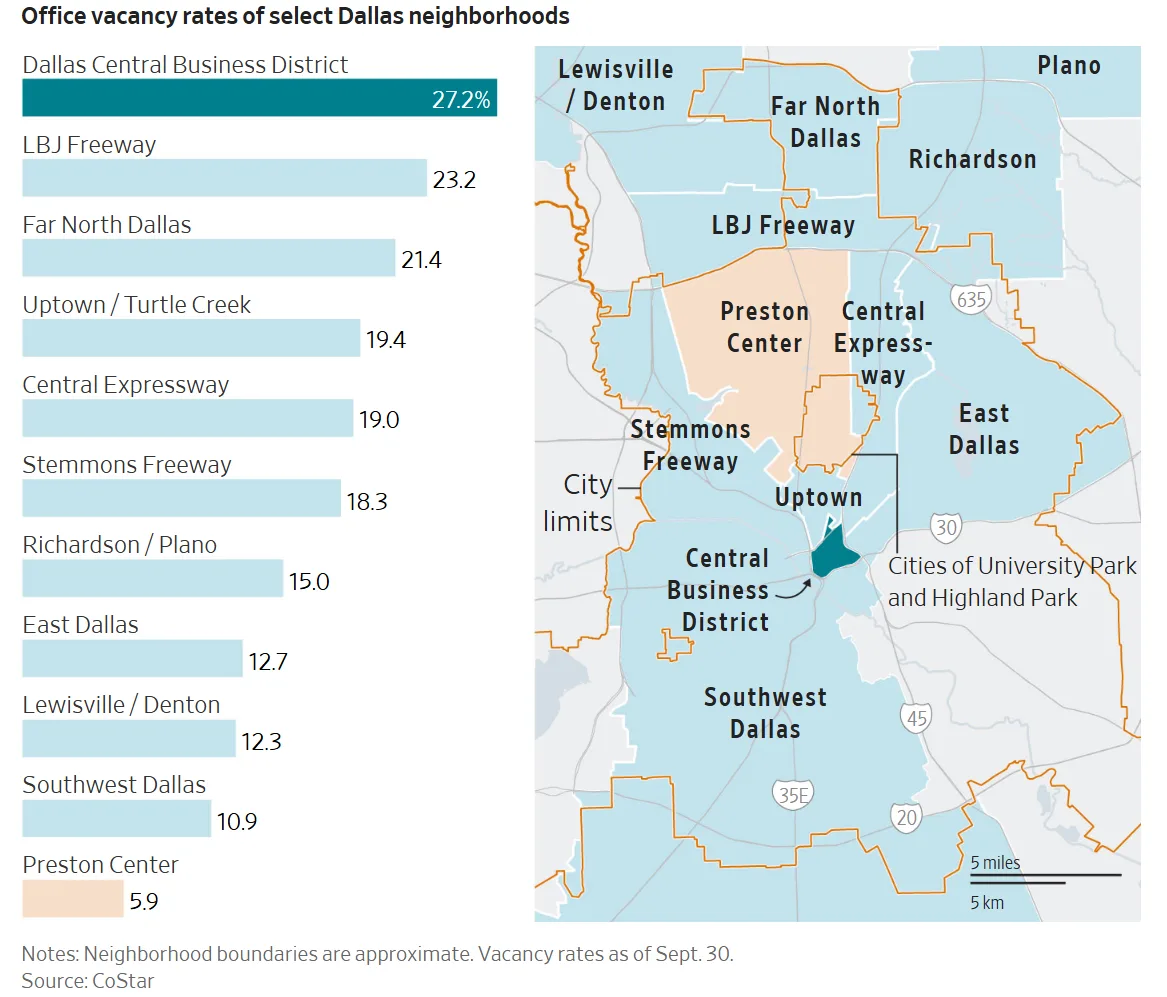

- Downtown Dallas recorded a 27.2% office vacancy rate—the second highest of any US downtown—while suburban areas like Preston Center enjoy rates as low as 5.9%.

- Companies like AT&T and Comerica may exit downtown, with others like Goldman Sachs and Nasdaq opting to grow outside the city core.

- Suburban campuses are winning due to modern amenities, safety, and proximity to employees—leaving downtown Dallas with struggling assets and a shrinking corporate base.

The Urban Core at Risk

The WSJ reports that Dallas is booming by nearly every economic metric—population growth, corporate relocations, and job creation. Yet at the center of this Sunbelt success story is a struggling downtown, now facing one of the highest office vacancy rates in the country at 27.2%, just behind Seattle.

Despite the city’s reputation as a magnet for finance and tech firms—earning it the nickname “Y’all Street”—downtown Dallas is losing its appeal. Aging office towers, safety concerns, and the shift to remote work are pushing companies into more appealing suburban enclaves.

The Suburban Shift

From Plano to Uptown, companies are choosing sleek campuses with modern amenities and easier commutes. Investment data paints a stark contrast: just $51.7M in office property was sold downtown in the first three quarters of 2025, compared to $1.8B in Dallas’s suburbs.

Even major corporate anchors may be on the move. AT&T, which employs 6,000 people downtown, is reportedly eyeing suburban locations as its 2031 lease expiration approaches. Meanwhile, Fifth Third Bancorp’s acquisition of Comerica casts uncertainty over another large tenant’s future.

This growing preference for suburban locations is also shaping how companies rethink their office strategies based on employee commuting patterns and workplace expectations.

The Core’s Challenges

Downtown Dallas’s decline isn’t just about remote work—it’s structural. Unlike older cities built around dense cores, Dallas evolved around highways, giving rise to multiple business districts like Las Colinas, Legacy West, and Preston Center. Suburban nodes now boast class A buildings, outdoor spaces, and convenience. Downtown, in contrast, has aging inventory and growing vacancy.

Safety is another concern. AT&T’s downtown campus reported multiple public safety incidents this year, prompting the city to increase police presence and homeless outreach. Yet perceptions persist, making suburban alternatives more attractive.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes

Signs of a Comeback

City leaders are working to reverse the trend. Downtown Dallas Inc. is pushing for a more livable urban core, and Dallas ranks third nationally in office-to-residential conversions, according to CBRE. A $3.7B convention center redevelopment is in the pipeline, expected by 2029.

There’s also a potential lifeline in pro sports. The Dallas Mavericks are evaluating downtown sites for a massive 50-acre entertainment complex, a project team executives say could transform the area.

Why It Matters

Downtown Dallas’s struggles reflect the uneven recovery of US office markets, even in growth hubs like Texas. As suburbs dominate the post-COVID office reset, traditional business districts must reinvent themselves—or risk being left behind.

What’s Next

The fate of downtown Dallas hinges on several key decisions in the next few years—from whether AT&T stays or goes, to how successful the city is in turning office space into homes and entertainment venues. For now, the data is clear: Dallas is booming, but downtown is in trouble.