- The CRE CLO distress rate rose to 13.2% in May, up 80 basis points from the previous month, ending a two-month decline.

- Delinquencies increased sharply, reaching 11.0%, while 50% of matured loans are now non-performing.

- Issuance volume jumped to $10.5B across 11 deals this year, up 377% from the same period in 2024.

Distress Rate Moves Higher

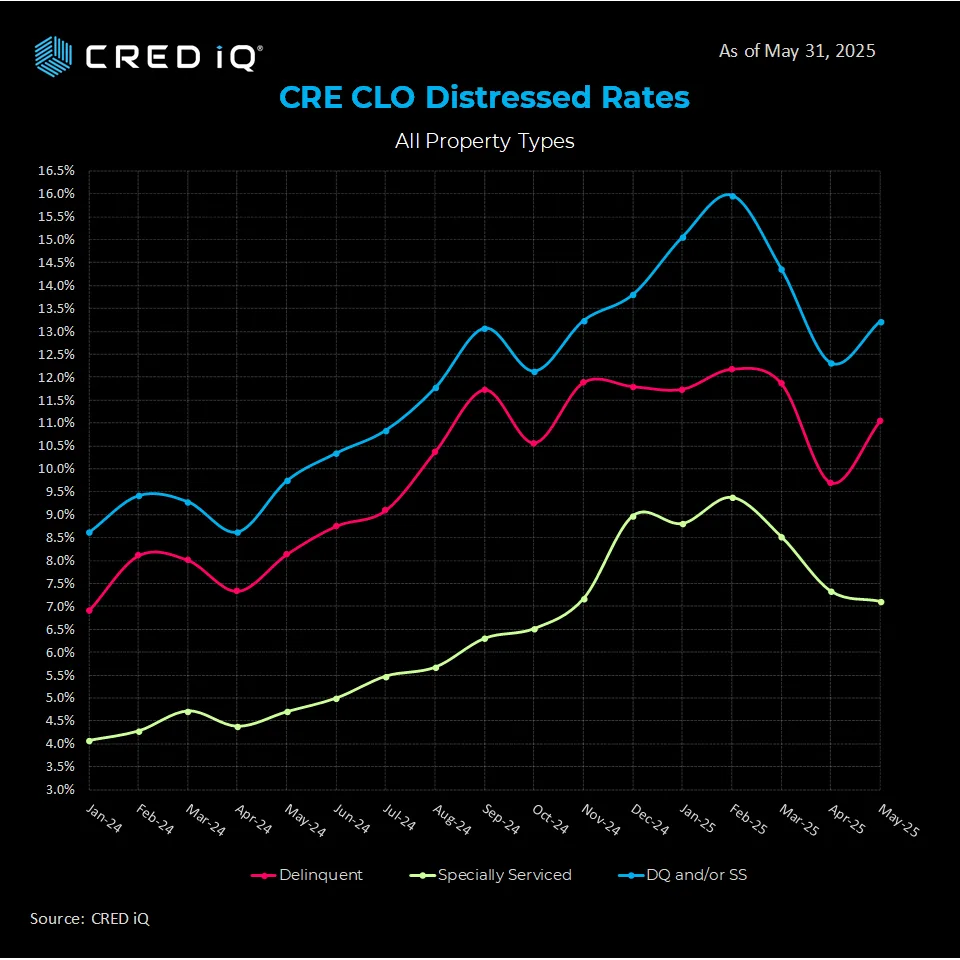

As reported by CRED iQ, after two months of improvement, the commercial real estate collateralized loan obligation (CRE CLO) market saw its distress rate rise again in May. The distress rate increased by 80 basis points to reach 13.2%, disappointing investors who had hoped for another decline.

Loan performance showed a mixed picture. The special servicing rate dropped to 7.1%, down 30 basis points. But the delinquency rate rose to 11.0%, adding 130 basis points—the largest jump in recent months.

Issuance Surges Despite Market Stress

CRE CLO issuance is showing strong momentum. So far this year, deals have totaled $10.5B across 11 transactions. This marks a 377% increase from the $2.2B across three deals during the same period in 2024.

This surge suggests that investors still see value in floating-rate assets, even as risks grow.

Loan Maturities Create More Pressure

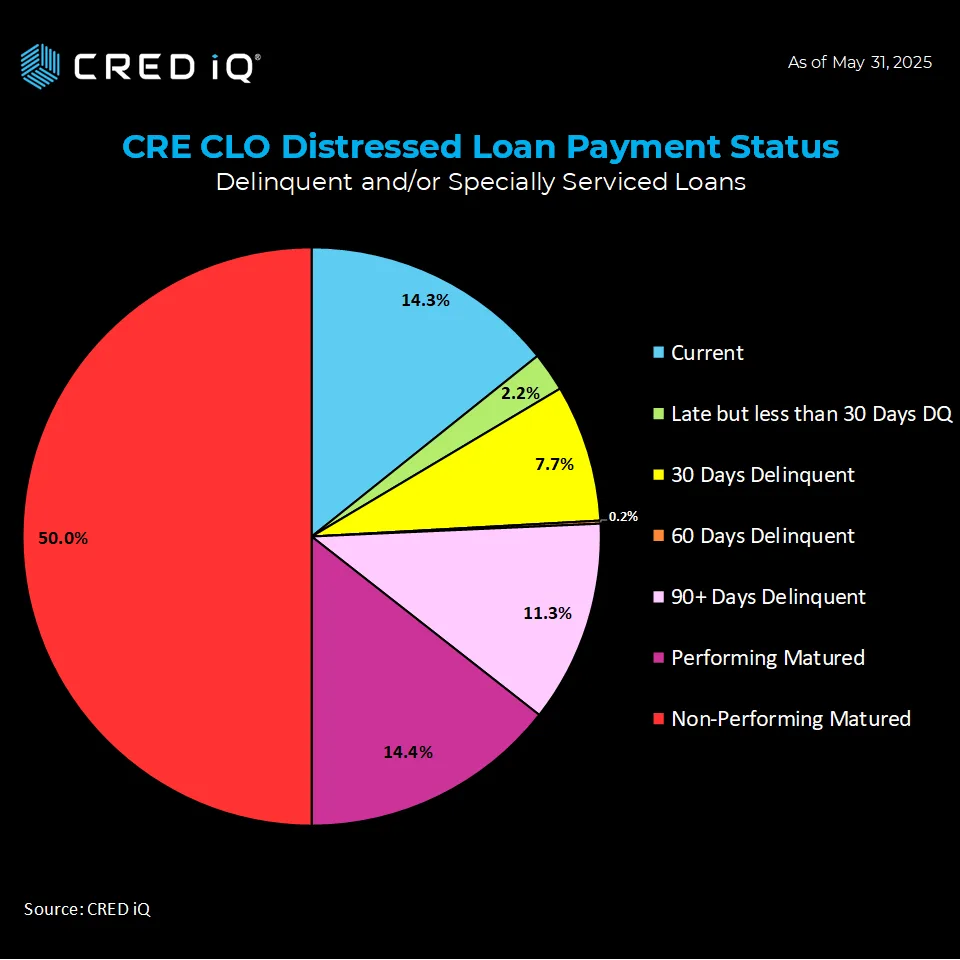

The number of loans past their maturity date continues to grow. In May:

- 64.4% of loans had already matured, up from 63.1% last month.

- 50.0% of those loans are not performing—double the rate from January.

- Only 14.3% of all loans are current, a drop from 16.8% in April.

- Pre-maturity delinquencies climbed to 21.3%, the third monthly increase in a row.

These issues reflect the consequences of loans made in 2021 and 2022, when low rates and high valuations led to aggressive underwriting. Many of those loans now face maturity in a very different lending environment.

Real-World Example: Norterra Canyon Apartments

The $58.6million Norterra Canyon Apartments loan shows how some borrowers are struggling. This loan is backed by a 426-unit multifamily complex in Las Vegas. The servicer placed it on the watchlist in November 2024 due to its upcoming maturity. By May 2025, it officially became non-performing after the borrower failed to refinance or repay the loan.

Why It Matters

CRE CLOs offer insight into the health of short-term, floating-rate real estate lending. A rising distress rate and fewer performing loans suggest more stress ahead, especially for loans written during the boom years of 2021–2022.

At the same time, strong issuance shows that many investors still want access to these high-yielding assets. But with more loans hitting maturity in today’s tougher climate, market conditions are likely to stay uncertain in the months ahead.

Get Smarter about what matters in CRE

Stay ahead of trends in commercial real estate with CRE Daily – the free newsletter delivering everything you need to start your day in just 5-minutes