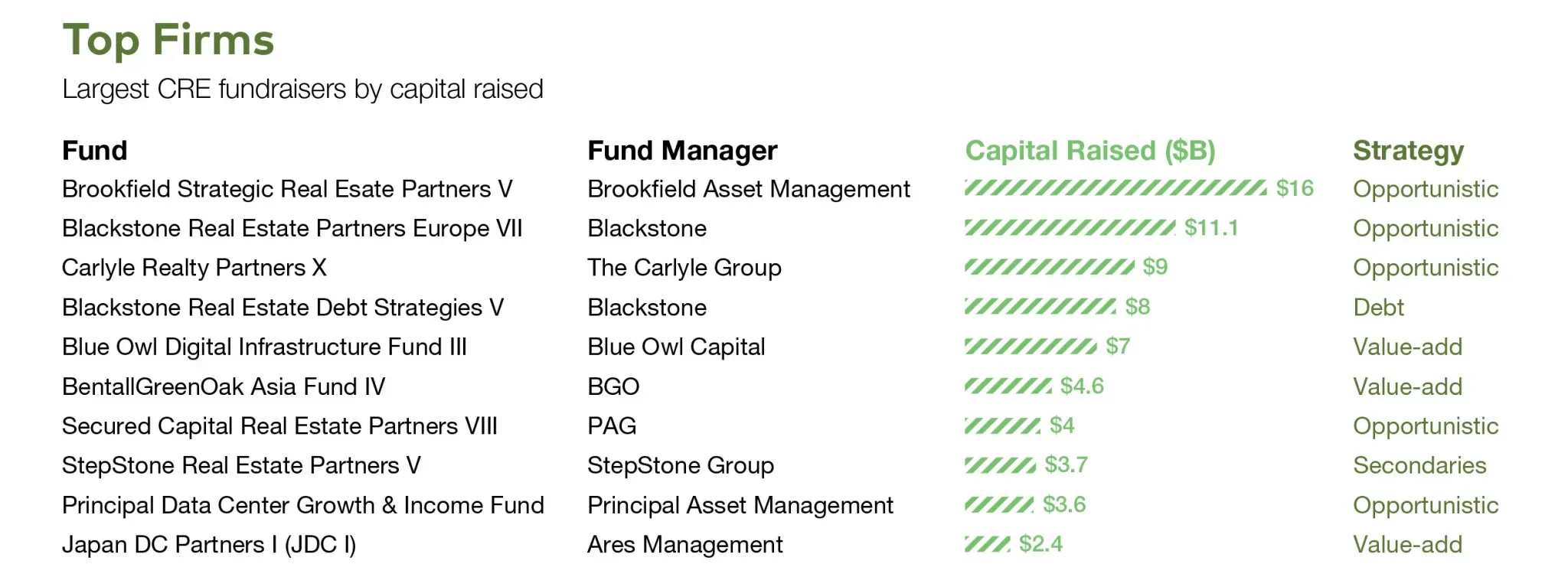

Opportunistic and value-add strategies are driving the bulk of capital flows, but momentum is shifting as more core and core-plus funds attract institutional attention. Notably, Brookfield Asset Management and Carlyle have achieved record fundraising for their opportunistic programs. This influx of capital has coincided with a notable uptick in REIT transactions, as improved market conditions boost investor confidence and portfolio repositioning accelerates. Core investors are re-entering the market and are expected to boost transaction activity in 2026, improving liquidity and deal pricing.

Industrial and Alternatives in Demand

Industrial properties remain a top target, particularly smaller multitenant assets with shorter lease terms or NNN leases. Tight supply and operational efficiency make these attractive even as some large-box industrial faces headwinds. Investors are increasingly targeting retail properties—especially grocery-anchored and select non-anchored strip centers. Alternative segments like medical office and self storage are gaining ground, aligning with demographic shifts and evolving tenant needs.

Market Outlook for 2026

Investment sales rebounded strongly in 2025, with industrial and retail posting double-digit year-over-year gains and office activity also improving. Investors expect narrowing bid-ask spreads and upcoming loan maturities to catalyze deal flow in 2026 and 2027. Investors with ample dry powder are preparing to act swiftly as more assets come to market, positioning for a more active CRE transaction landscape.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes